'Is Bitcoin Stupid?': Dogecoin (DOGE) Creator Reacts to BTC Price

Bitcoin had another rough week, and Billy Markus, who co-created Dogecoin, used it as an open mic, turning the drop into a running commentary that surely echoed the mood across social media.

After BTC spent several sessions struggling to break through, leaving traders staring at levels they never planned to revisit this soon, it is only natural for someone to say what everyone else is thinking.

This time it was Billy Markus asking whether Bitcoin is "stupid or something," and the timing fit perfectly with a chart that moved from $105,000 earlier in the month to repeated prints under $94,000, while liquidation boards confirmed more than $240,000,000 in BTC positions flushed out in a 24-hour period.

is bitcoin stupid or something

— Shibetoshi Nakamoto (@BillyM2k) November 16, 2025

Markus followed one post with more punches that captured the fatigue of many retail traders after watching the main cryptocurrency in "down only" mode and refusing to bounce. He joked about the "bad price," telling himself he would buy with deeper discounts but backing out, and about Bitcoin being "this thing that keeps losing value."

Bitcoin in November 2025

These jabs landed because the crypto market had just watched three sessions, where even small relief candles looked decorative. Needless to say, the sentiment right now is at extreme fear levels.

The backdrop was enough to justify his tone as data put BTC at $95,535 in the last session, after hitting a low near $93,763. Mix that with liquidations numbers, and it comes clear how the current environment matches the November pattern, where Bitcoin fails to break out and drags investors through a slow grind that either ends with a "Santa rally" or crypto winter.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin’s Plunge Below $96K Sparks Concerns Over a Bear Market Resurgence Similar to 2024

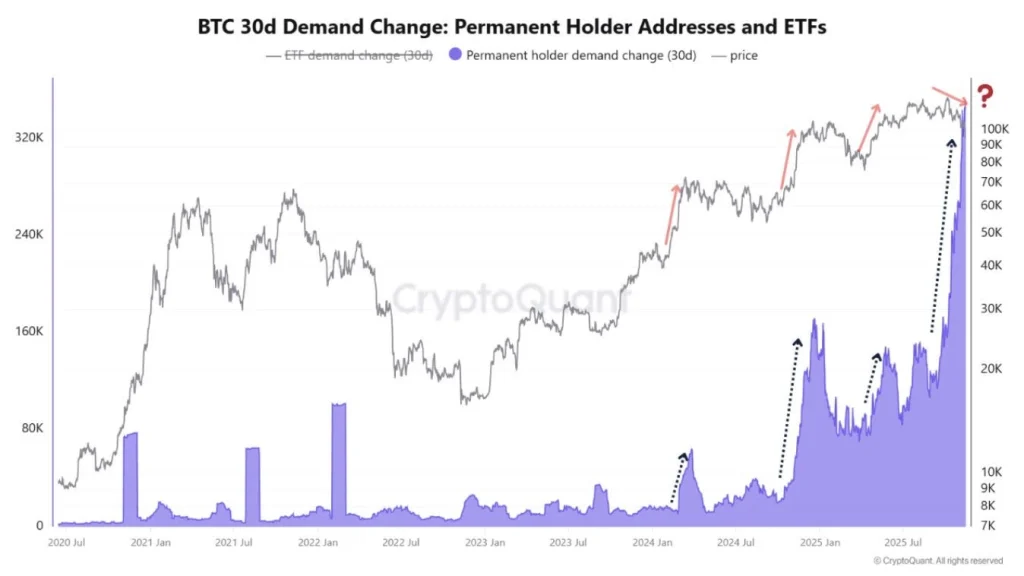

- Bitcoin fell below $96,000, erasing 2025 gains and triggering $44M in liquidations as ETF outflows hit $870M. - Market cap dropped 5.4% to $3.36T, with Ethereum and XRP hitting multi-month lows amid weak demand. - Chain metrics show 815,000 BTC sold by long-term holders, while Bull Score Index collapsed to 20 from 80. - Technical indicators warn of further declines below $93,500, testing 2024 bear market lows if support breaks. - MicroStrategy added $835M BTC despite criticism, but fear/greed index hit 1

Bitcoin News Today: Bitcoin ETFs See $870M Outflow as Long-Term Holder Selling Drives Price Near $80k

- Bitcoin’s price nears $80,000 as fear indices hit 16, signaling panic-driven capitulation. - $870M ETF outflows and 815,000 BTC sold by LTHs accelerate downward pressure since October. - Key technical levels breached: 365-day SMA broken, 50-week SMA at risk, bear market risks rising. - Ethereum faces 200-day EMA resistance; whales accumulate ETH despite $3.66B in ETF outflows. - STHs near 12.79% losses, 6-12M holder cost basis at $94,000 may offer temporary support.

Bitcoin News Update: Bitcoin ETF Sees $1.5 Billion Withdrawals While Institutional Investors Increase Their Holdings

- BlackRock's IBIT ETF saw $1.5B net outflows over 10 days as investors reassess Bitcoin exposure amid volatility. - Harvard University boosted IBIT holdings to $442.8M, surpassing its combined stake in major tech firms, while diversifying into gold . - Institutional ownership in IBIT rose to 29% QoQ, with UAE entities and sovereign wealth funds among key holders, signaling crypto's growing institutional acceptance. - KuCoin expanded institutional services as ETF outflows highlight market recalibration, wi

Bitcoin Price Retests Major Bull Market Support at $92k: $130k or $80k Next? Analysts Insights