Cardano Avoids a Breakdown, Now Looks Ready To ‘Squeeze’ Out A Bounce

The Cardano price has dropped almost 10% in a week but continues to hold its wedge support. Big-wallet inflows and a heavy short build-up now give ADA room for a fast rebound. If momentum pushes just 2% higher, the first squeeze levels come into play.

The Cardano price has dipped approximately 10% over the past seven days. Despite the wider correction, ADA has managed to stay above the lower trend line of an otherwise bullish pattern. That alone shows buyers are defending the structure instead of letting the downtrend accelerate.

The question now is whether this support, plus signs of returning big-wallet interest, can help ADA squeeze out a short-term bounce.

Big Money Support Helps ADA Hold Its Structure

ADA has been moving inside a falling wedge for weeks, and holding comfortably above the lower boundary is important because this pattern often leads to short-lived upward moves.

Staying above that line indicates that buyers still care about defending the trend, even during periods of weakness. The line was briefly tested on November 4.

The Chaikin Money Flow (CMF), which tracks whether large wallets are adding or removing capital, seems to be rising again. CMF had been drifting lower toward its descending trend line over the past few sessions.

Yet, it stayed above it, avoiding a big money breakdown. It has now curled upward again.

Cardano Whales Still Active:

TradingView

Cardano Whales Still Active:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

That signals renewed inflows from larger holders, which often appear before rebound attempts. The Cardano holding its wedge support and CMF turning higher at the same time gives ADA its first real sign of strength in weeks.

Short Positions Dominate And Create A Squeeze Setup

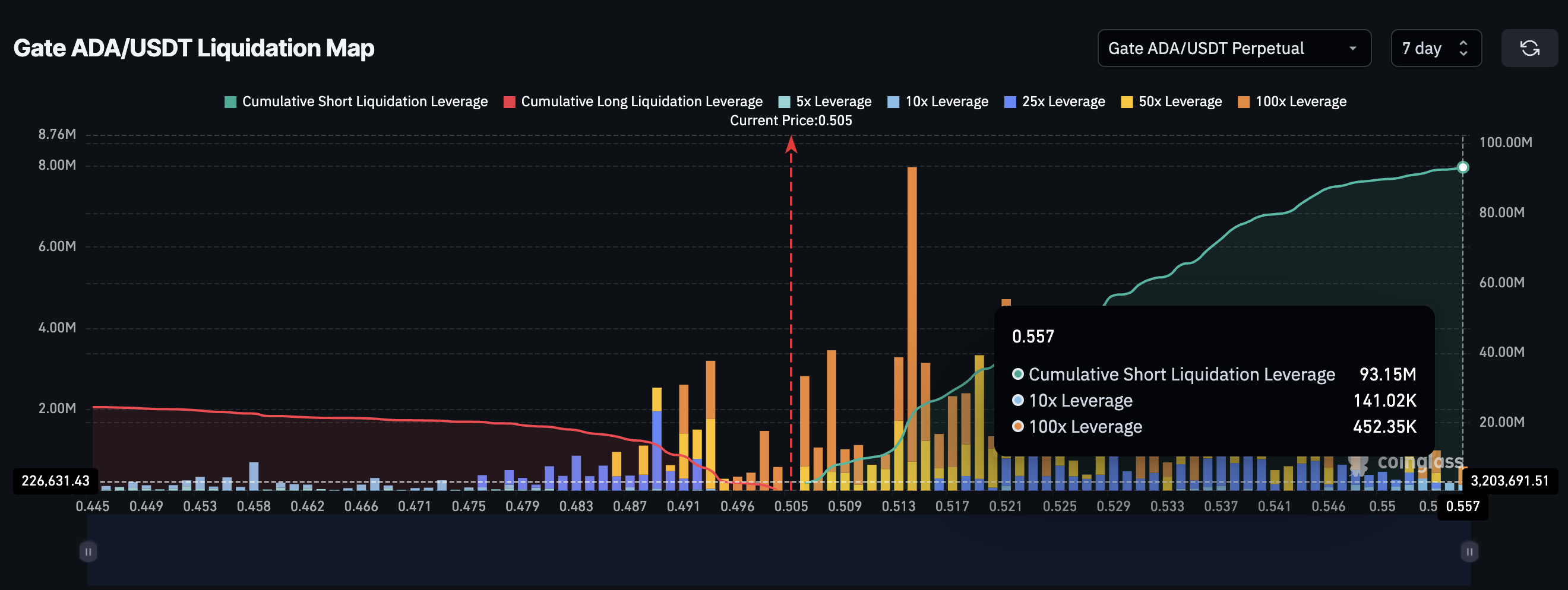

If the Cardano price pushes higher, the derivatives market could amplify the move. On Gate’s ADA-USDT liquidation map alone, short exposure is $93.15 million, while long exposure is only $24.46 million. Shorts hold nearly four times the leverage longs do.

Liquidation Map Hints At A Squeeze Setup:

Coinglass

Liquidation Map Hints At A Squeeze Setup:

Coinglass

A squeeze becomes possible when price rises just enough to force shorts to close. In ADA’s case, it needs roughly a 2% move to start hitting the first big batch of short liquidations, which start at $0.51.

If the chart pushes slightly above current levels, the unwind can begin, which often accelerates into a much larger move.

This is the core setup: the wedge protects ADA from breaking down, CMF shows big wallets are returning, and the short-heavy market gives ADA enough fuel for a fast bounce if momentum shifts.

Cardano Price Needs A Small Push To Confirm A Bounce

ADA needs only a small gain of about 2% to begin triggering short liquidations. That means the first Cardano price hurdle sits at $0.51. Once the chain reaction starts, the ADA price can climb quickly through nearby clusters.

If momentum continues after that, ADA would need a break above the wider resistance zone near the top of the wedge. Clearing around $0.64 is the point where the bounce transitions into a full breakout attempt. Only then does the structure shift, allowing a deeper rally.

Cardano Price Analysis:

TradingView

Cardano Price Analysis:

TradingView

Invalidation sits below $0.49. Losing that level breaks the wedge, which is anyway weak considering it only has two clear touchpoints.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump and Mamdani’s Bet on Affordability: Uniting Opposing Ideologies

- Trump and Mamdani's Nov. 21 meeting highlights clashing ideologies on affordability and governance, with New York's $1.286T economy at stake. - Both leaders share focus on cost-of-living crises but differ sharply on solutions, with Trump threatening federal funding cuts and Mamdani advocating rent freezes. - Experts see the dialogue as critical for redefining strained city-federal relations, emphasizing urban centers' role as economic engines. - Mamdani's corporate tax proposals clash with Trump's deregu

Bitcoin News Update: Navigating Crypto’s Balancing Act to Steer Clear of 2018’s Downturn as Global Economic Conditions Evolve

- Crypto markets avoid 2018-style collapse as macro-driven cycles and reduced speculation prolong volatility, per Lyn Alden. - Fed policy uncertainty and leveraged ETF launches highlight risks and innovations amid $2.2B crypto outflows and $914M liquidations. - MSTR's BTC gains and Gunden's $1.3B sell-off reflect divergent investor strategies, while Munari's Solana project targets long-term adoption. - Analysts split between 65-70% Bitcoin retracement forecasts and prolonged cycles driven by institutional

Bitcoin Updates: U.S. Suggests Using Bitcoin for Tax Payments to Dominate Worldwide Digital Economy

- U.S. Rep. Warren Davidson introduced the "Bitcoin for America Act," allowing Americans to pay federal taxes in Bitcoin and creating a Strategic Bitcoin Reserve. - The bill cites Bitcoin's fixed supply and long-term appreciation potential, aligning with corporate strategies like Michael Saylor's $48.37B BTC holdings. - It aims to counter global competition from China/Russia while balancing risks like BTC's 30% price drop from its August peak. - Proponents argue voluntary BTC tax contributions could build

XRP News Today: XRP Faces Uncertainty: Bearish Trends Clash with Optimism from ETF Prospects

- XRP faces critical juncture at $1.96 as bearish technical patterns clash with institutional optimism from new ETFs. - Descending triangle breakdown and RSI divergence signal potential 25% drop to $1.55, contradicting ChartNerd's reversal prediction. - Bitwise XRP ETF's $25.7M debut volume injects liquidity but risks accelerating forced selling from 41.5% of supply at a loss. - Analysts debate ETF-driven bullish potential vs. structural risks, with $2.20 support zone and $1.25 price floor as key battlegro