Key Notes

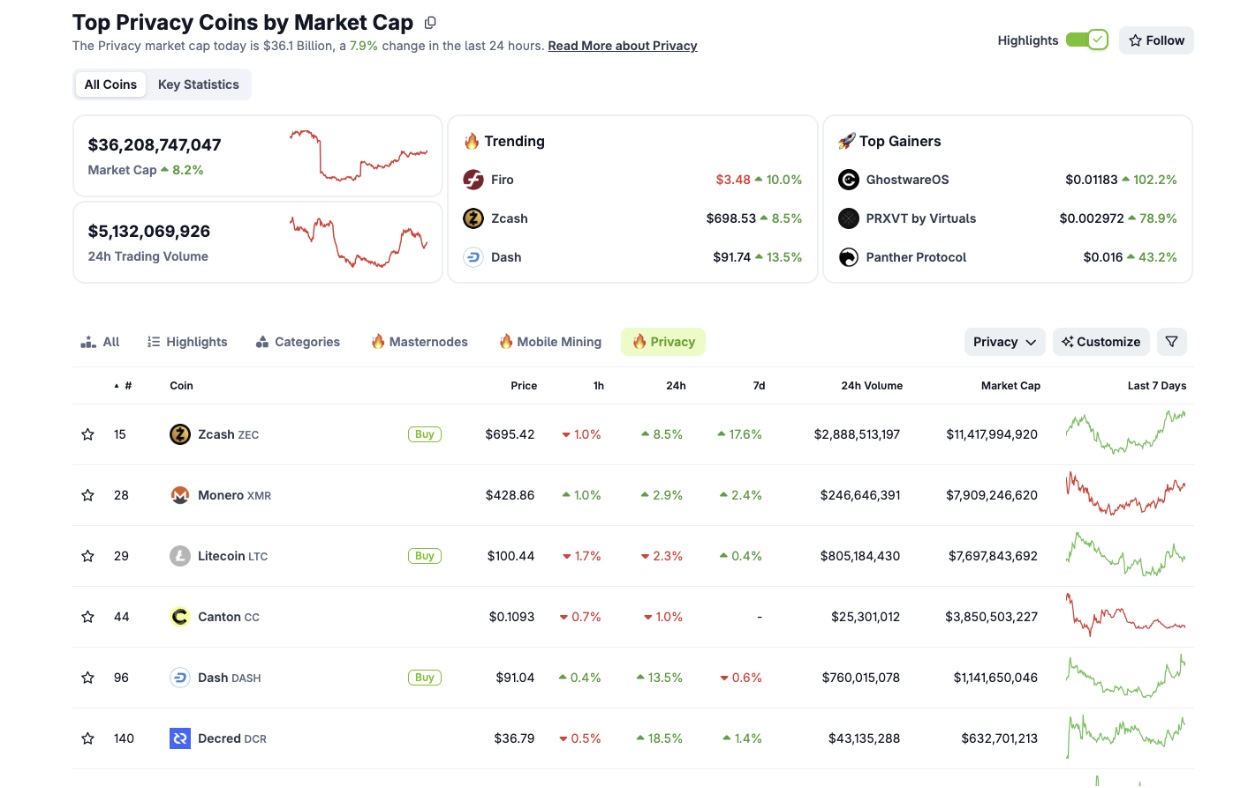

- Privacy-coin market cap surged to $36.1 billion as traders hedge against rising US political risk.

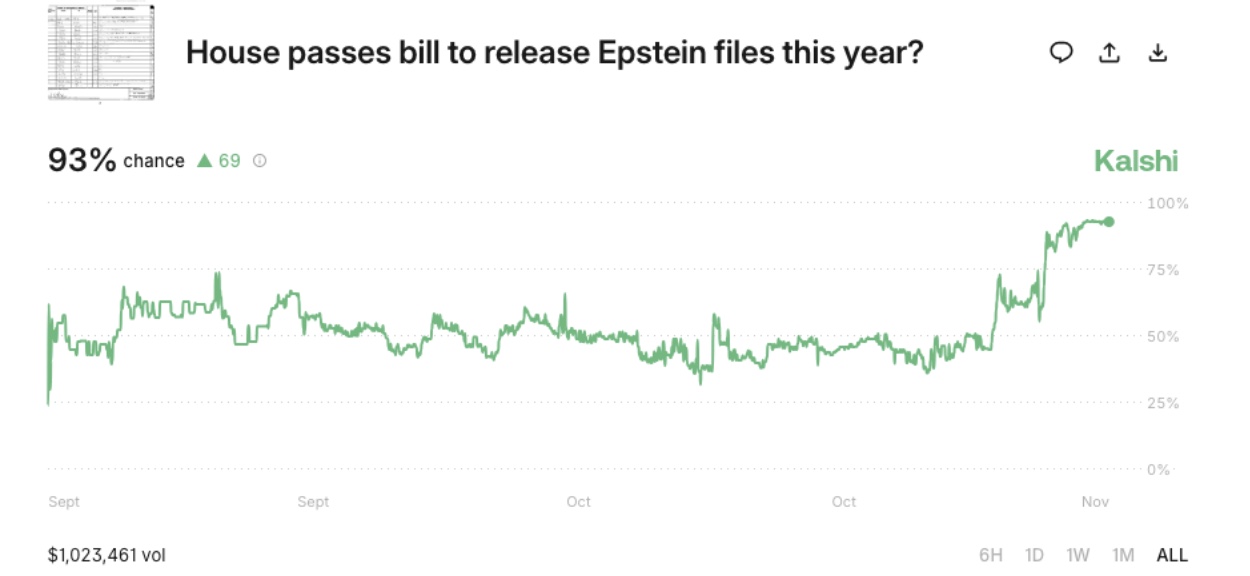

- Prediction markets now price a 93% chance Congress forces President Trump to release Epstein-related files.

- Zcash, Dash, and Firo lead gains as traders position ahead of Tuesday’s high-impact congressional vote.

As the digested positive tailwinds from the US government shutdown ended on Wednesday , the relief rally was quickly subdued by controversy around recently disclosed emails reportedly connecting the president to the investigation.

Crypto privacy coins recorded strong weekend gains as markets reacted to intensifying uncertainty surrounding a crucial U.S. congressional vote that could force President Trump to release sealed files linked to the Epstein case.

Privacy Coins Hit $36 Billion as Traders Hedge Against Trump Scandals

Privacy-focused cryptocurrency assets have emerged as a preferred edge against rising uncertainty surrounding the Trump administration’s exposure in the Epstein investigation.

Speaking with MS Now on Saturday, Rep. James Walkinshaw, who sits on the House oversight committee that published recent controversial emails, warned that delaying the release of the files threatens democratic stability and risks further eroding public trust.

Kalshi prediction markets pricing 93% odds on House passing bill to release Epstein files | Nov 16, 2025

This rhetoric resonates across prediction markets with an active Kalshi event showing traders now assign a 93% probability to a Yes vote, compelling file disclosure at Tuesday’s congressional session. The event has already generated more than $1 million in trading volume as of Sunday noon (GMT)

In crypto spot markets, intraday flows show a clear selective capital allocation. While the total crypto sector flattened at $3.25 trillion, privacy coins surged 8% to $36.2 billion on Sunday. Zcash led the charge, with traders favoring privacy-focused assets to hedge against swirling political speculation in the US.

Privacy coins aggregate market capitalization crosses $36 billion, Nov 16, 2025 | Source: Coingecko

Zcash, Dash, and Firo booked 7.5%, 13%, and 22% gains, respectively, and recorded the highest search interest on Sunday as traders take strategic positions against the risk of a political blowout.

With the vote due in 48 hours, privacy-coin inflows may accelerate, particularly once institutional desks reopen on Monday. Grayscale’s Zcash Trust (ZCSH), launched in 2017, currently reports more than $228 million AUM, according to official performance reports as of Friday, Nov 14.

next