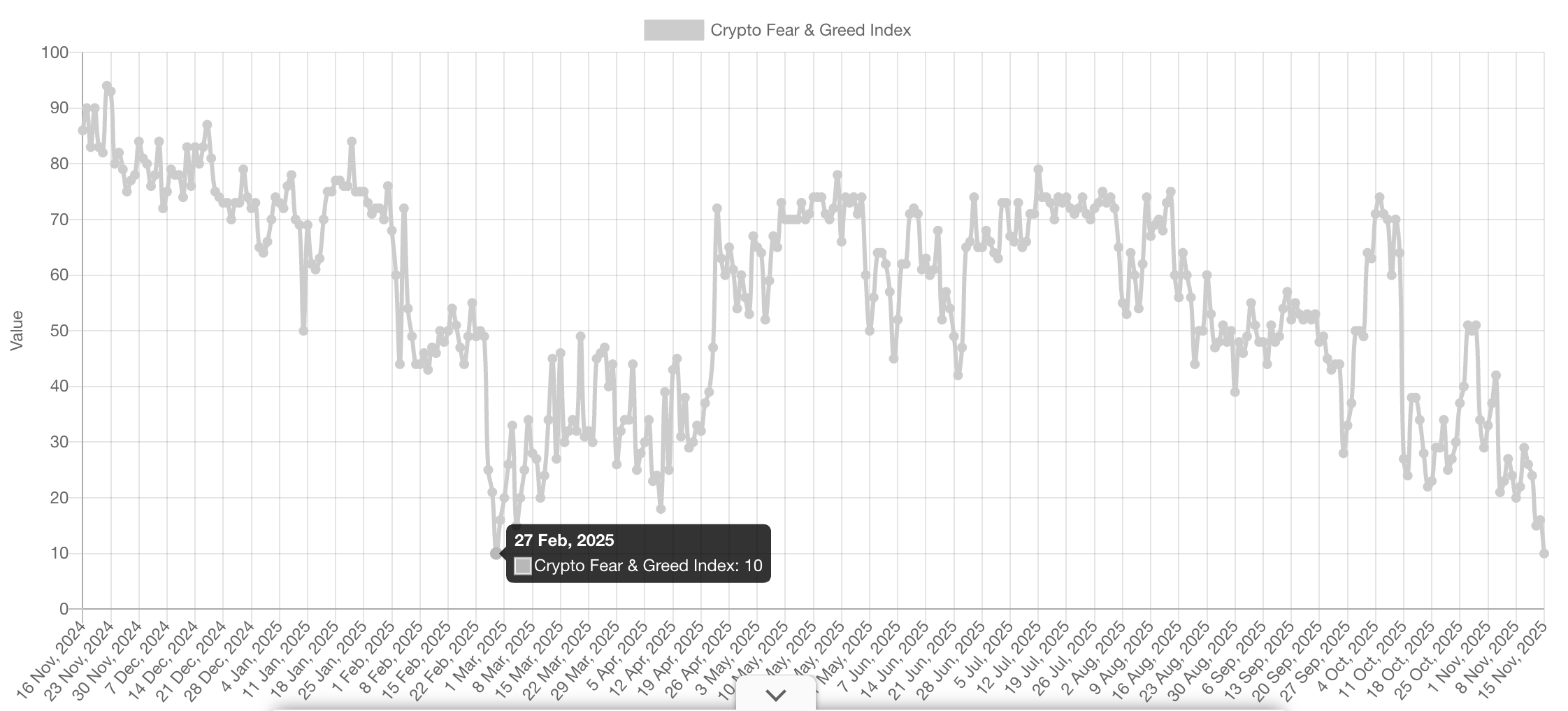

Crypto sentiment index sinks to lowest score since February

Crypto sentiment has dropped to its most fearful level in over eight months, as ongoing macroeconomic uncertainty continues to rattle market participants.

However, crypto analysts are anticipating the bearish mood to be short-lived.

The Crypto Fear & Greed Index, which measures overall market sentiment, posted an “Extreme Fear” score of 10 in its Saturday update, the lowest score it has seen since Feb. 27, as Bitcoin (BTC) fell below $95,000 on Friday and has yet to reclaim above $96,000 at the time of publication, according to CoinMarketCap.

The February low came just days after spot Bitcoin ETFs saw their worst-ever single-day outflows of $1.14 billion, as Bitcoin fell from $102,000 at the start of the month to $84,000.

Indicators suggests market is less bearish than previous downturns

Crypto market participants use sentiment indexes to gauge the broader market’s sentiment toward the sector and inform their decisions on whether conditions favor buying or selling.

However, Bitwise’s European head of research, Andre Dragosh, argued the situation isn’t as bleak as it may appear when compared with past downturns.

“Sentiment index is bearish but less so than during previous corrections despite lower prices,” Dragosh said in an X post on Friday, pointing to Bitwise’s crypto sentiment index showing signs of reversal.

“Our Cryptoasset Sentiment Index also continues to show a positive divergence,” Dragosh said.

While US President Donald Trump recently signed a bill ending the longest government shutdown in US history, an event some crypto market participants had blamed for recent volatility, uncertainty persists around the US Federal Reserve’s interest-rate cut decision, which is often linked to the crypto market.

Bitcoin chart signaling “potentially positive” move ahead

Meanwhile, NorthmanTrader founder Sven Henrich told his 503,400 X followers on Friday that Bitcoin’s price chart is showing “something potentially positive” for Bitcoin bulls. “Falling wedge, positive divergence,” Henrich said.

A Messari research manager, known online as “DRXL,” said that in his eight years working in the crypto industry, he has never seen “such dissonance between the headlines and the sentiment.”

Related: ‘We are buying’: Michael Saylor denies reports of Strategy dumping BTC

“Everything we once dreamed of is happening, yet it somehow feels… over,” he said.

Some analysts see the lack of a year-end surge as a healthy sign. Bitwise chief investment officer Matt Hougan recently told Cointelegraph that “The biggest risk was [if] we ripped into the end of 2025 and then we got a pullback.”

Magazine: 2026 is the year of pragmatic privacy in crypto: Canton, Zcash and more

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Federal Reserve Pauses QT While Nvidia's AI Boom Sparks Bubble Concerns

- The Fed will end quantitative tightening by December 1, aiming to stabilize liquidity after years of balance-sheet reduction. - Nvidia reported $57.01B Q3 revenue, driven by $51.2B in AI-powered data center sales, surpassing Wall Street estimates by $2B. - Bitcoin rebounded above $90,000 following Nvidia's results, but AI bubble concerns persist with 45% of fund managers citing it as top risk. - Major investors like Peter Thiel and SoftBank have reduced Nvidia stakes, contrasting CEO Huang's "decades-lon

Trump’s Tariff Gamble Faces Supreme Court Judgment

- Trump's administration prepares alternative tariff strategies under Sections 301/122 if Supreme Court invalidates IEEPA-based duties, risking legal and enforcement challenges. - IEEPA-derived tariffs (55% of 14.4% average rate) face judicial scrutiny, with lower courts already deeming country-based levies unlawful over "economic emergency" claims. - Potential $88B duty refunds and renegotiations with China/Brazil loom, while crypto markets price in 24% odds of SCOTUS upholding Trump's emergency powers. -

Bitcoin Updates: Digital Asset Companies Lose $4.5 Billion as Bitcoin Drops Near Key Support Level

- Bitcoin's drop below $90,000 triggered $4.5B in losses for digital asset firms, with major holders like Strategy Inc. and Bitmine facing massive unrealized losses. - Market-wide liquidations exceeded $2B, exposing fragility in corporate crypto treasuries and ETF outflows as Bitcoin tests critical $40,000 support levels. - Regulatory moves and institutional interest failed to offset macro risks, with analysts divided on whether this is a cyclical correction or deeper bear market onset.

Hyperliquid News Today: LivLive's Practical Profit Approach Ignites Crypto's Next 1000x Surge

- LivLive ($LIVE) surges in Q4 2025 crypto with 300% BLACK300 bonus, $2.1M raised in presale. - AR missions, wearable tech , and real-world utility drive $LIVE's 1000x potential vs. stagnant XRP/Hyperliquid. - $1K investment triples to 200,000 tokens via BLACK300, projected $50K value at $0.25 listing price. - XRP (-1.86%) and HYPE (+1.72%) lag as LivLive's closed-loop economy attracts asymmetric-return seekers.