3 Low-Cap Altcoins Broke Out of Long-Term Accumulation in November

Three low-cap altcoins—FIRO, ALCX, and XNO—broke out of long-term accumulation in November, signaling heightened demand and stronger bullish sentiment. Their rising volume and exchange outflows suggest growing investor confidence despite the risks.

When an altcoin experiences a strong pump and breaks out of a long-term accumulation zone, the move can signal renewed attention toward that project. This pattern can be even more meaningful for low-cap altcoins because they often offer higher profit potential.

Several altcoins showed this behavior in November. Details follow below.

1. Firo (FIRO)

Firo (FIRO) is a privacy-focused cryptocurrency. Its recent rally benefited from a rising interest in blockchain privacy.

BeInCrypto’s price data shows that FIRO’s market cap has increased from $10 million to over $48 million since October. The asset also broke out of its 2025 accumulation range.

FIRO Price Performance. Source:

FIRO Price Performance. Source:

Even after a nearly fivefold increase in market cap, FIRO still remains a low-cap altcoin. Many investors believe that escaping the 2025 accumulation zone could allow FIRO to move further and possibly reach 10 USD in 2026.

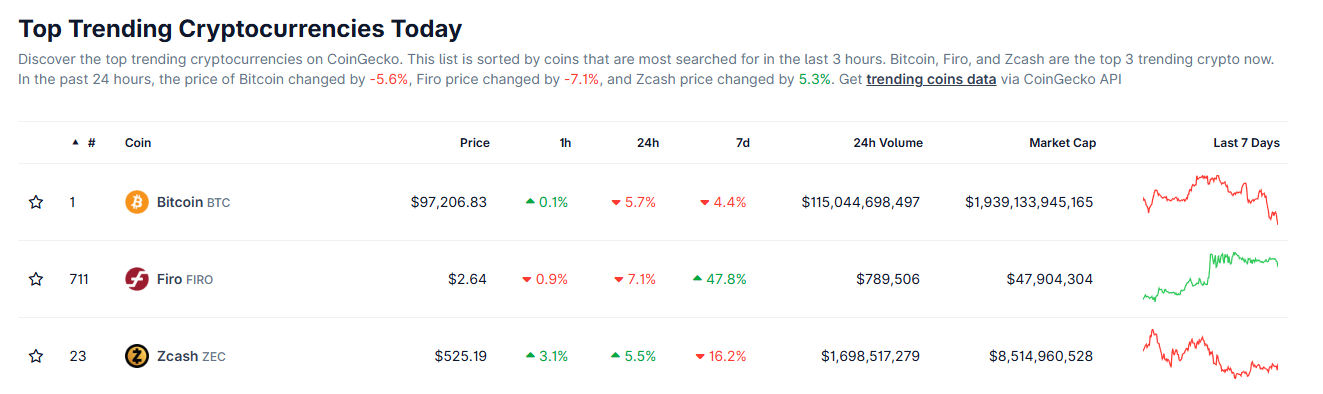

FIRO also remained in the top Trending section on Coingecko throughout the week. This trend reflects strong research interest from investors.

CoinGecko Top Trending Coins. Source: CoinGecko.

CoinGecko Top Trending Coins. Source: CoinGecko.

“FIRO has been trending #1 on Coingecko for an entire week. When the tech is truly great, the interest speaks for itself. Billions.” – Investor Zerebus commented.

Alongside the rally, FIRO’s exchange balance dropped by more than 21%, down to just over 256,000 tokens, according to Nansen. This decline indicates that demand for accumulation remains strong, despite the fear that dominated November.

2. Alchemix (ALCX)

Alchemix (ALCX) is a DeFi protocol that enables users to borrow synthetic assets, such as alUSD or alETH, based on the future yield generated by their collateral.

Price data shows that ALCX surged 140% in November. This move officially ended the sideways phase that lasted from February until now.

ALCX Price Performance. Source:

ALCX Price Performance. Source:

This altcoin has a low circulating supply of just over 3 million ALCX. Ethplorer data shows that the first two weeks of November recorded the highest on-chain ALCX transaction volume in three years. More than 20,000 ALCX were transferred in the first week and over 10,000 in the second.

ALCX Price vs. Transfer Volume. Source:

ALCX Price vs. Transfer Volume. Source:

This activity reflects strong accumulation. Nansen data also shows that ALCX’s exchange balances dropped more than 35% in the past 30 days.

These signals have strengthened investor expectations for continued growth. The optimism is reinforced by ALCX’s relatively small market cap of roughly 37.5 million USD.

“ALCX has more than 100X potential based on a huge price breakout that took place early on this cycle and these prices may only be gearing up for such growth…” Investor JAVON MARKS predicted.

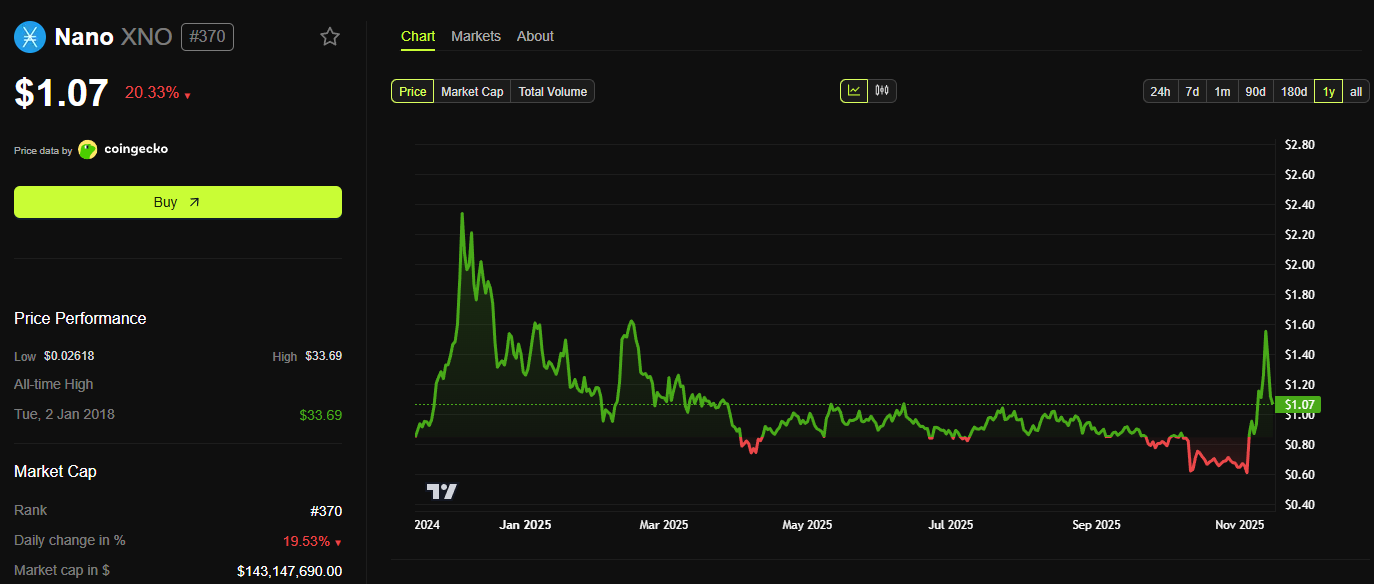

3. Nano (XNO)

Nano (XNO) is a cryptocurrency designed for real-world payments. It offers fast, feeless, and sustainable transactions thanks to its block-lattice architecture and energy-efficient consensus mechanism.

Price data shows that XNO climbed more than 70% over the past month. The asset now trades around $1 with a market cap of $143 million. This rally pushed XNO out of the accumulation zone that began in March.

XNO Price Performance. Source:

XNO Price Performance. Source:

Nano originated during the 2017 altcoin season and has survived multiple market cycles. The recent surge in trading volume has renewed investor hopes that XNO may target $5 or even $8.

Additionally, more than 86.5 million XNO—approximately 67% of the circulating supply—has been staked by Representatives who validate network transactions. This level of staking demonstrates investor commitment to supporting the network and reinforces the upward trend.

Breaking out of long-term accumulation remains one of the strategies many analysts highlighted in November. However, low-cap altcoins carry higher risk. Their lower liquidity can lead to sharper volatility during market downturns.

Because of this, maintaining a moderate allocation may be crucial when dealing with these assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Navigating Cryptocurrency Frauds: The COAI Token Fiasco and the Importance of Investor Research

- COAI token's 88% collapse in 2025 exposed DeFi vulnerabilities, causing $116.8M investor losses through algorithmic stablecoin flaws and opaque governance. - Centralized token distribution (87.9% in ten wallets) and regulatory ambiguities like the U.S. CLARITY Act enabled coordinated manipulation and liquidity crises. - Global authorities imposed sanctions and froze assets, but jurisdictional gaps persist as Southeast Asia remains a crypto scam hub with $10B annual frauds. - Experts urge smart contract a

XRP News Update: XRP Falls 15% Amid ETF Hopes—Is $2.70 Within Reach?

- XRP fell 15% to $2.17 amid whale selling, but ETF launches and institutional inflows could drive a rebound toward $2.70. - Major ETF providers like Franklin Templeton and Grayscale are preparing XRP products, signaling growing institutional confidence in its cross-border payment utility. - Bitcoin and Ethereum also declined 12-13.4%, but analysts view the dip as a buying opportunity amid ETF-driven demand and stable technical indicators for XRP. - Price resilience above $2.15 and ETF inflows outpacing ou

USB-C in Business: How Standardization Brings Global Trade Together

- Commerce Operations Foundation launches onX, a standardized protocol unifying global commerce systems via real-time order management and inventory sync, akin to USB-C's digital standardization. - Pedego-Urtopia partnership rebrands as New Pedego Holdings, leveraging smart tech and lean manufacturing to expand 500 U.S.-Canada stores through community-focused retail innovation. - MegaETH's cross-chain bridge and Mutuum Finance's DeFi lending protocol highlight DeFi's maturation, with USDm liquidity and aut

Dogecoin News Update: Trump's Chainsaw Agency Dissolved, Efficiency Initiative Continues Amid Bureaucratic Reform

- Trump's DOGE agency, aimed at cutting federal waste, disbanded early amid unverified savings claims and staff departures after Musk's exit. - OPM absorbed DOGE's functions, while Musk's "chainsaw" approach faced criticism for layoffs and lack of transparency in budget reallocations. - Trump administration shifts efficiency focus to AI-driven deregulation, with states like Idaho adopting localized DOGE models. - Critics highlight DOGE's legacy of legal challenges and broken promises, though its cost-cutti