How Grayscale Holds XLM as the Price Drops More Than 50%

Stellar faces steep market fear, yet Grayscale’s firm position and rising ecosystem activity signal potential stabilization ahead. The network’s payments push and RWA growth could help buffer continued pressure.

From its 2025 peak, Stellar (XLM) has fallen from $0.52 to $0.26. Grayscale — one of the leading crypto investment funds — has notably managed its XLM holdings during this downturn.

Extreme market fear at the end of the year continues to fuel negative expectations. What does Stellar (XLM) have to face these headwinds?

Grayscale Holds More Than 116 Million XLM

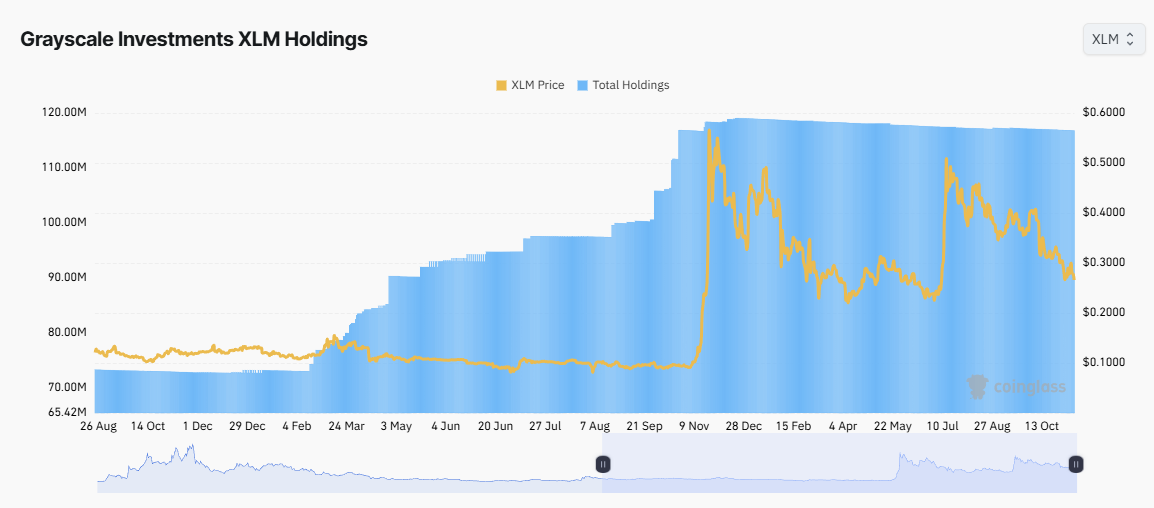

According to the latest data from Coinglass, Grayscale’s XLM holdings increased from last year, before XLM printed a “god candle” in November 2024 with nearly 600% growth.

Grayscale successfully accumulated XLM from 70 million to 119 million ahead of the rally. This move highlights the fund’s effectiveness as a smart-money participant that positioned itself before major market swings.

Grayscale Investments XLM Holdings. Source:

Coinglass

Grayscale Investments XLM Holdings. Source:

Coinglass

However, since early 2025, the fund has stopped accumulating. XLM’s price has stopped setting new highs and entered a downward trend. Compared to the 2025 peak, Grayscale’s XLM holdings slightly decreased to 116.8 million.

The fund’s refusal to sell aggressively reflects its investors’ long-term perspective. They appear to view XLM as a valuable asset in the cross-border payments sector.

More notably, shares of Grayscale Stellar Lumens Trust (GXLM) trade at a premium over its actual Net Asset Value (NAV).

Grayscale Stellar Lumens Trust Performance. Source:

Grayscale

Grayscale Stellar Lumens Trust Performance. Source:

Grayscale

GXLM’s market value sits at $24.85, while its NAV per share is $22.29.

The market price is about 10–15% higher than NAV. This premium indicates that investors are willing to pay above the underlying asset value. This condition has dominated most of the trading sessions in 2025.

However, when comparing Grayscale’s XLM holdings to the more than 32 billion XLM circulating supply, the fund only controls about 0.36% of the supply. This share remains too small to create any decisive impact on the market.

What Does Stellar (XLM) Have to Counter Selling Pressure?

November 2025 marked a pivotal moment when seven major crypto players — Fireblocks, Solana Foundation, TON Foundation, Polygon Labs, Stellar Development Foundation, Mysten Labs, and Monad Foundation — officially launched the Blockchain Payments Consortium (BPC).

This alliance aims to promote blockchain-based payment standards. BPC focuses on cross-chain integration, enabling XLM to reach millions of users across other ecosystems. These developments could boost demand in 2026.

“During Q3, the Stellar network saw 37% growth in full-time developers, 8 times faster than the industry growth rate,” Stellar stated.

In parallel, the Stellar ecosystem continues to see explosive growth in Real-World Assets (RWA). Total RWA value on the network reached a record $654 million in November 2025, up from $300 million at the beginning of the year.

Tokenized Asset Value on Stellar. Source:

RWA

Tokenized Asset Value on Stellar. Source:

RWA

Charts from RWA.xyz show significant contributions from tokenized funds, including Franklin OnChain US Government Fund and WisdomTree Prime.

However, real adoption stories do not always align with market sentiment. Recent analysis indicates that XLM has historically performed poorly in November. With altcoins drowning in extreme fear, XLM may struggle to escape the broader negative trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: JPMorgan's Shutdown of Strike Opposes Trump's Directive Against Debanking

- JPMorgan's closure of Strike CEO Jack Mallers' accounts contradicts Trump's August executive order banning crypto "debanking," sparking regulatory scrutiny. - Mallers criticized the lack of transparency, noting JPMorgan cited "concerning activity" without specifics and warned against future account access. - Industry experts argue such actions risk pushing crypto innovation to unregulated markets, undermining U.S. financial leadership and democratic systems. - The incident highlights contradictions in JP

Bitcoin News Update: With Trump's Crypto Faltering, Investors Turn to Stablecoins for Security

- Trump's crypto investments lost $1B as ABTC and TMTG collapsed, prompting a shift to stablecoins exceeding $300B market cap. - Trump Media's $250M Bitcoin investment initially boosted shares but was overshadowed by broader crypto market declines. - SEC probes and central bank warnings highlight risks in politically connected crypto projects and stablecoin redemption vulnerabilities. - Despite losses, Trump family members remain bullish on Bitcoin, while DOGE meme coin surged post-program termination. - M

Investors Abandon HBAR Due to Instability, Turn to Small-Cap Options

- HBAR price collapsed below $0.1440, triggering bearish signals as key support levels failed to hold amid surging trading volume. - Zero-volume trading halts and distribution patterns highlight liquidity risks, with critics questioning market depth infrastructure. - Investors shift toward low-cap alternatives as HBAR's volatility contrasts with gains in fintech (SoFi +87.7%) and space-tech (BlackSky $71.4M revenue). - Analysts warn further downside to $0.1340 remains likely without institutional support,

ECB Cautions That Fluctuations in Tech and Crypto May Trigger a Market Crash Similar to 2000

- ECB warns U.S. tech and crypto volatility risks triggering a 2000-style market crash, citing sharp asset corrections and AI-driven valuation fragility. - ECB officials stress central banks must retain rate-cut flexibility amid rising risks, as crypto outflows and equity inflows highlight market divergence. - JPMorgan analysis flags crypto panic-selling risks spilling into broader systems, while MSCI warns a 63% sector collapse could follow AI confidence loss. - ECB and BIS caution stablecoin growth threa