Not ETF Buzz, Nor Whales — This Group Can Save Dogecoin (DOGE) Price From a Breakdown

Dogecoin price continues to fall even as whales accumulate and ETF anticipation builds. The only group that has historically triggered DOGE recoveries — long-term holders — is still selling heavily. With the price sitting below a key cost-basis cluster, the next move rests entirely on whether this group flips back to inflows.

Dogecoin is down about 1% over the past week and dropped another 7.3% in the last 24 hours, making it one of the weakest large-cap coins during the latest market dip. The ETF noise did not help either. The countdown for the Bitwise spot Dogecoin ETF began on November 7, but DOGE has barely moved since then.

Whales have been buying too, yet the price keeps sliding. The charts show that one group can stop Dogecoin from breaking down, and they have not returned yet.

Whales Buy and ETF Buzz Builds — But Price Still Drops

Buying from whale wallets holding 100 million to 1 billion DOGE has continued since November 7. On that day, their holdings were 30.75 billion DOGE. Now they hold 34.11 billion DOGE. They added around 3.36 billion DOGE in one week. At today’s price, that represents more than $550 million in accumulated value.

Dogecoin Whales:

Dogecoin Whales:

Even with this level of buying, DOGE is still down 1% over the same period. The ETF countdown also had no effect. Price stayed flat while institutional interest increased.

Looks like Bitwise is doing the 8(a) move for their spot Dogecoin ETF, which basically means they plan on going effective in 20 days barring an intervention.

— Eric Balchunas (@EricBalchunas) November 6, 2025

When whales buy and the price does not respond, it usually means another force is stronger. That force is long-term holders.

This Hodler Group Has a History of Triggering Rallies and Bounces

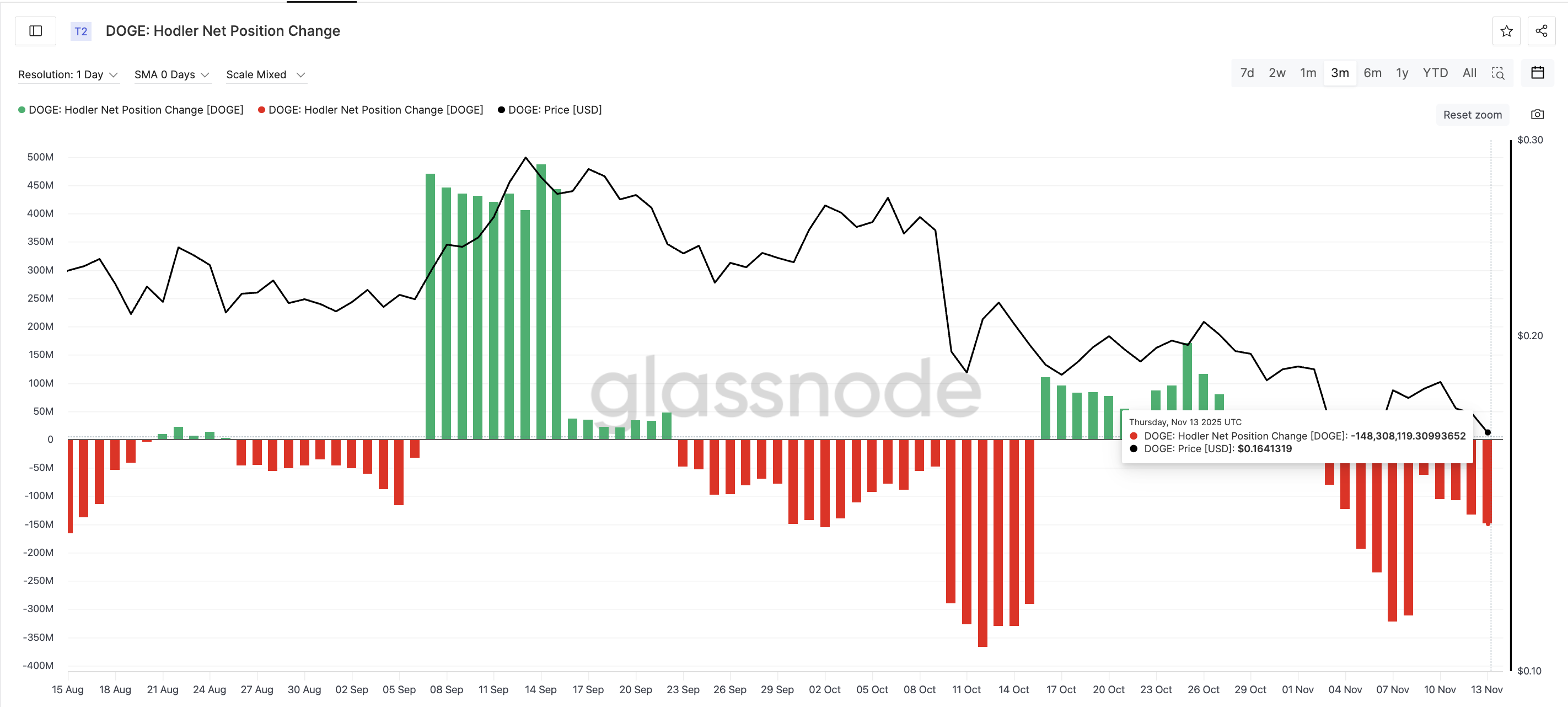

The Hodler Net Position Change shows long-term wallets have been selling aggressively. This metric tracks whether long-term holders are adding (inflows) or removing (outflows) coins.

On November 9, long-term holders removed 62.3 million DOGE. As of November 13, that number has jumped to 148.3 million DOGE, leaving long-term wallets. That is a 138% increase in selling pressure in less than a week.

Dogecoin Hodlers Need To Buy Again:

Dogecoin Hodlers Need To Buy Again:

This same group triggered earlier price reactions:

• Between September 6–7, the metric flipped from outflows to inflows, and DOGE jumped about 33% shortly after.

• Between October 15–16, the same shift produced a smaller bounce of around 5% after a few days.

These moves show a clear pattern: price strength usually returns when long-term holders stop selling and begin adding again. Right now, the signal remains deep in outflows. Until it flips again, DOGE cannot build a real recovery.

Dogecoin Price Nears Breakdown Zone — One Level Holds the Entire Structure

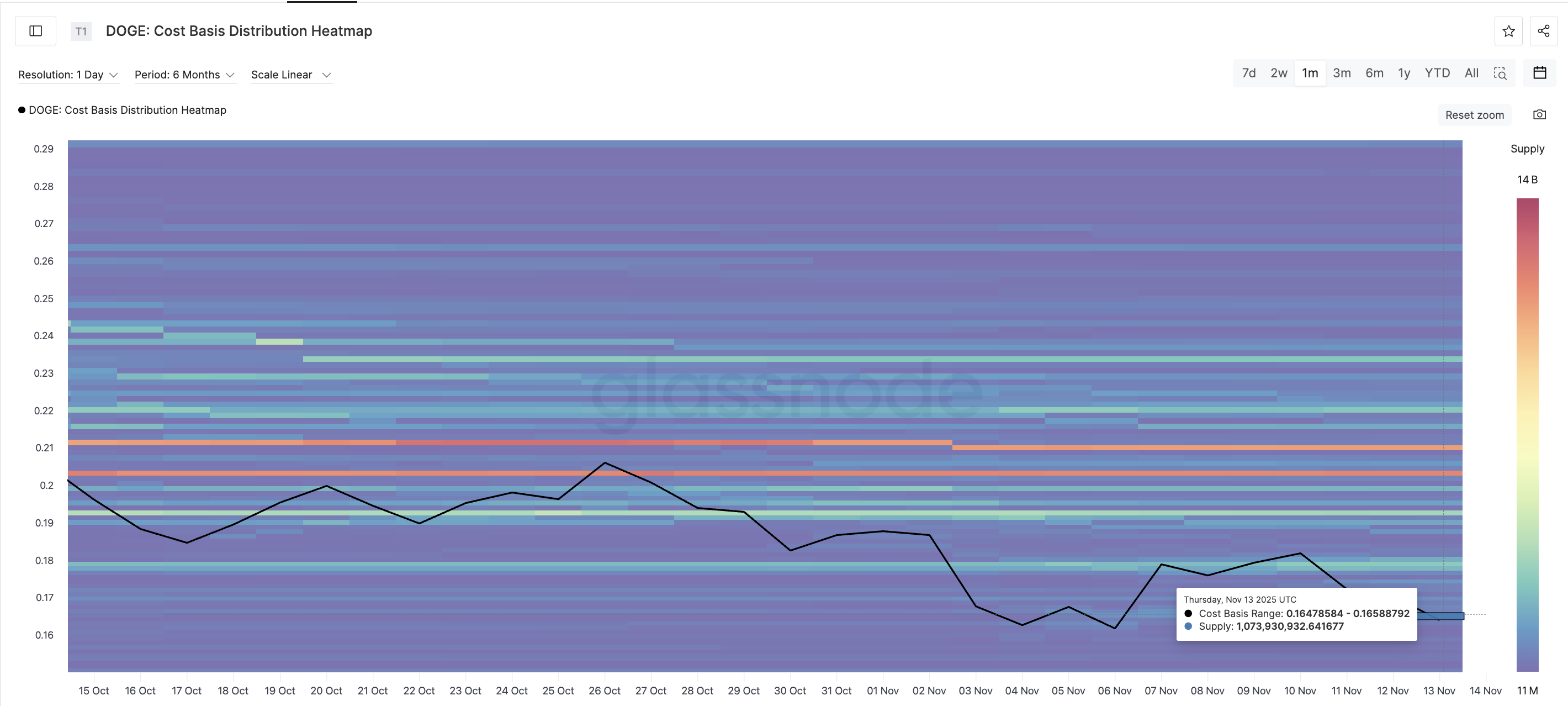

DOGE now trades near $0.163 and sits near its largest cost-basis support cluster. The cost-basis heatmap shows the strongest concentration of holders between $0.164 and $0.165. As long as this zone holds, DOGE can stay stable and attempt a bounce or two.

Cost Basis Heatmap To Identify Supply Zones:

Cost Basis Heatmap To Identify Supply Zones:

If DOGE closes a daily candle below $0.164 (which is currently possible), it will slip under this cluster. With almost no heavy support levels beneath it, the price can drop quickly. The next key level is $0.158, only 2.6% lower. A breakdown there exposes $0.151 and deeper losses if the market stays weak.

Dogecoin Price Analysis:

Dogecoin Price Analysis:

On the upside, the DOGE price needs a move above $0.178 to show early strength. A stronger short-term reversal needs a clean break above $0.186. But neither move can hold unless long-term holders return and shift back to inflows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: MicroStrategy's Bold Bitcoin Investment Stands Strong Despite 57% Drop in Stock Value

- MicroStrategy's CEO reaffirms Bitcoin buying strategy amid market volatility, adding 8,178 BTC for $835.6M. - Despite 57% stock decline, MSTR's Bitcoin holdings reach $61.7B, funded by preferred shares and convertible notes. - Critics question debt-driven model's sustainability, but analysts praise its Bitcoin-per-share growth and $535 price target. - Saylor envisions $1T Bitcoin balance sheet, leveraging appreciation for credit products and reshaping global finance.

Ethereum Updates Today: Buddy Goes All-In on ETH with $13 Million Leveraged Wager Amid Market Slump

- Buddy Huang’s ETH long position was liquidated, prompting a $9.5M reentry amid market turmoil. - Market selloff attributed to macroeconomic pressures, with BTC dropping 28.7% below $90K. - A $1.24B ETH whale added 13,117 ETH despite $1.59M unrealized losses, signaling bullish conviction. - Institutional caution grew as SoftBank exited $5.8B NVIDIA stake, while Coinbase hinted at December 17th product launch. - Buddy’s $13M leveraged bet faces liquidation risk if ETH fails to stabilize above $3,000, highl

The Rapid Drop in COAI Shares: Red Flag or Investment Chance?

- COAI Index fell 88% YTD in Nov 2025, sparking debate over systemic collapse vs undervalued opportunity. - Market sentiment diverges from fundamentals: C3.ai shows 26% YoY revenue growth despite governance crises and $116M Q1 loss. - CLARITY Act regulatory uncertainty, leadership turmoil at C3.ai, and crypto frauds like Myanmar's $10B scam fueled sector-wide selloff. - C3.ai's $724M cash reserves and 69% gross margin highlight resilience, but legal battles and regulatory ambiguity persist as key risks. -

DappRadar's Shutdown Reflects Challenges Faced by the Industry Amid Market Volatility

- Web3 analytics firm DappRadar announced its shutdown due to "financially unsustainable market conditions," causing its RADAR token to drop 30%. - Companies like PG Electroplast and GEM Aromatics reported revenue declines amid U.S. tariffs, GST changes, and raw material costs, reflecting broader economic challenges. - Geox cut 2025 sales forecasts by high single digits after 6.2% year-to-date revenue fall, while cost cuts helped stabilize its EBIT margin. - Tech stocks face volatility: Nvidia downgraded a