Bitcoin Price Tanks Below $97K as Analyst Warns the Worst Is Yet to Come

Despite the positive developments on a macro front, such as the US government reopening, BTC’s quite unfavorable price actions continued in the past 12 hours or so as the asset plunged to a new multi-month low.

The cryptocurrency stood above $107,000 just three days ago after Trump promised to send tariff checks of at least $2,000 to some Americans and hinted that the government shutdown might end soon. However, bitcoin failed to capitalize on this momentum and quickly dipped back to $103,000.

Nevertheless, it rebounded to $105,000 on Wednesday before the bears took complete control of the market, especially on Thursday. The POTUS signed legislation to reopen the government, which was first followed by an immediate bounce, but the landscape changed for the worse shortly after.

In less than a day, bitcoin dumped by more than eight grand and currently struggles below $97,000, which is the lowest it has been since early May.

Doctor Profit, who has been bearish on the asset for weeks, believes the worst is yet to come by predicting another nosedive to somewhere around $90,000 and $94,000.

#Bitcoin: First promised target of 90-94k region is about to be hit. Important to note that I wont take any profits from the short at 90-94k region! https://t.co/p6qQqxsaor pic.twitter.com/Rhamwixvct

— Doctor Profit 🇨🇭 (@DrProfitCrypto) November 14, 2025

The altcoins have followed suit with multiple double-digit price declines. AAVE, ENA, RENDER, SUI, PEPE, and LINK are also down by more than 12%. Even the largest of the bunch has plunged by over 11% and now struggles well below $3,200.

You may also like:

- Bitcoin’s Price Jumps as Trump Signs Bill to End Record US Govt Shutdown

- Bitcoin Tumbles Below $100K Again, Liquidations Approach $700 Million

- BTC Steadies Over $100K: Sign of Maturity While ‘Moonvember’ Buzz Builds

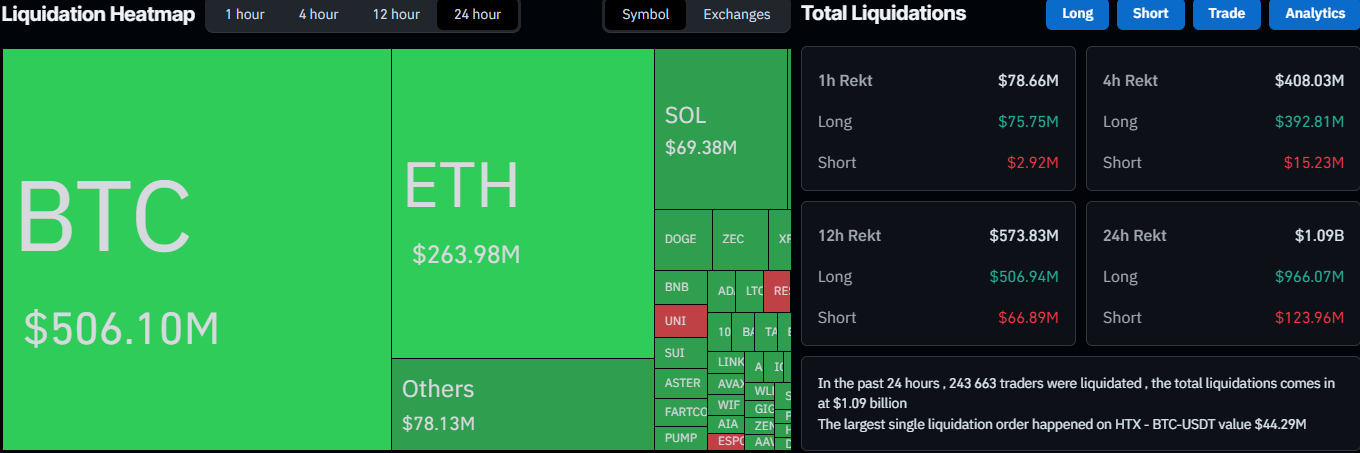

The total value of wrecked positions has skyrocketed to almost $1.1 billion on a daily basis. The single-largest liquidated position, according to CoinGlass, took place on HTX and was worth a whopping $44.29 million. The number of wrecked traders is above 240,000.

Naturally, longs represent the lion’s share, with $966 million. Short liquidations are worth $124 million as of press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Eightco’s WLD Staking Jumps 3% as Company Moves Focus from Biometric Disputes to Blockchain Infrastructure

- Eightco's 1.3B WLD stake drove a 3% price surge as the firm shifts focus from biometric data to blockchain infrastructure projects. - The disclosure highlights institutional crypto ownership trends while distancing from WLD's controversial data monetization model. - Intuit's $100M+ OpenAI partnership boosted shares 3.4% by integrating AI financial tools into ChatGPT and enterprise platforms. - The deal underscores AI-driven fintech innovation, positioning Intuit against competitors expanding generative A

Cardano News Update: Hoskinson's Wager Against Major Holder Sell-Offs—Is ADA's $0.50 Floor at Risk?

- Cardano (ADA) stabilized above $0.50 amid whale selling and Charles Hoskinson's $200M investment in Trump-linked American Bitcoin . - Over 4 million ADA dumped weekly by large holders, signaling volatility as Hoskinson defends Bitcoin-AI synergy potential. - ADA's 41% lower trading volume and 3% open interest drop reflect reduced speculation despite technical support at $0.50. - Whale activity and stagnant $240M TVL highlight market skepticism, with Hoskinson attributing DeFi challenges to low user engag

Solana News Today: Solana Challenges $130 Support Level: Will ETF Inflows Offset Negative Market Trends?

- Solana (SOL) tests $130 support as price falls below $140, with technical indicators signaling bearish consolidation below key moving averages and resistance at $136. - Institutional adoption accelerates via VanEck's U.S. spot Solana ETF, managed by SOL Strategies through its Orangefin validator node, joining Bitwise and Grayscale in attracting $382M inflows. - Price remains range-bound near $155 amid mixed signals: ETF inflows provide partial support, but RSI/MACD remain bearish, with $162 breakout pote

Ethereum Updates Today: U.S. Paves Way for Banks to Offer Crypto Services Following Change in Blockchain Fee Regulations

- U.S. banks can now hold crypto on balance sheets to pay blockchain fees, per OCC guidance, easing crypto service integration. - Policy clarifies permissible use of assets like ETH for gas fees, requiring "reasonable" reserves and compliance with safety standards. - Trump-era crypto-friendly reforms, including the GENIUS Act, aim to position the U.S. as a global crypto innovation leader. - Major banks accelerate crypto adoption, expanding custody partnerships and stablecoin projects amid regulatory clarit