Ethereum Flashes a Reversal Setup — Now It Just Needs the ‘Mega’ Confirmation

Ethereum is flashing a clean reversal setup on the daily chart, but major holders are still reducing exposure. One key zone now decides whether the bullish pattern expands or fails.

Ethereum price fell nearly 11.5% over the past 24 hours. It has since recovered roughly 2.5%, now trading above $3,230. Yet, the 24-hour ticker still shows a near 6% dip.

The corrective move, however, has printed a bullish reversal pattern on the chart, but the question is whether it can play out while large holders continue to step back.

Reversal Pattern Appears, but Whale Activity Still Shows Weakness

Ethereum has formed a bullish harami on the daily chart. This pattern happens when a small green candle sits inside the body of a larger red candle from the previous day. It often shows selling pressure slowing and buyers trying to regain control.

A similar setup appeared on November 5, but the bounce failed because buying strength faded quickly. That failure puts more weight on the current pattern and whether buyers can sustain momentum this time.

Bullish Pattern Identified:

TradingView

Bullish Pattern Identified:

TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

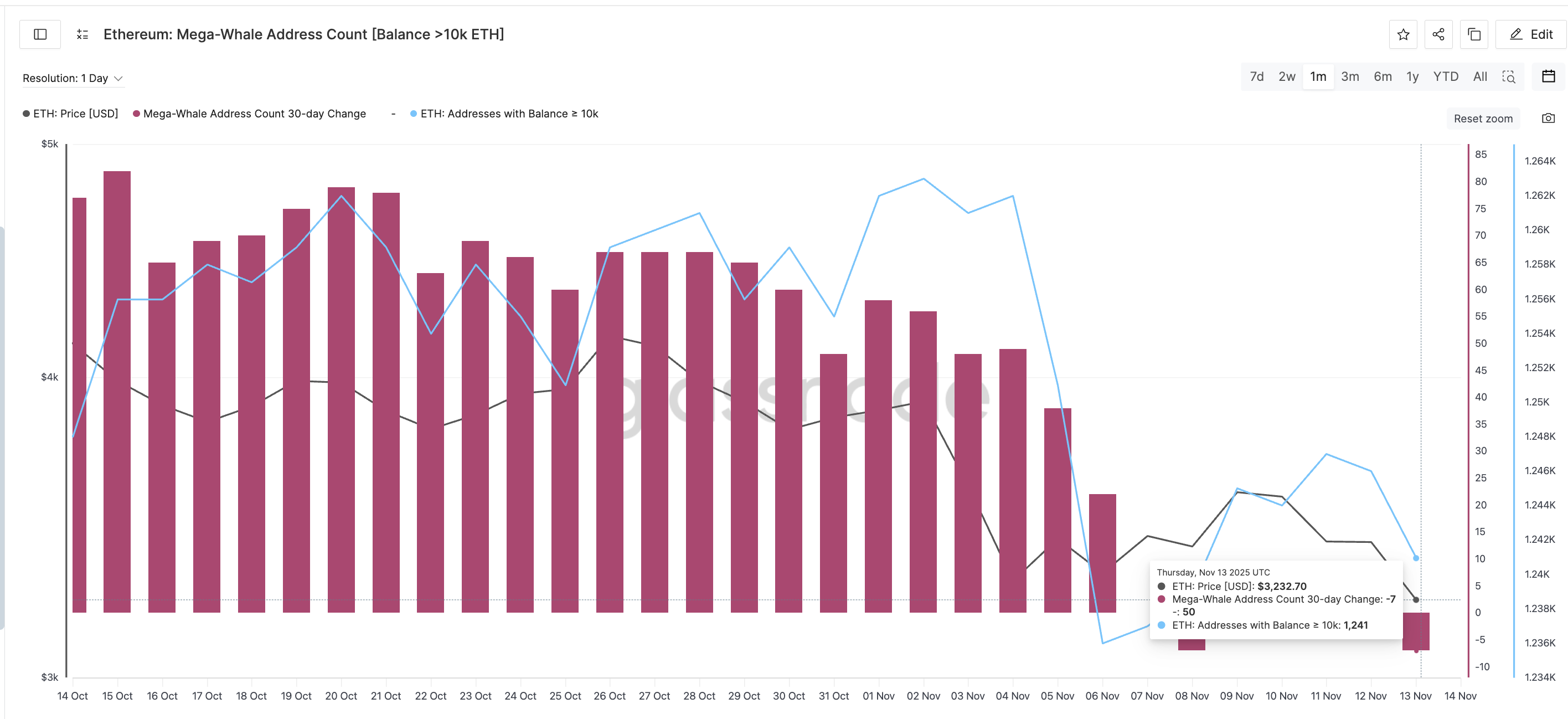

The pressure comes from whale behavior. The mega-whale address count, which tracks the 30-day change in wallets holding over 10,000 ETH, has dropped again. It is now back to the same negative level seen on November 8.

The number of addresses holding 10k ETH has also been falling since November 2. There was a small pickup from November 6 to 11 during a short-lived rebound, but the decline returned immediately after. That decline in holdings coincided with Ethereum’s bearish crossover, a risk we highlighted earlier.

Mega ETH Whales Not Convinced:

Glassnode

Mega ETH Whales Not Convinced:

Glassnode

So even though the bullish harami is active, whales are not supporting the move yet. That keeps the Ethereum price reversal setup weaker than it looks on the chart.

Key Levels Now Decide Whether the Ethereum Price Reversal Expands or Fades

If the bullish pattern holds, Ethereum’s next test sits near $3,333, a short-term level that has limited rebounds this week. That level is mentioned later when we discuss the Ethereum price chart.

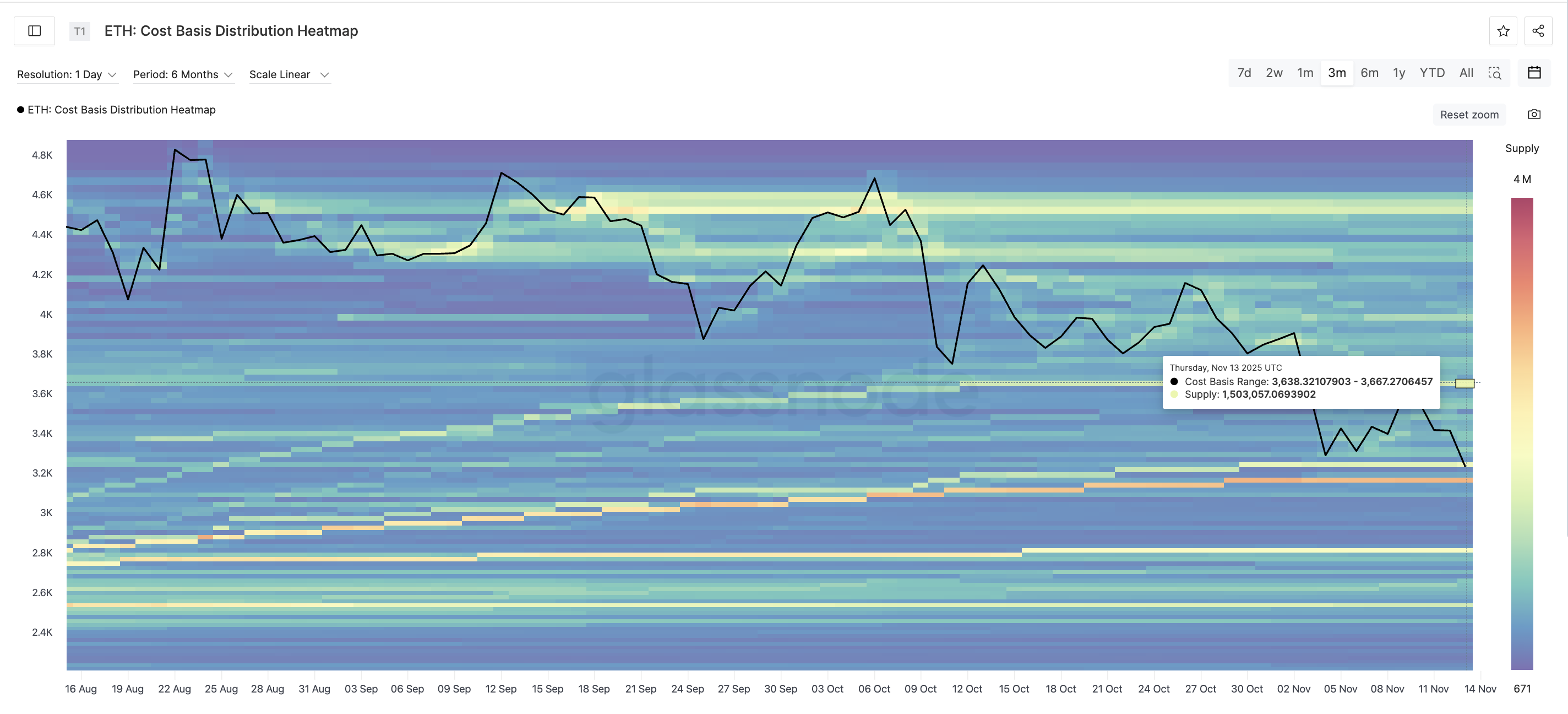

The stronger hurdle is $3,650, which requires a 12% move from the recent low. Data from the cost-basis distribution heatmap, a tool that maps where large amounts of ETH last changed hands, shows that $3,638–$3,667 holds one of the biggest supply zones.

Ethereum Supply Cluster:

Glassnode

Ethereum Supply Cluster:

Glassnode

It contains more than 1.5 million ETH, so clearing it would show strong buyer commitment. This is why the $3,650 level becomes all the more important.

A close above this band would confirm that the bullish harami is working and could open a broader recovery. But if the Ethereum price loses support near $3,150, the pattern weakens fast.

Ethereum Price Analysis:

TradingView

Ethereum Price Analysis:

TradingView

A sharp drop below $3,050 would invalidate the structure and allow sellers to push lower, repeating what happened after the failed harami earlier this month.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Removal from Index May Undermine MSTR’s Bitcoin-Based Strategy

- JPMorgan warns MSTR faces $8.8B in forced selling if MSCI excludes it from indices due to 50%+ digital asset threshold. - MSTR's stock dropped 67% since November 2024 peak as its valuation increasingly aligns with Bitcoin holdings (mNAV ~1.1). - CEO Saylor defends MSTR as "Bitcoin-backed enterprise," but critics argue its financial model lacks sustainability outside benchmarks. - Retail backlash against JPMorgan intensified, with figures like Grant Cardone closing accounts amid short-selling allegations.

Bitcoin News Update: MSTR's Business Role Under Scrutiny as MSCI Considers $8.8B Removal

- MSCI's proposed exclusion of MicroStrategy from global indices could trigger up to $8.8B in outflows due to its 50%+ bitcoin asset allocation. - JPMorgan warns the removal would damage MSTR's liquidity and capital-raising ability, with shares down 67% since November 2024. - CEO Michael Saylor defends MSTR's operational identity, rejecting "passive bitcoin fund" claims while adding $835M in crypto holdings. - MSCI's Jan. 15 decision could disrupt index-linked investor exposure to bitcoin, with MSTR shares

Bitcoin News Update: Institutions Acquire Crypto Shares Amid Rising Bearish Bets on Bitcoin

- Bitcoin's $80,000 put options dominate trading with $2B open interest, signaling sharp bearish reversal after its worst monthly drop since 2022. - ETF outflows accelerated declines, with $3.8B November redemptions, while Ark Invest added $38.7M in crypto equities amid market fragmentation. - Analysts warn leveraged losses ($19B in October) and forced liquidations amplify downturn, with Citi noting critical support at $80,000. - Market remains divided: Binance calls pullback "healthy," while Peter Brandt

Hyperliquid News Today: Speculation Drives Meme Coin Rally Despite Regulatory Alerts

- Meme coins surged on Nov 24, 2025, with PIPPIN rising 80% in 2 hours to $0.053 and $53.15M market cap. - BANANA (+20%) and TNSR (+50%) joined the frenzy, reflecting speculative flows shifting to high-risk assets amid Bitcoin stabilization. - Perpetual DEX protocols hit $4.24M daily revenue while Fed rate-cut expectations and token unlocks fueled volatility. - Regulators warned of risks as India exposed an AI-generated deepfake fraud, highlighting sector instability and regulatory scrutiny. - Analysts cau