Key Market Information Discrepancy on November 14th - A Must-See! | Alpha Morning Report

Editor's Picks

1.Crypto Market Suffers Another Blow as Bitcoin Touches $98,000, US Stock Crypto Concept Stocks Fall Across the Board

2.Musk Announces X Money Will Soon Go Live

3.Aster Launches DEXE Trading Event with Rewards Totaling Over $200,000

4.Boosted by Robinhood Listing, AVNT Surges Over 8%

5.Total Liquidations in the Past 24 Hours Soar to $748 Million, Over 197,000 People Liquidated

Articles & Threads

1. "The New Era of Token Financing, a Milestone in US Regulatory Financing"

The discussion about Monad's ICO on Coinbase with a $25 billion FDV was a hot topic this week. Apart from debating whether the sale at a $25 billion FDV is worth participating in, the "compliance level" as Coinbase's first ICO also sparked widespread discussion and was seen as a landmark event in the industry's compliance. Stablecoin issuer Circle mentioned in its recent quarterly report that it is exploring the possibility of issuing native tokens on the Arc Network. Coinbase also hinted at the launch of the Base token this October, almost two years after the joint founder of Base Chain, Jesse Pollak, said in an interview. All signs indicate that asset issuance in the industry is entering a new era of compliance.

2. "Major Adjustment in U.S. Crypto Regulation, CFTC Could Take Over Spot Market"

The long-standing blurred boundary of crypto regulation in the United States is being redrawn. With Mike Selig nominated as CFTC chairman and Congress advancing new legislation, the division of labor between the SEC and CFTC is emerging for the first time at a policy level, and a rare clear trend in the regulatory structure is appearing: the SEC focuses on securities; the CFTC focuses on the digital commodity spot market.

Market Data

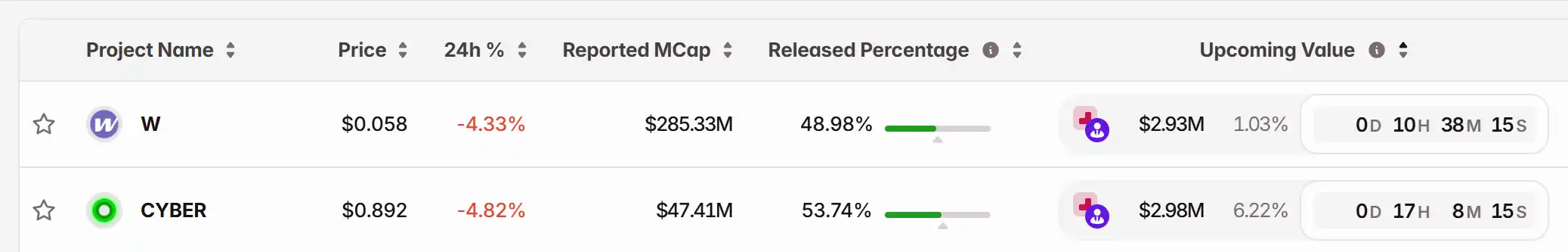

Daily Marketwide Capital Flow Heatmap (reflected by funding rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TRX News Today: JUST DAO Links USDJ with TRX to Address Market Fluctuations and Regulatory Challenges

- JUST DAO suspends USDJ operations, pegging it to TRX at 1:1.5532 to stabilize amid crypto volatility and regulatory scrutiny. - USDJ surged 187.82% pre-announcement, outperforming Bitcoin’s 0.77% drop as TRON-based assets show resilience. - Market cap fell to $3.21T as USDJ’s TRX peg aims to reduce fiat reliance and align with DeFi’s blockchain-native trends. - Mixed reactions highlight risks of TRX volatility undermining the peg, while analysts foresee TRX’s DeFi integration boosting its 2025 appeal.

TWT's Updated Tokenomics Framework: Transforming DeFi Governance and Enhancing Investor Yields

- Trust Wallet's TWT token redefines DeFi governance through utility-driven value creation, deflationary supply, and community governance in 2025. - Permanent burning of 88.9 billion tokens creates scarcity, while gas discounts, collateral capabilities, and governance rights align utility with platform adoption. - Hybrid investor returns combine scarcity-driven appreciation, staking yields, and fee-burn mechanisms, but depend on Solana ecosystem performance and utility adoption. - Challenges include fragme

ETH Tracks a Multi-Wave That Points Toward a $16,528 Projection

El Salvador government adds $100M worth of Bitcoin amid market dip