Zcash Reclaims Momentum — Short Sellers Now Risk Losing $30 Million

Zcash shows renewed strength with CMF holding positive and a potential move toward $600 threatening major short liquidations. ZEC must break $521 to confirm upside.

Zcash is showing renewed strength after a sharp bounce in the last 24 hours, signaling the potential repeat of a familiar pattern from recent market history.

The privacy-focused altcoin has begun reversing its earlier losses, and if momentum continues building, the recovery could come at a significant cost to short traders positioned against the rally.

Zcash Has Its Holders’ Support

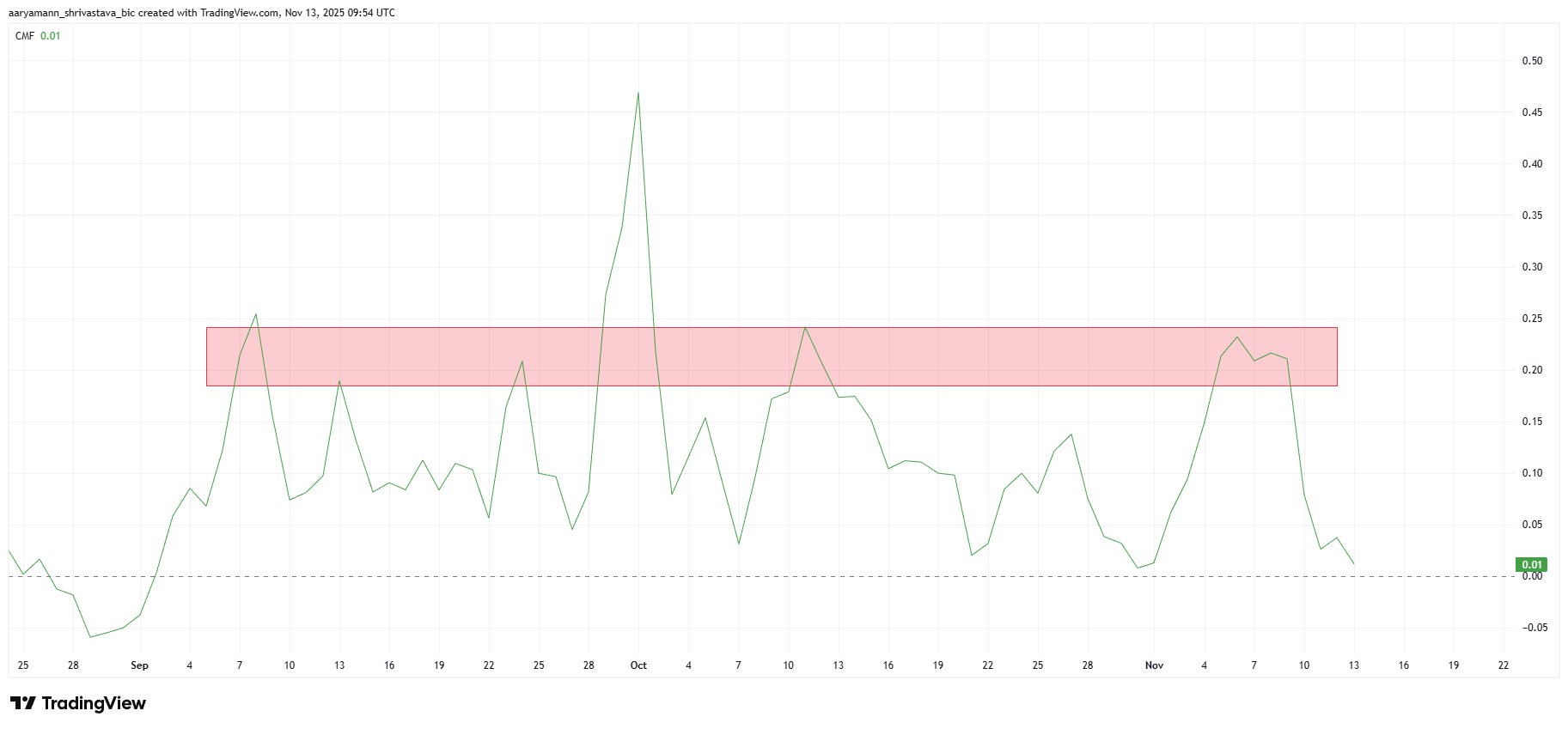

Zcash’s recent movement is closely tied to shifts in investor sentiment reflected by the Chaikin Money Flow (CMF) indicator. The CMF is currently dipping but remains above the zero line, which traditionally signals that inflows still outweigh outflows. Although a downward tilt often implies weakening buying pressure, ZEC’s historical behavior suggests otherwise.

Each time the CMF hovered just above zero, Zcash noted a quick resurgence in inflows, triggering price rebounds even before the indicator turned firmly bullish. This positioning suggests optimism remains alive despite the dip.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

ZEC CMF. Source:

Source:

ZEC CMF. Source:

Source:

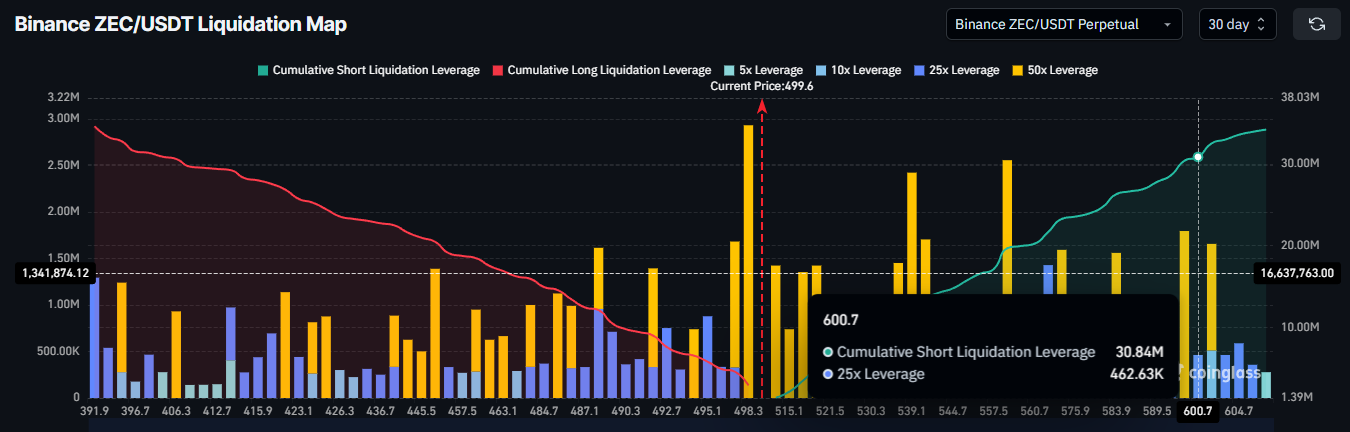

The broader macro momentum surrounding Zcash adds further intrigue. A liquidation map analysis reveals a significant threat to short traders if ZEC extends its climb. Technical cues point toward an impending rise, and the next major resistance sits near $600. A move to this level would trigger an estimated $30.8 million in liquidations for short positions.

This potential wipeout creates an additional layer of pressure on bearish traders, who may step back temporarily to avoid heightened risk. Historically, large-scale short liquidations often amplify upside momentum, accelerating price rallies and strengthening short-term bullish sentiment.

ZEC Liquidation Map. Source:

ZEC Liquidation Map. Source:

ZEC Price May Be Able To Bounce

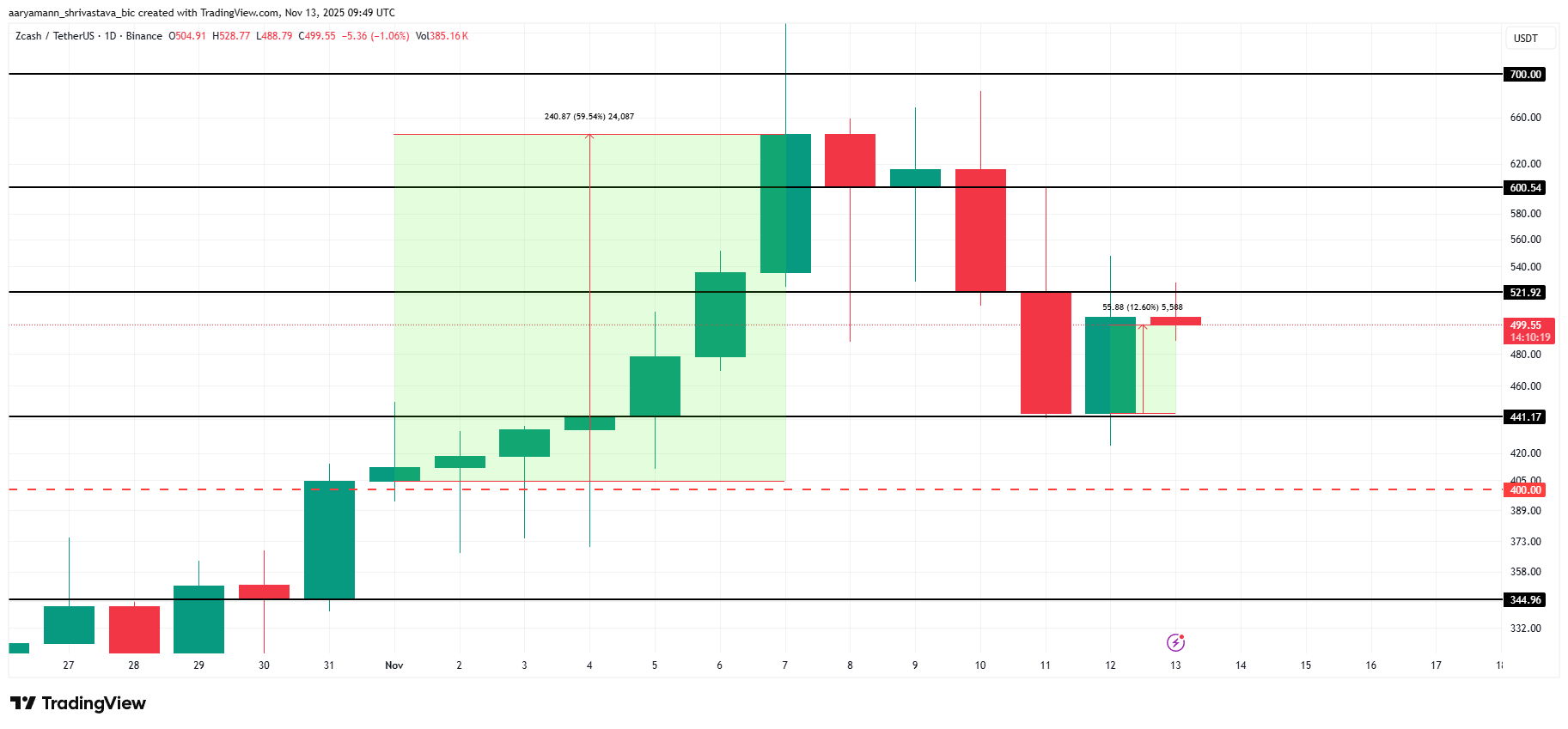

Zcash is up 12.6% over the last 24 hours, hinting at early recovery signals. Despite this jump, ZEC has yet to reclaim the nearly 60% gains it logged at the start of the month. Still, the indicators mentioned above paint a bullish picture that suggests more upside may be within reach.

If ZEC can break above $521 and push through the $600 barrier, a path toward $700 could open. This move would force widespread short liquidations and reinforce the bullish reversal, helping ZEC regain lost ground more quickly.

ZEC Price Analysis. Source:

Source:

ZEC Price Analysis. Source:

Source:

However, failure to breach $521 may weaken the recovery outlook. In that case, Zcash could retrace toward $441 or even fall below $400. This would invalidate the bullish thesis and place the altcoin back into a broader corrective trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin as Digital Gold, Ethereum as the Engine of Decentralized Finance: How Cryptocurrencies Are Carving Out Distinct Functions

- BlackRock executives highlight Bitcoin's shift toward "digital gold" as a long-term store of value, supported by institutional demand and fixed-supply models like Bitcoin Munari. - Ethereum's faster transaction velocity (3x BTC) reinforces its "digital oil" role, contrasting with Bitcoin's stable, passive accumulation strategy and macro-hedge appeal. - Regulatory clarity on stablecoins and blockchain transparency could deepen Bitcoin's institutional adoption while highlighting risks in altcoins like Aero

Stargate’s AI Strategy: Safeguarding the Nation or Raising Antitrust Concerns?

- Stargate, a $500B AI joint venture led by OpenAI, Oracle , and Nvidia , aims to consolidate computing power across seven gigawatt data centers in the U.S. and UAE. - Yale scholar Madhavi Singh warns the alliance violates antitrust laws by merging fierce competitors, risking cartel-like behavior and stifling innovation in chips and cloud services. - Critics argue Stargate eliminates competition in key AI sectors, while the Trump administration and lawmakers praise it as a strategic move to counter China,

Bitcoin Updates Today: Bitcoin Faces a Battle: DWF Issues Buy Alert Amid Market Turbulence

- DWF Labs buys Bitcoin at $84,000 amid 30%+ drop from $126,000 peak, signaling institutional confidence despite market turbulence. - U.S. market weakness highlighted by 21-day negative Coinbase premium (-0.0989%) and $3.79B ETF outflows, including $523M from BlackRock's IBIT . - Strategic buyers like Harvard (+250% IBIT holdings) and Japan's Metaplanet (¥15B allocation) contrast with $4B in realized Bitcoin losses and 35% drop in futures open interest. - Long-term bullish factors include U.S. Strategic Bi

Bitcoin News Today: "Institutional Embrace Helps Steady Bitcoin During Market Volatility"

- Bitcoin remains stable amid market volatility, with analyst Lyn Alden dismissing crash fears due to institutional adoption and macroeconomic factors. - Stablecoin reserves hit $72B, while Circle's USDC outpaces Tether and Solana secures $1B in institutional funding, signaling growing regulated crypto confidence. - Alden predicts $100K Bitcoin by 2026, attributing stability to extended cycles driven by macro demand rather than traditional halving patterns. - Diverging analyst views highlight risks, but Al