Ethereum Whales Snap Up $1.6 Billion ETH As Selling Declines

Ethereum shows early recovery signs as whales accumulate heavily and long-term holder selling drops. ETH now faces a crucial test at the $3,607 resistance level.

Ethereum is attempting to stabilize after an extended decline that raised concerns about its ability to stage a recovery. ETH has struggled to generate upward momentum for most of the month.

However, shifting investor behavior now suggests the situation may be changing. Declining selling pressure and aggressive whale accumulation are creating early signs of strength.

Ethereum Whales Show Their Strength

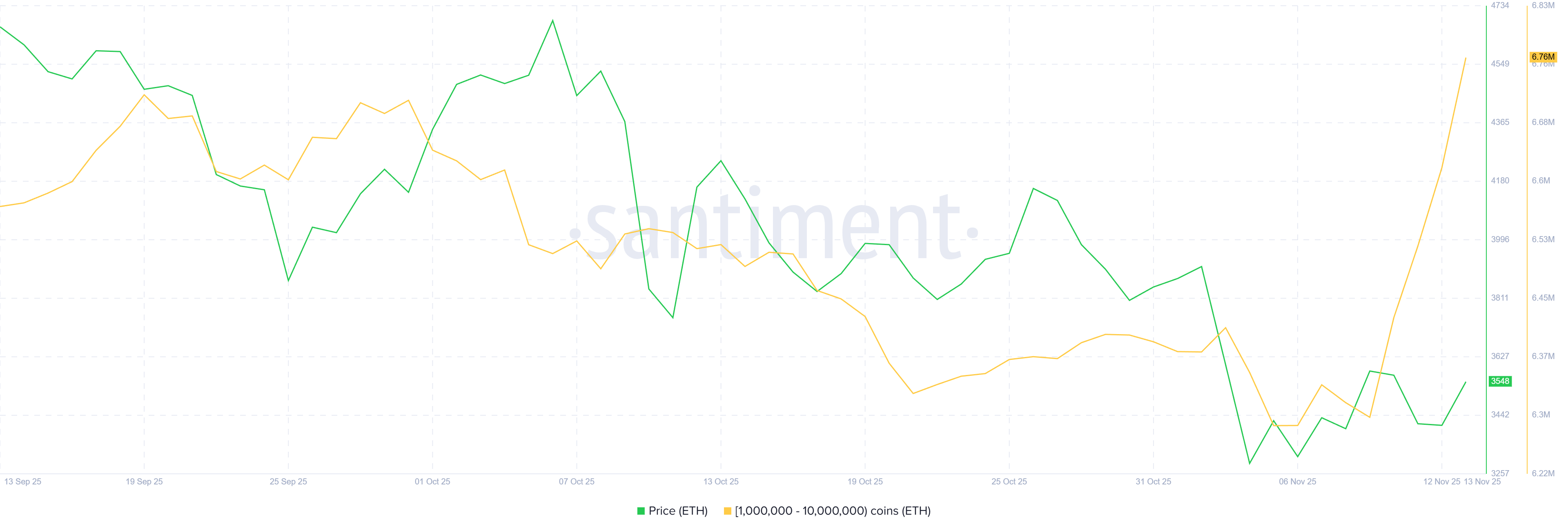

Whale activity has become a key driver of Ethereum’s current market sentiment. Addresses holding between 1 million and 10 million ETH have accumulated nearly 460,000 ETH in the last four days. This haul, valued at more than $1.6 billion, indicates strong conviction among large holders that Ethereum is positioned for a rebound. Their behavior often sets the tone for broader market direction, and this scale of accumulation signals renewed confidence.

This buying spree also highlights that whales see ETH’s discounted prices as an opportunity rather than a warning. Large purchases during periods of market weakness often precede recovery phases.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Ethereum Whale Holdings. Source:

Ethereum Whale Holdings. Source:

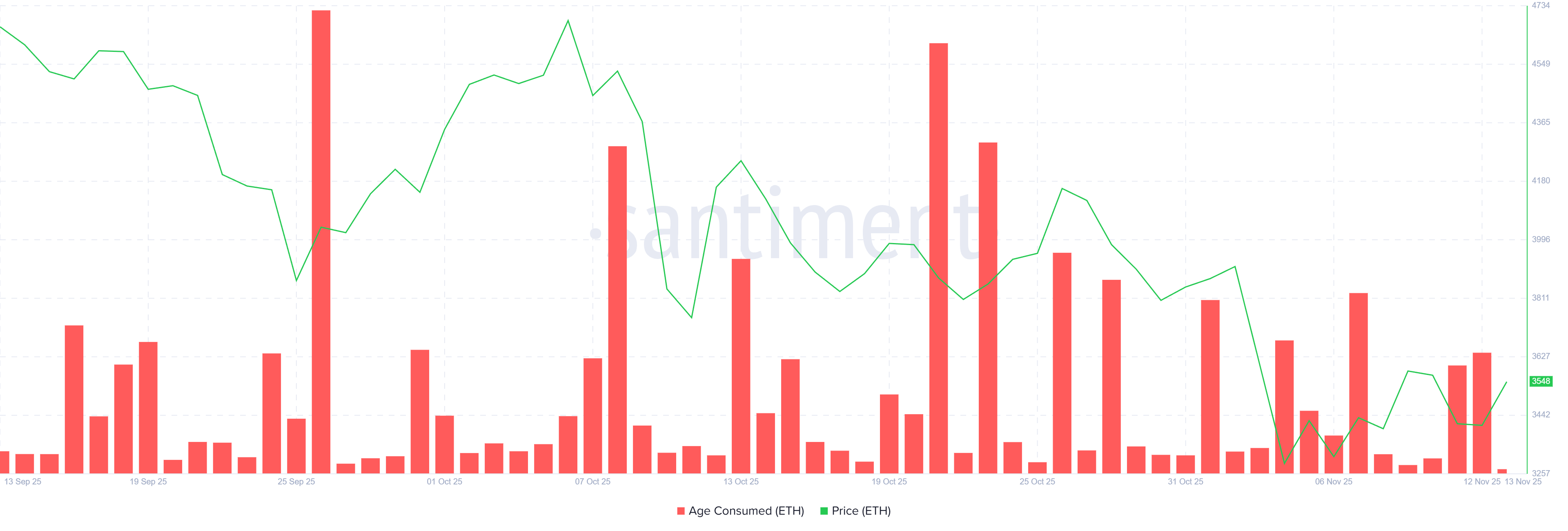

Beyond whale accumulation, Ethereum’s macro momentum shows additional improvement. The Age Consumed metric is declining, reflecting a noticeable slowdown in long-term holder selling. The indicator tracks the movement of older coins, and smaller spikes suggest fewer long-standing investors are parting with their holdings. This behavior is critical, as LTH selling, historically, amplifies market downturns.

The reduced movement among dormant coins gives Ethereum breathing room. When LTHs hold instead of distributing their supply, selling pressure eases, helping stabilize price action. Combined with whale accumulation, this creates a more resilient foundation that could allow ETH to recover once favorable conditions return.

Ethereum Age Consumed. Source:

Ethereum Age Consumed. Source:

ETH Price Faces Downtrend

Ethereum’s price is at $3,540 at the time of writing as it attempts to break above the $3,607 local resistance. ETH remains under a month-long downtrend, but this ceiling is the first key level that must be reclaimed before bullish momentum can return.

If the factors mentioned earlier continue to strengthen, Ethereum could successfully clear $3,607 and advance toward $3,802. Reaching this level would help ETH challenge the prevailing downtrend and potentially open the door to further gains.

ETH Price Analysis. Source:

ETH Price Analysis. Source:

However, if ETH fails to breach $3,607, the altcoin could slide toward the $3,287 support level again. Losing that floor would expose the price to a deeper drop toward $3,131, invalidating the emerging bullish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: The Delicate State of Bitcoin: Surrender or Stabilization

- Bitcoin fell below $87,000, triggering $900M+ liquidations as long positions collapsed amid extreme retail fear metrics. - Analysts highlight oversold conditions, historical parallels to 2025 Q1 reversals, and potential $85k–$100k consolidation ahead of year-end $100k retests. - MicroStrategy faces MSCI index exclusion risks over Bitcoin holdings, while Rental Coins' bankruptcy underscores crypto sector fragility. - $75M ETF inflows and short-squeeze potential at $98k offer cautious optimism despite macr

Bitcoin Updates: Crypto Market Loses $2 Billion—Is This a Fresh Start or the Beginning of a Lengthy Downturn?

- Crypto markets crashed on Nov. 21, 2025, wiping $2B in leveraged positions as Bitcoin fell to $82,000, its lowest since April. - The sell-off was driven by macroeconomic pressures, ETF outflows, and algorithmic liquidations exacerbating price dislocations. - Over 396,000 traders lost $1.78B in long positions, while exchanges underreported liquidations due to partial reporting practices. - Institutional analysts warn of deeper structural risks, with some predicting further 50% declines to flush out specul

Chainlink price hits support as exchange supply dives ahead of ETF launch

Don’t fear the FDV: How real revenue creates sustainable value | Opinion