Pi Coin Investors’ Support Remains Weak, Price To Suffer The Consequences

Pi Coin shows minimal transactional activity and rising bearish pressure, keeping the price trapped between $0.234 and $0.217. A break above resistance is needed to revive momentum.

Pi Coin is struggling to regain momentum after days of stagnant price movement. The token has failed to register meaningful growth as investor support remains weak and broader market sentiment stays bearish.

Despite attempts to stabilize, Pi Coin continues to face pressure from declining participation and unfavorable technical indicators.

Pi Coin Holders Are Not Doing Enough

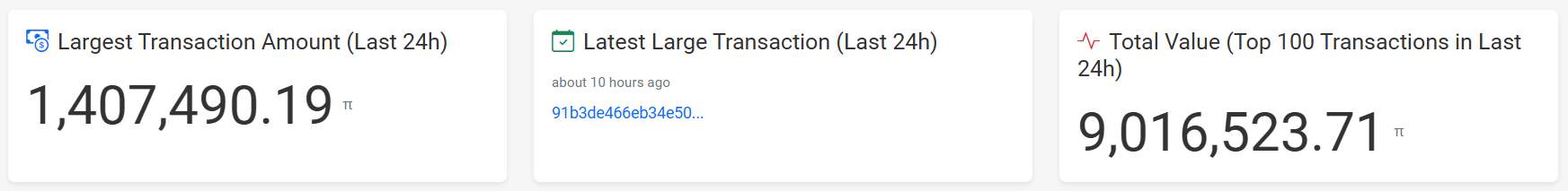

The lack of investor engagement is becoming increasingly evident on-chain. Data from the top 100 transactions in the past 24 hours shows that only slightly more than 9 million PI moved across the network. This activity is valued at under $2.45 million, highlighting the minimal transactional volume supporting the asset.

Among these, the largest transaction involved PI worth less than $319,000, revealing limited interest from major holders. Such low-value movements signal that investors are not actively contributing to liquidity or momentum.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Pi Coin Transactions. Source:

Pi Coin Transactions. Source:

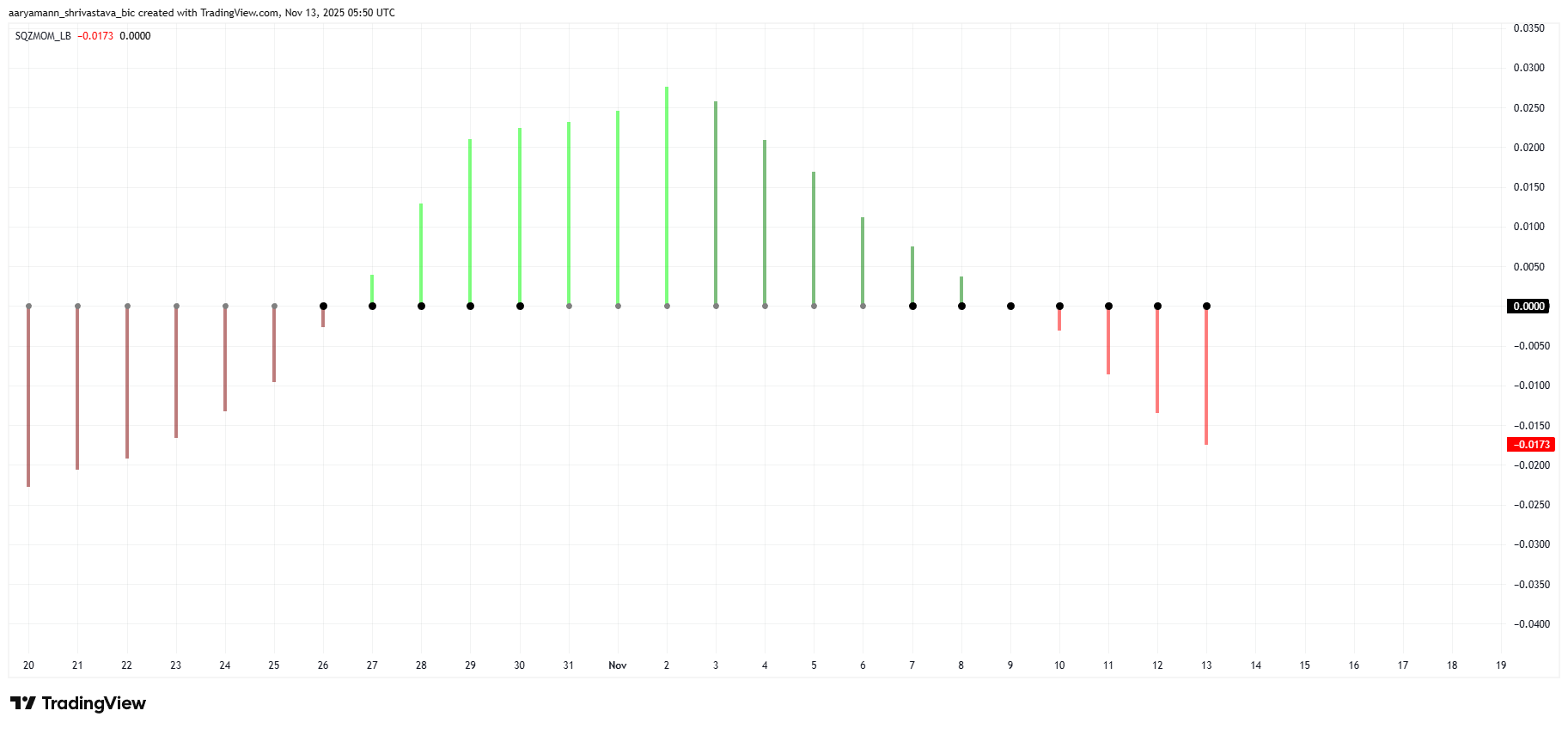

Pi Coin’s broader outlook is further challenged by bearish macro indicators. The Squeeze Momentum Indicator shows a squeeze forming, marked by extending red bars. This pattern reflects strengthening bearish pressure, suggesting that market sentiment may deteriorate further before finding relief.

When the squeeze eventually releases, Pi Coin is likely to face heightened volatility. Given the current bias toward downward momentum, this volatility could trigger a sharper price drop. The ongoing buildup in bearish energy signals that Pi Coin may struggle to maintain its current range.

Pi Coin Squeeze Momentum Indicator. Source:

Pi Coin Squeeze Momentum Indicator. Source:

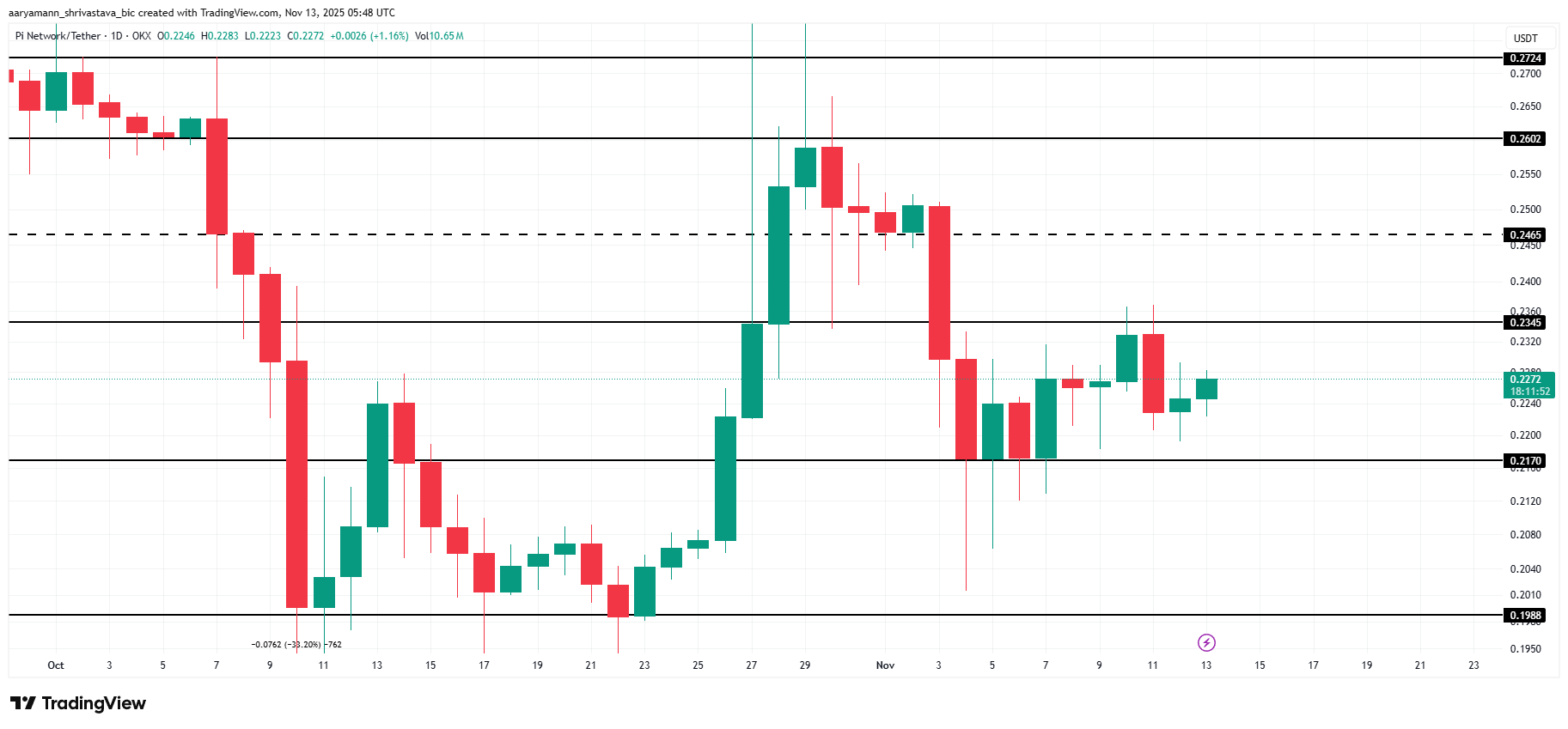

PI Price Remains Consolidated

Pi Coin is trading at $0.227 at the time of writing and continues to consolidate between $0.234 and $0.217. The token lacks the strength needed to break above the $0.234 resistance level, reflecting the effects of investor apathy and weak market conditions.

Given the indicators mentioned above, Pi Coin is likely to remain rangebound. If pressures intensify, the price may slip below $0.217, extending the ongoing decline and weakening recovery prospects. Without a shift in sentiment, consolidation may persist.

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

However, if investors step in to support the asset, Pi Coin could regain upward momentum. A break above the $0.234 resistance would open the path to $0.246. This would invalidate the current bearish thesis and offer the first signs of stabilization.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin as Digital Gold, Ethereum as the Engine of Decentralized Finance: How Cryptocurrencies Are Carving Out Distinct Functions

- BlackRock executives highlight Bitcoin's shift toward "digital gold" as a long-term store of value, supported by institutional demand and fixed-supply models like Bitcoin Munari. - Ethereum's faster transaction velocity (3x BTC) reinforces its "digital oil" role, contrasting with Bitcoin's stable, passive accumulation strategy and macro-hedge appeal. - Regulatory clarity on stablecoins and blockchain transparency could deepen Bitcoin's institutional adoption while highlighting risks in altcoins like Aero

Stargate’s AI Strategy: Safeguarding the Nation or Raising Antitrust Concerns?

- Stargate, a $500B AI joint venture led by OpenAI, Oracle , and Nvidia , aims to consolidate computing power across seven gigawatt data centers in the U.S. and UAE. - Yale scholar Madhavi Singh warns the alliance violates antitrust laws by merging fierce competitors, risking cartel-like behavior and stifling innovation in chips and cloud services. - Critics argue Stargate eliminates competition in key AI sectors, while the Trump administration and lawmakers praise it as a strategic move to counter China,

Bitcoin Updates Today: Bitcoin Faces a Battle: DWF Issues Buy Alert Amid Market Turbulence

- DWF Labs buys Bitcoin at $84,000 amid 30%+ drop from $126,000 peak, signaling institutional confidence despite market turbulence. - U.S. market weakness highlighted by 21-day negative Coinbase premium (-0.0989%) and $3.79B ETF outflows, including $523M from BlackRock's IBIT . - Strategic buyers like Harvard (+250% IBIT holdings) and Japan's Metaplanet (¥15B allocation) contrast with $4B in realized Bitcoin losses and 35% drop in futures open interest. - Long-term bullish factors include U.S. Strategic Bi

Bitcoin News Today: "Institutional Embrace Helps Steady Bitcoin During Market Volatility"

- Bitcoin remains stable amid market volatility, with analyst Lyn Alden dismissing crash fears due to institutional adoption and macroeconomic factors. - Stablecoin reserves hit $72B, while Circle's USDC outpaces Tether and Solana secures $1B in institutional funding, signaling growing regulated crypto confidence. - Alden predicts $100K Bitcoin by 2026, attributing stability to extended cycles driven by macro demand rather than traditional halving patterns. - Diverging analyst views highlight risks, but Al