Tom Lee’s BMNR Is a Brilliant Treasury Model or Hidden Time Bomb | US Crypto News

BitMine Immersion Technologies, led by crypto strategist Tom Lee, has amassed over 3.5 million ETH—worth $13.7 billion—using equity financing instead of debt. While the model shields BMNR from bankruptcy, it hinges on investor confidence and ETH’s price. A market downturn or funding freeze could expose its biggest vulnerability yet.

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and lean in. Behind the headlines, a company is quietly stacking billions in Ethereum, turning equity into a high-stakes treasury experiment. Some call it brilliant, while others consider it a ticking time bomb, and everyone is watching to see what happens next.

Can Tom Lee’s Debt-Free Crypto Empire Survive an Ethereum Winter?

BitMine Immersion Technologies (BMNR), led by crypto strategist Tom Lee, uses equity financing to construct a substantial Ethereum (ETH) treasury.

Unlike traditional businesses, BMNR raises capital by issuing shares rather than borrowing, directing each funding round straight into ETH accumulation and staking. This model has delivered dramatic returns but comes with a set of unique risks.

BMNR’s reliance on equity over debt means that classic bankruptcy, triggered by loan defaults, is unlikely.

The company’s assets, a combination of ETH holdings and cash reserves, far exceed its liabilities. On-chain data shows BMNR holds over 3.5 million ETH, around 2.8% of the total supply, alongside roughly $389 million in cash.

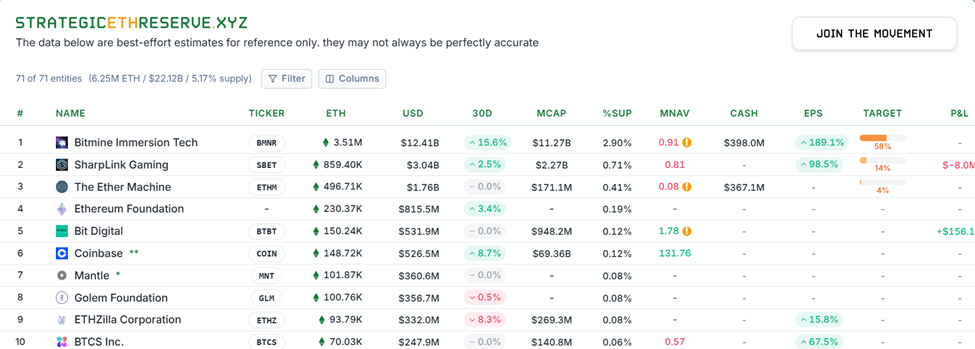

Ethereum Reserves. Source:

Strategic ETH Reserve

Ethereum Reserves. Source:

Strategic ETH Reserve

Combined, its crypto and cash treasury is valued at approximately $13.7 billion. With minimal debt obligations, BMNR avoids the conventional pathways to financial failure. Yet the company’s stability hinges on two critical “switches”:

- The market’s willingness to invest in new shares, and

- The performance of the ETH price.

If ETH prices fall sharply or investors stop providing capital, BMNR could face a liquidity crunch.

“Because the company has no large debts and mainly relies on equity financing, the path of debt crushing bankruptcy basically doesn’t exist…Can’t raise money, coin price crashes, company expansion stops, valuation drops with a bang,” said analyst Unicorn in a post.

The pseudonymous analyst noted that while such an outcome would not cause a typical debt-driven collapse, it would lead to asset shrinkage and disrupt the financing chain.

The model is highly reflexive as both the treasury’s growth and the stock’s performance are intertwined with market sentiment and Ethereum’s valuation.

BMNR’s High-Stakes ETH Treasury Faces Market Sentiment and Dilution Risks

BMNR shares have surged up to 10 times since the Ethereum treasury strategy was implemented, outpacing the growth of ETH itself. Arkham Intelligence recently flagged an $82.8 million withdrawal of ETH from Galaxy Digital.

TOM LEE IS DCA BUYING $ETH A fresh address has just withdrawn $82.8M of ETH from Galaxy Digital, matching known Bitmine purchase patterns.Tom Lee is DCAing the dip on ETH.

— Arkham (@arkham) November 11, 2025

As this transaction aligned with BMNR’s previous accumulation patterns, it suggests renewed buying activity. Despite these bullish signals, several risks warrant attention:

- Continuous equity issuance can dilute existing shareholders, particularly given BMNR’s aggressive at-the-market offerings.

- The company’s valuation is extremely high relative to its operational revenue, which sits around $4.6 million annually with negative net income.

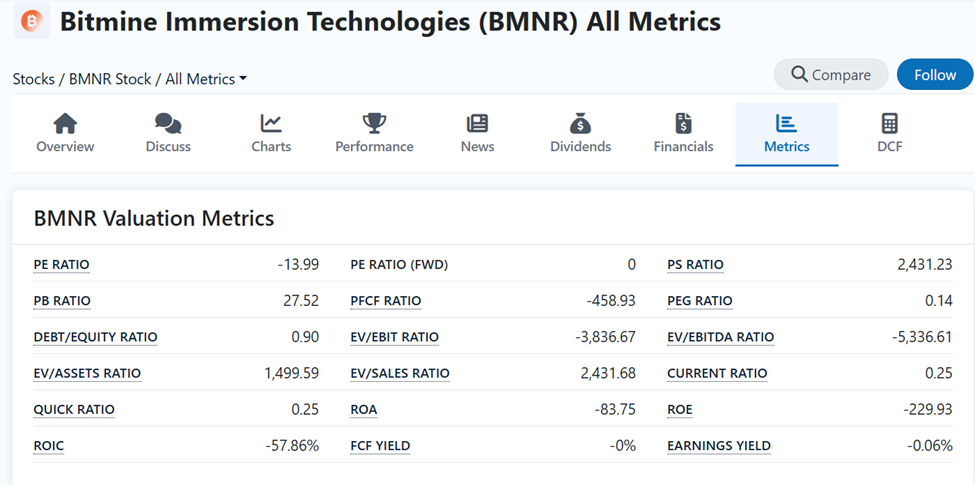

BitMine Immersion Technologies Valuation Metrics. Source:

FinanceCharts

BitMine Immersion Technologies Valuation Metrics. Source:

FinanceCharts

- The Altman Z-Score, a standard measure of financial distress, is currently negative (−0.96), highlighting potential vulnerability if conditions turn unfavorable.

- Moreover, BMNR’s non-traditional structure, functioning more as a treasury vehicle than an operational business, means standard revenue streams are dwarfed by ETH accumulation.

- Operational missteps or regulatory scrutiny could exacerbate risks, particularly if investor appetite slows or Ethereum experiences significant volatility.

- Even with no debt, failure to secure new equity or a sharp ETH decline could erode the company’s asset base really fast.

In summary, BMNR is a high-stakes experiment in equity-financed crypto accumulation. Under normal market conditions, with ETH performing well and investor sentiment positive, the company avoids classic bankruptcy and continues to grow its treasury.

However, the model’s heavy reliance on Ethereum prices and investor participation makes it vulnerable to sudden shocks, dilution, and valuation corrections.

So, what are the takeaways for investors?

BMNR is not a typical company. Its success depends less on operational execution and more on maintaining confidence in its treasury strategy.

If Ethereum falters or market enthusiasm wanes, the seemingly debt-free company could face a sharp contraction, turning a “brilliant treasury model” into a hidden time bomb.

Chart of the Day

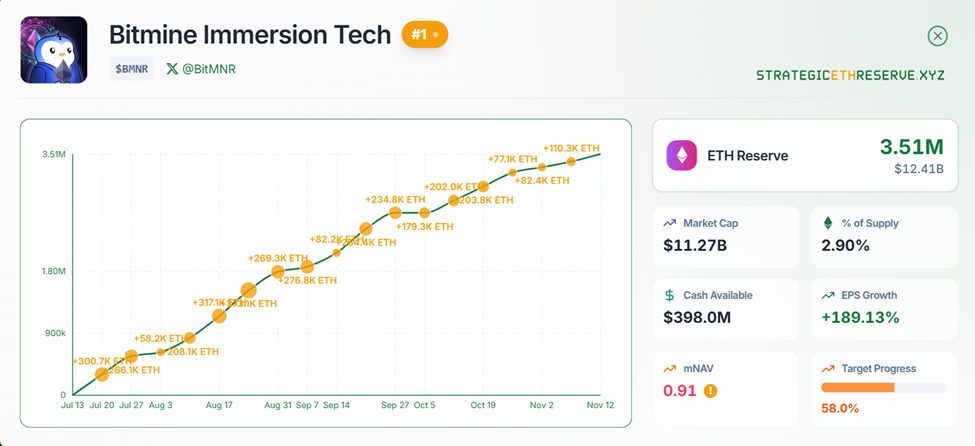

BitMine Immersion Tech. Source:

Strategic ETH Reserve

BitMine Immersion Tech. Source:

Strategic ETH Reserve

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Why analysts see a $5 target for XRP price in Q4 2025.

- Smart money continues to buy Solana despite a 20% SOL price drop.

- Three signs pointing to mounting selling pressure on Pi Network in November.

- Top 3 price prediction Bitcoin, Gold, Silver: One last buy opportunity before the US shutdown ends?

- JPMorgan achieves the first true bridge between banks and DeFi.

- XRP finds traction among new investors, but $2.50 remains a challenge.

- Pi Coin rebound hope hangs by a thread — and it’s being pulled from both sides.

- Did one whale steal aPriori’s airdrop? 14,000 wallets raise big questions.

Crypto Equities Pre-Market Overview

| Company | At the Close of November 11 | Pre-Market Overview |

| Strategy (MSTR) | $231.35 | $235.09 (+1.62%) |

| Coinbase (COIN) | $304.01 | $308.45 (+1.46%) |

| Galaxy Digital Holdings (GLXY) | $30.74 | $31.21 (+1.53%) |

| MARA Holdings (MARA) | $14.63 | $14.93 (+2.05%) |

| Riot Platforms (RIOT) | $16.14 | $16.40 (+1.61%) |

| Core Scientific (CORZ) | $17.32 | $17.56 (+1.39%) |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: ETF Withdrawals Reveal the Unstable Base of Crypto Treasuries

- Bitcoin's 27% price drop since October has triggered massive ETF outflows, with BlackRock's ETHA losing $421.4M in November 2025. - BitMine Immersion Technologies faces $3.7B unrealized ETH losses as crypto treasuries struggle with collapsing valuations and limited capital expansion. - Bitcoin Munari (BTCM) emerges as a Bitcoin-pegged Layer 1 blockchain with EVM compatibility, fixed 21M supply, and 2027 mainnet roadmap. - BlackRock's staked Ether ETF filing aims to disrupt treasury models by offering yie

Bitcoin Updates: Institutions Pull Out and $2 Billion Wiped Out—Is This a Crypto Catastrophe or a Strategic Market Reset?

- Bitcoin ETFs face $3.79B outflows in November, triggering a $2B liquidation crisis as prices drop 9% below $84K. - Institutional profit-taking, fading Fed rate-cut hopes, and $4.2B options expiry amplify crypto market fragility. - $120B daily market loss highlights sector vulnerability amid regulatory scrutiny and geopolitical risks under Trump. - Analysts warn ETF outflows, stalled listings, and leveraged trading pressures pose ongoing rebound risks.

Bitcoin Updates: BTC's Sharp Decline Spurs Institutional Wagers on a $200K Recovery

- Bitcoin's sharp selloff and extreme fear metrics have triggered cautious optimism among analysts and institutional investors, who see potential rebounds and long-term demand signals. - Historical patterns show market bottoms often follow Fear and Greed Index readings below 20, with institutional buyers typically stepping in during retail capitulation phases. - Despite $3.79B in Bitcoin ETF outflows, technical indicators suggest oversold conditions and potential bullish patterns, with some experts forecas

Bitcoin News Update: MSCI Faces Index Challenge as Saylor’s Bitcoin Strategy Confronts $8.8B Withdrawal Threat

- Michael Saylor reaffirms MicroStrategy's Bitcoin-focused strategy amid MSCI's review of index eligibility for firms with major digital-asset holdings. - JPMorgan warns index exclusion could trigger $8.8B in outflows, risking liquidity, capital costs, and investor confidence for the $59B market cap company. - Saylor highlights $7.7B in Bitcoin-backed digital credit issuance and treasury expansion, aiming to build a "trillion-dollar Bitcoin balance sheet" despite 60% stock decline. - MSCI's January 2026 de