Key Market Intelligence on November 12th, how much did you miss?

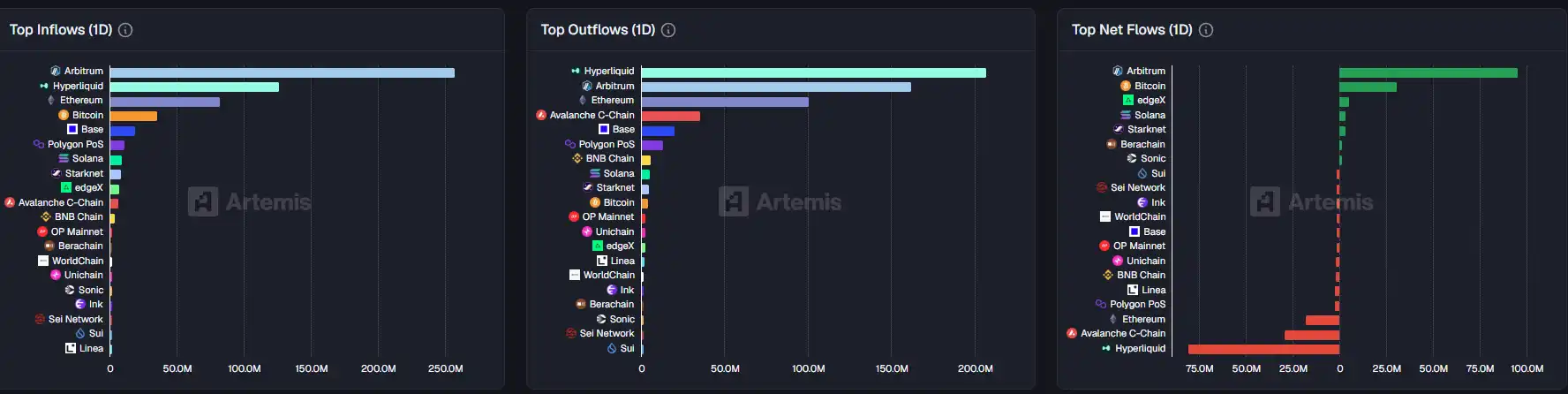

1. On-chain Funds: $95.5M USD flowed into Arbitrum today; $80.8M USD flowed out of Hyperliquid 2. Largest Price Swings: $SURGE, $ALLO 3. Top News: The U.S. House of Representatives will vote at 5 a.m. tomorrow to decide whether to end the government shutdown

Featured News

1. The U.S. House of Representatives will vote at 5 a.m. tomorrow to decide whether to end the government shutdown

2. DUNI's market cap exceeds $7 million, with a 24-hour surge of over 84x

3. SOL and BSC-based meme coins traded lower today, mostly maintaining a narrow range of within 6%

4. Pre-market crypto concept stocks in the U.S. saw a general increase, with Strategy up 1.52%

5. Altcoins experienced a widespread decline, with KDA plunging over 59% in 24 hours

Trending Topics

Source: Overheard on CT, Kaito

Here is the translation of the original content:

[ALLORA]

ALLORA gained significant attention today due to its listing on major exchanges such as Binance, OKX, Kraken, etc. The project innovatively combines AI and decentralized finance to create a predictive AI network. The community actively discussed its potential impact on AI and the crypto market, showing strong optimism. The listing was accompanied by airdrops and incentive measures, further driving interest and participation.

[BINANCE]

Discussions revolving around Binance today highlighted its crucial position in the crypto market, including the launch of trading features, a BNB Smart Chain trading competition, and participation in the Allora (ALLO) listing. Binance's reserves remain strong, and its influence in DeFi and AI projects is significant. The platform's strategic initiatives, such as partnerships and innovation, continue to solidify its reputation as a leading crypto exchange.

[WALLCHAIN]

WALLCHAIN has attracted attention due to the successful minting of the Quack Heads NFT series, which quickly sold out, with some stages lasting only seconds. The NFT minting price was 2.5 SOL, and the floor price has risen to 16 SOL, demonstrating strong demand and the potential profits for early participants. Discussions also revolve around algorithm adjustments on the InfoFi platform and the possibility of token distribution to NFT holders. The community is actively engaged, expressing optimism for future developments.

[KINDRED]

KINDRED has been frequently discussed for its AI capabilities and NFT products. Tweets highlight the popularity of Kindred AI, its collaboration with MemeCore, and the bullish sentiment surrounding the Klara NFT, which has seen a significant price increase. Discussions also involve the potential of Kindred AI in the digital economy transformation and integration with platforms like Sei Network. The upcoming Kindred x MemeCore AMA event further stirs community expectations.

Featured Articles

1.《From Queen Dream to Prison, Qian Zhimin and the Absurd $60 Billion Bitcoin Scam》

Very few scams in crypto history have combined such absurdity and scale. Qian Zhimin, a Chinese woman who claimed to be on the verge of being crowned queen of a "micronation," ultimately received an 11-year, 8-month prison sentence from a UK court for orchestrating a scam involving 60,000 bitcoins, totaling a staggering $60 billion. She once dreamed of being enthroned in a temple in Liberland, wearing a crown. Now, behind bars, she faces the collapse of the myth she wove with her own hands.

2.《Why the Prediction Market Is Still in an Exploratory Stage》

The prediction market is experiencing its moment in the sun. Polymarket's coverage of the presidential election made headlines, and Kalshi's regulatory victory has opened new frontiers, suddenly everyone wants to talk about this "world truth engine." But behind this wave of excitement lies a more intriguing question: if prediction markets are truly so good at forecasting the future, why haven't they become more mainstream?

On-chain Data

On-chain Fund Flow for the Week of November 12

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Latest Updates: Calm Whale's Bold Move: Gains $4.8M Despite $4M ZEC Deficit

XRP News Today: Crypto Market Transformation: Investors Favor Practical Use Rather Than Pure Speculation

- November 2025 crypto market saw XRP fall below $2 despite ETF approval, driven by whale sales and structural imbalances. - Binance Coin (BNB) dropped 30% to $912 amid bearish sentiment, contrasting Digitap ($TAP)'s 150% presale surge and real-world banking integration. - Digitap's $2M+ presale and Visa-card-enabled crypto-fiat platform attracted investors seeking utility over speculation in a volatile market. - Market shifts highlight growing demand for projects like Digitap, which bridges traditional fi

What Led to the Latest Bitcoin Price Drop?

- Bitcoin's late 2025 crash stemmed from $3B in ETF outflows and Fed rate uncertainty, triggering a 7.35% price drop. - Institutional exits from IBIT/GBTC contrasted with earlier Q3 2025 inflows that pushed BTC to $126,000, revealing shifting risk appetite. - Fed's 3.75%-4% rate hold and "mildly restrictive" policy eroded crypto confidence, accelerating capital flight to safer assets. - The crash highlighted crypto's growing dependence on macroeconomic cycles and institutional sentiment for price stability.

Bitcoin Leverage Liquidation Spike: A Warning Story on Heightened Risks in Derivatives Trading

- 2025's crypto derivatives market saw $17B in Bitcoin liquidations on October 10, driven by leveraged positions collapsing amid a 18.26% price drop. - November 2025 saw $2B+ daily liquidations as bearish sentiment intensified, with Bybit/Hyperliquid accounting for 50% of losses and long positions dominating. - Bybit and Binance faced leverage contraction post-crash, with open interest halving on Bybit and 30% declines at Binance, revealing structural fragility. - Rising USD and Treasury yields compounded