3 Signs Pointing to Mounting Selling Pressure on Pi Network in November

Pi Network’s price may hit new lows in November as massive token unlocks, rising exchange reserves, and weak liquidity weigh on sentiment. Yet, loyal supporters remain hopeful that long-term fundamentals will eventually spark a rebound.

Trading data for Pi Network (PI) signals a bearish outlook for its price in November. Although Pi has already dropped more than 90% from its peak, market forces may continue to push the price lower.

What are the warning signs, and how do Pi’s loyal supporters explain them?

A Massive Amount of Pi Tokens Being Unlocked

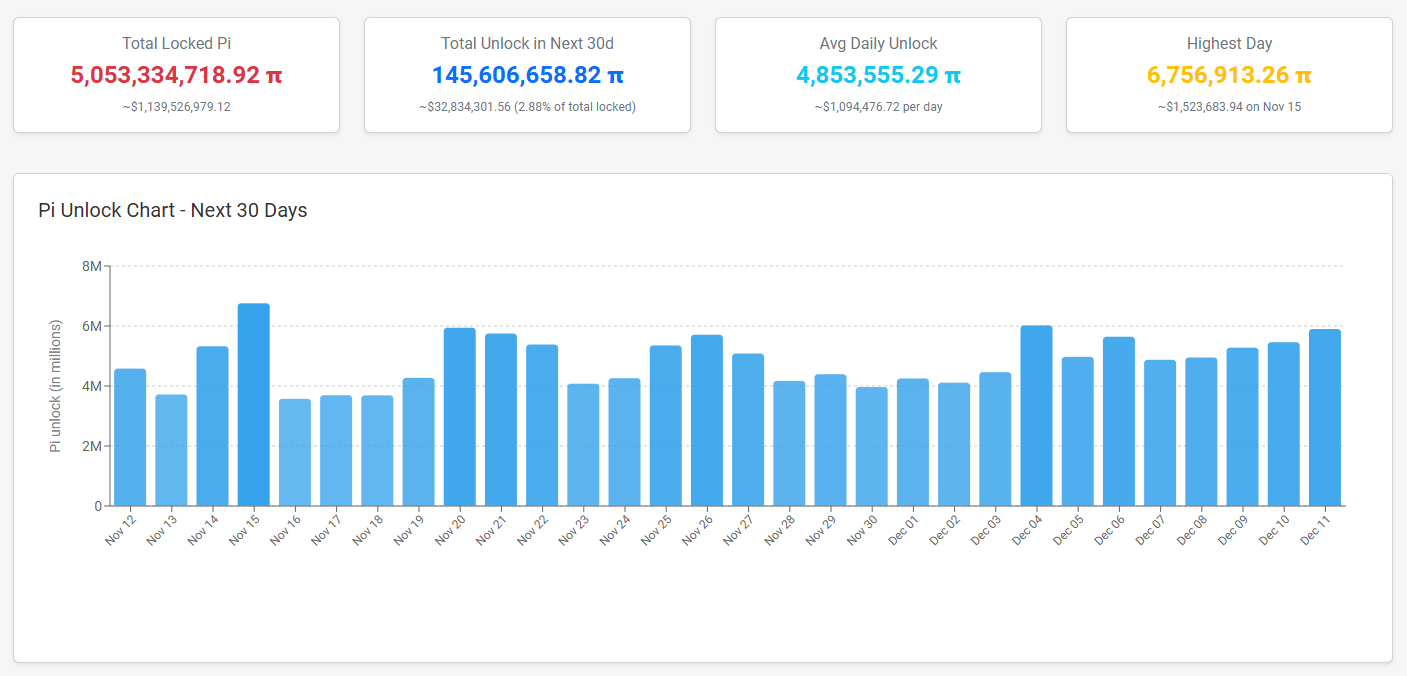

First, Piscan data shows that the number of Pi unlocked per day is up to 4.85 million PI, and the number of Pi unlocked in the next 30 days is up to 145 million Pi.

Number of Pi Tokens Unlocked Per Day. Source:

Piscan

Number of Pi Tokens Unlocked Per Day. Source:

Piscan

Piscan data also reveals that in December, more than 173 million Pi will be unlocked — the highest monthly unlock volume until September 2027.

This steady and increasing unlock pressure is likely to persist through the end of the year, creating a significant obstacle to any price recovery on exchanges.

Rising Exchange Balances Indicate Continuous Selling Pressure

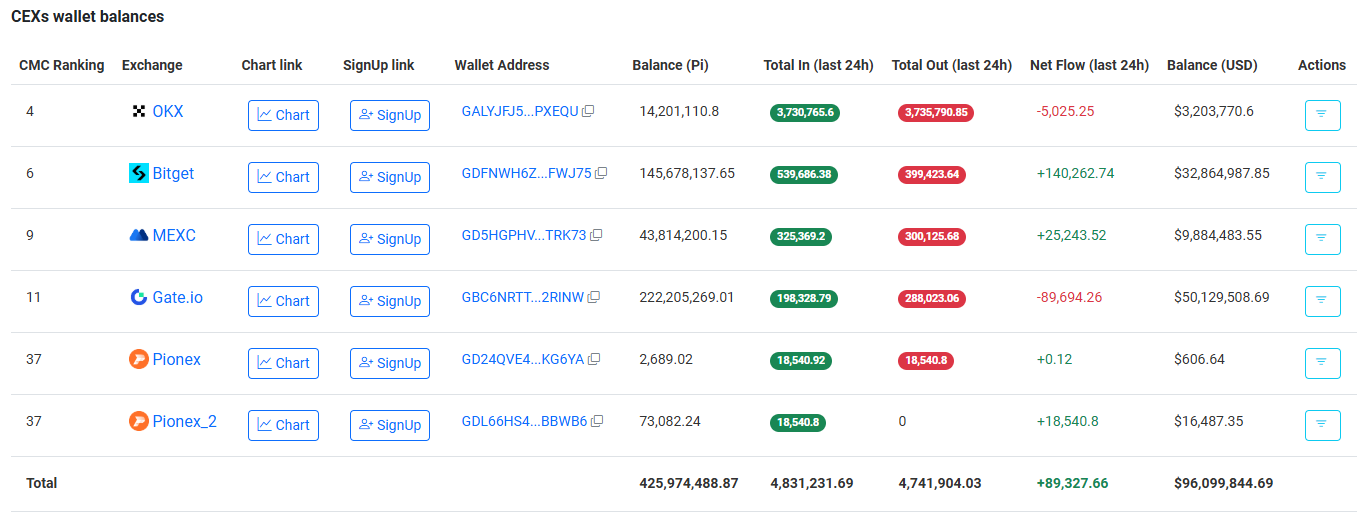

The amount of Pi held on exchanges continues to increase in November.

Pi Supply on Exchanges. Source:

Piscan

Pi Supply on Exchanges. Source:

Piscan

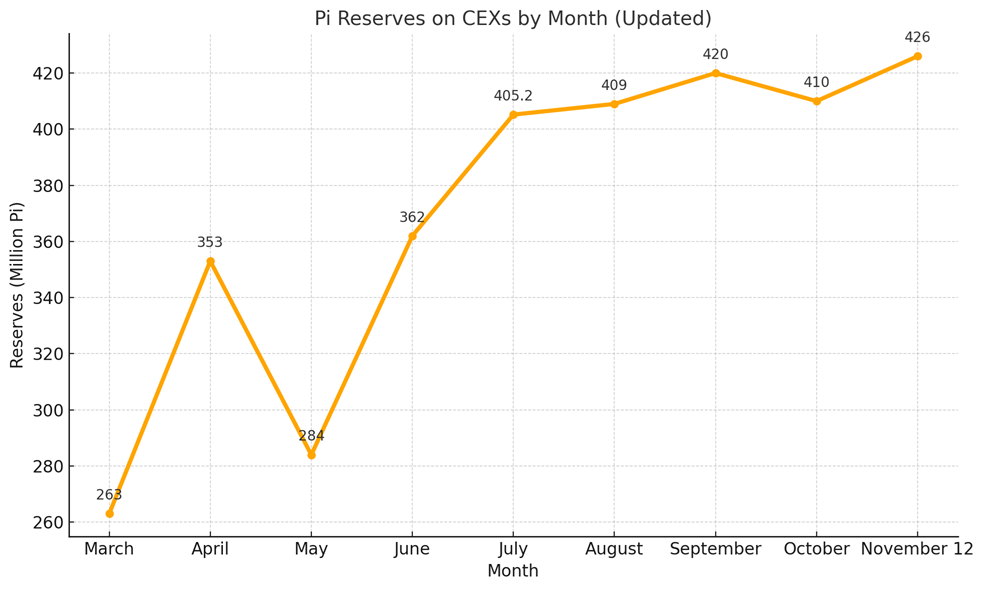

According to Pi Network’s early-month report, there were about 423 million Pi on exchanges. By mid-November, that figure had climbed to nearly 426 million Pi, marking an all-time high.

Pi Reserves on CEXs by Month. Source: Data Curated by BeInCrypto

Pi Reserves on CEXs by Month. Source: Data Curated by BeInCrypto

Such growth in exchange reserves indicates that exchanges now hold more Pi tokens, ready for trading or sale, which could put downward pressure on prices.

Weak Trading Volume Reflects Low Market Activity

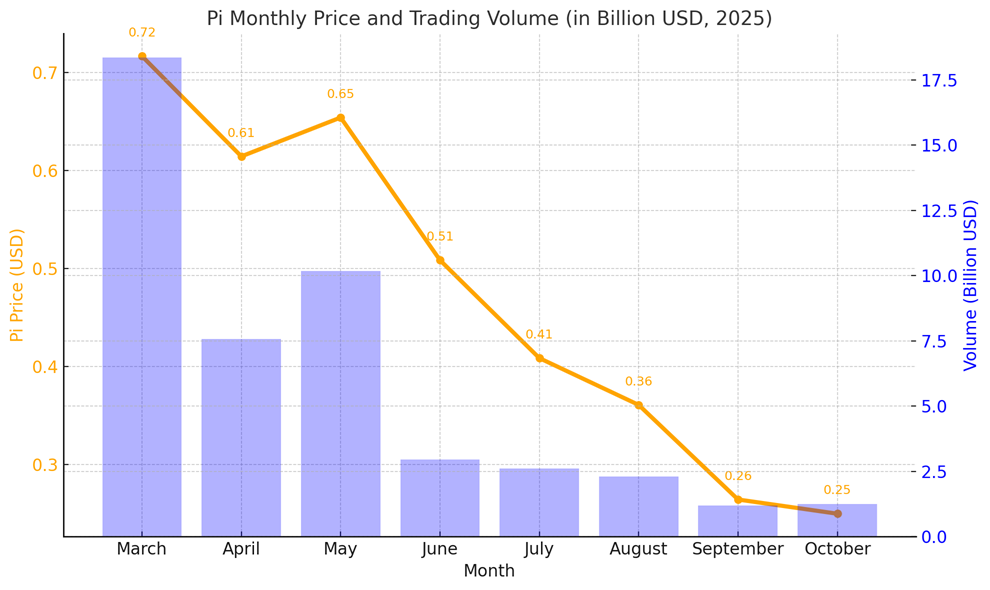

Spot trading volume for Pi on centralized exchanges has shown little improvement in November. The 24-hour trading volume currently hovers around $30 million.

CoinMarketCap data indicates that Pi’s monthly trading volume fell to just $1.2 billion last month. Both price and trading volume have declined in parallel.

Pi Monthly Price & Trading Volume. Source:

CoinmarketCap

Pi Monthly Price & Trading Volume. Source:

CoinmarketCap

Weak liquidity, along with the constant unlocking and inflow of Pi to exchanges, could intensify the downward price movement.

Pi Supporters Remain Confident Despite the Pressure

Despite the bearish signals, Pi supporters remain optimistic.

An X account named Dao World, identifying as a Pioneer, argued that while Pi has a large maximum supply, the actual circulating amount is only around 3 billion. The Pi Core Team, he noted, has not been aggressively selling.

He also suggested that a few market makers (MM) on certain exchanges mainly control Pi’s current price. Once selling pressure is fully absorbed, he believes the price could rebound.

Even though $Pi has a large max supply, considering that the CT has not been aggressively selling tokens and the actual circulating supply is only a little over 3B, and price action is largely managed by MM on a few exchanges — am I the only one who thinks that when it’s time for… pic.twitter.com/0GUIXfx2EF

— Dao world November 11, 2025

Several other Pioneers share this view, claiming that the current $0.20 range presents a buying opportunity — one they expect will be remembered fondly in the future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: The Ongoing Competition Between Ethereum and Solana to Transform Blockchain Value Acquisition

- Ethereum's Fusaka upgrade (Dec 3) aims to boost scalability and economic incentives, positioning ETH as a cash-flowing asset per Fidelity and Bitwise analyses. - The upgrade harmonizes consensus and execution layers, prioritizing monetization while balancing adoption risks as noted by Max Wadington and Fidelity reports. - Solana's Sunrise initiative streamlines token imports, competing with Ethereum to redefine decentralized value capture through seamless integration strategies. - Analysts warn of trade-

Fed Faces Conflicting Data and Political Tensions as December Verdict Approaches

- The Fed faces internal divisions over rate cuts amid conflicting signals on inflation and a weakening labor market. - A 10–2 vote to lower rates to 3.75%–4% masked broader disagreements, with markets now pricing <35% chance of further cuts in December. - Political pressures intensify as Trump criticizes Powell and pushes for Bessent to lead the Fed, despite Bessent's refusals. - Upcoming November 20 data on payrolls and manufacturing will be critical in resolving the Fed's policy uncertainty.

Bitcoin News Today: Bitcoin Surges to $87k—Is This a Panic-Fueled Bounce or a Sign of Lasting Market Change?

- Bitcoin surged past $87,000 in late November 2025, driven by technical support, shifting institutional sentiment, and historical rebound parallels. - Retail fear and ETF inflows signal potential recovery, while macro factors like Nvidia's earnings and Fed rate cut expectations add uncertainty. - Institutional divergence and macroeconomic headwinds pose risks, with Bitcoin's $87k and Ethereum's $2,800 support levels critical for a sustained rebound.

DASH Aster DEX Integration: Paving the Way for Advanced DeFi Infrastructure and Institutional Embrace in 2026

- DASH Aster DEX listing accelerates DeFi's 2026 growth, targeting $3T+ transaction volume via real-world asset tokenization and cross-chain liquidity. - Aster's on-chain order book architecture bridges CEX speed with DEX transparency, achieving $27.7B daily volume through strategic BNB Chain-Ethereum integration. - Institutional adoption gains momentum as Aster introduces gold/stock trading, privacy-focused ZKP features, and 5-7% annual token burns to enhance $ASTER utility. - Investors gain exposure to n