Tether taps HSBC executives to ramp up $12b gold strategy

Tether poached two senior executives from a bank that oversees one of the world’s most extensive gold vaults.

- Tether is doubling down on its gold bet by hiring two of HSBC’s top gold traders

- HSBC operates one of the largest private gold vaults in the world

- The stablecoin issuer currently holds more than $12 billion in physical gold

As macro uncertainty fuels renewed interest in precious metals, the world’s largest stablecoin issuer is doubling down on its gold bet. On Tuesday, November 11, Tether announced the hiring of two top gold traders from London-based HSBC.

HSBC’s global head of metals trading, Vincent Domien, will join Tether in the coming months. He’ll be accompanied by Mathew O’Neill, HSBC’s head of precious metals for Europe, the Middle East, and Africa.

The two executives’ role will be to aggressively expand the firm’s physical bullion holdings, which currently total $12 billion.

These include the reserves for the Tether Gold (XAUT) token, which has a market cap of $1.56 billion. The remaining physical gold is part of the reserves that back USDT.

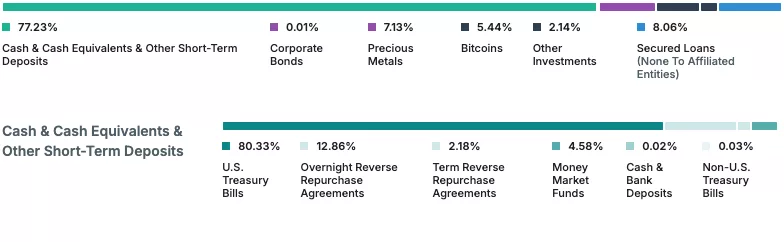

Reserves backing USDT stablecoins, as of September 30 | Source: Tether

Reserves backing USDT stablecoins, as of September 30 | Source: Tether

Tether plans major gold expansion

Tether has been adding gold to its reserves at an average pace of 1 metric ton per week during September of this year. According to Bloomberg, this makes Tether one of the largest non-state buyers of gold. For this reason, taping HBSC executives makes strategic sense for the firm.

HBSC operates a vast gold reserve in London, one of the largest in the world. The company is also one of the biggest market makers in spot gold, gold futures, swaps, and options. It is also one of the core clearing members in the London Bullion Market Association. HSBC was also one of the first companies to launch a tokenized gold offering, which went live in 2024.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: As Investors Pull Out of Bitcoin ETFs, Altcoins See Increased Inflows During November Sell-Off

- U.S. bitcoin ETFs lost $1.22B in net outflows for the week ending Nov 21, extending a four-week negative streak with total November redemptions reaching $3.79B. - Bitcoin fell below $82,000 amid a 7-month low, triggering a $350B crypto market cap drop as Citi noted 3.4% price declines per $1B ETF outflow. - Solana and XRP ETFs bucked the trend with $300M and $410M inflows, attracting institutional interest despite broader market weakness. - Analysts warn of potential 50% further Bitcoin declines, while F

Bitcoin Updates: Bitcoin's Sharp Drop and ETF Outflows Trigger a Cycle of Self-Perpetuating Sell-Off in Crypto

- Bitcoin fell to a seven-month low amid $3.79B ETF outflows in November, with BlackRock's IBIT and Fidelity's FBTC accounting for 91% of redemptions. - Analysts cite profit-taking, leveraged position unwinding, and Fed rate uncertainty as key drivers, while NYDIG highlights structural shifts like collapsing stablecoin supply and DAT premiums. - Citi Research links $1B in ETF outflows to a 3.4% Bitcoin price drop, pushing Bitcoin dominance to 58% as investors shift to riskier altcoins. - Despite bearish sh

Markets Predict Fed Pivot, Central Bank Remains Silent

BIS sounds the alarm: Stablecoins could trigger a bond crash