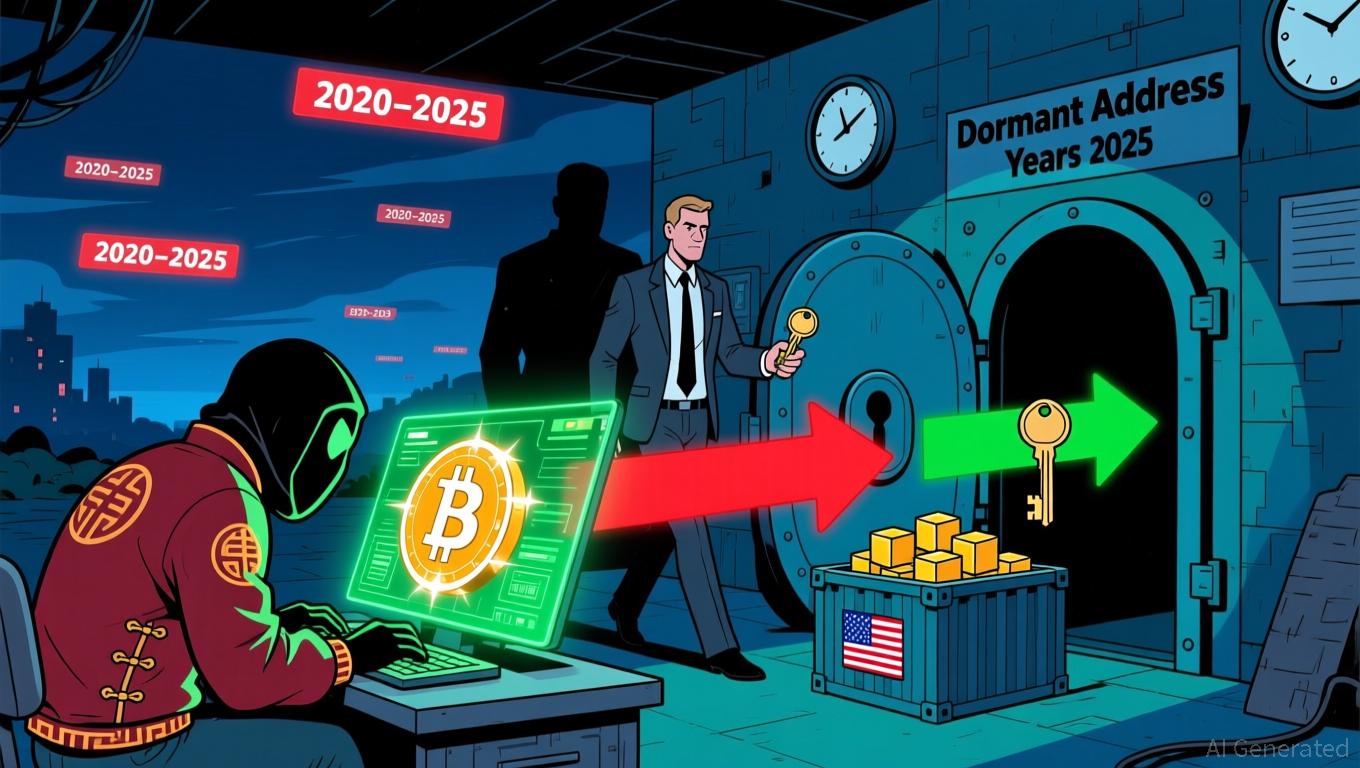

Bitcoin News Today: Digital Sovereignty Clash: US-China Tensions Escalate Over $13B Bitcoin Seizure

- China's CVERC accuses U.S. government of orchestrating a $13B Bitcoin theft from 2020 LuBian mining pool hack. - U.S. denies claims, asserting 2025 seizure targeted criminal proceeds from Cambodian fraudster Chen Zhi's $2B scheme. - Dispute highlights geopolitical tensions over digital sovereignty, with 127,426 BTC (0.65% of total supply) now central to U.S.-China crypto rivalry. - CVERC demands enhanced blockchain security measures as seized assets represent largest U.S. crypto forfeiture in history. -

China’s cybersecurity authorities have accused the United States of carrying out a $13 billion

The controversy revolves around a cyberattack on LuBian in December 2020, which led to the theft of 127,426 BTC—worth $3.5 billion at the time, according to a

The U.S. Department of Justice (DOJ) has justified the seizure, stating the bitcoins were tied to Chen Zhi’s alleged $2 billion cryptocurrency fraud and were confiscated through a civil forfeiture action in October 2025, according to a

This dispute has reverberated throughout the cryptocurrency market, with Bitcoin hovering around $105,000 as investors assess the broader geopolitical fallout. Experts point out that about 0.65% of Bitcoin’s total supply—roughly 127,000 coins—is now entangled in the controversy, which could restrict liquidity and impact long-term price trends, according to an

CVERC has urged the adoption of stronger blockchain security protocols, such as layered defenses and real-time surveillance, to guard against future government-sponsored cyberattacks, according to a

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: ETF Outflows Push Bitcoin to Lowest Point in Seven Months Amid Market Turmoil

- Bitcoin fell below $83,400, its lowest in seven months, as U.S. spot ETFs saw $3.79B in November outflows, led by BlackRock’s $2.47B loss. - Record $903M single-day ETF redemptions accelerated crypto and equity market selloffs, with Nvidia and crypto stocks dropping sharply. - Ethereum ETFs lost $1.79B, while altcoin funds like Bitwise’s XRP gained $105M, reflecting shifting investor preferences amid liquidity concerns. - Analysts attribute the selloff to macroeconomic uncertainty and delayed Fed rate cu

Dogecoin News Today: Grayscale DOGE ETF Debut May Trigger a Wave of Institutional Interest This November

- Grayscale's DOGE ETF launches Nov 24, aiming to boost institutional adoption of the meme coin amid SEC approval. - BlockDAG's $436M+ presale outpaces ADA/BCH, leveraging hybrid PoW-DAG tech and 3.5M miners to attract 312K holders. - Ethereum faces $2,850 support pressure after FG Nexus sells 11,000 ETH, triggering $170M in 24-hour liquidations. - DOGE hovers near $0.15 support with mixed technical signals, while ETF optimism contrasts with ongoing distribution trends.

ZK Atlas Enhancement: Leading the Way in Blockchain Expansion and Enterprise Integration

- ZKsync's 2025 Atlas Upgrade resolves blockchain scalability trilemma via modular architecture, achieving 15,000–43,000 TPS with 1–500ms finality. - Institutions like Deutsche Bank adopt ZKsync for cross-chain settlements, while TVL in ZK ecosystems hits $3.5B and ZK token price rises 50%. - Compliance features and EVM compatibility address institutional needs, with $15B in Bitcoin ETF inflows accelerating adoption of tokenized assets and RWAs. - Analysts project 60.7% CAGR for ZK Layer-2 solutions throug

ZK Technologies' Price Soars: The Intersection of Major Scalability Advances and Growing Institutional Interest

- ZK Technologies surged to $0.085–$0.090 in late 2025, driven by ZK rollup innovations and institutional adoption. - ZK rollups achieved 15,000 TPS by October 2025, with Ethereum's EVM optimization reducing proof costs 50-fold. - Deutsche Bank , Sony , and Citibank adopted ZK-rollups for confidential settlements and cost-efficient transactions. - Deflationary token model and fee buybacks increased scarcity, driving demand and value accrual. - ZK-based solutions now address scalability and privacy, becomin