Key Market Information Gap on November 12th - A Must-Read! | Alpha Morning Report

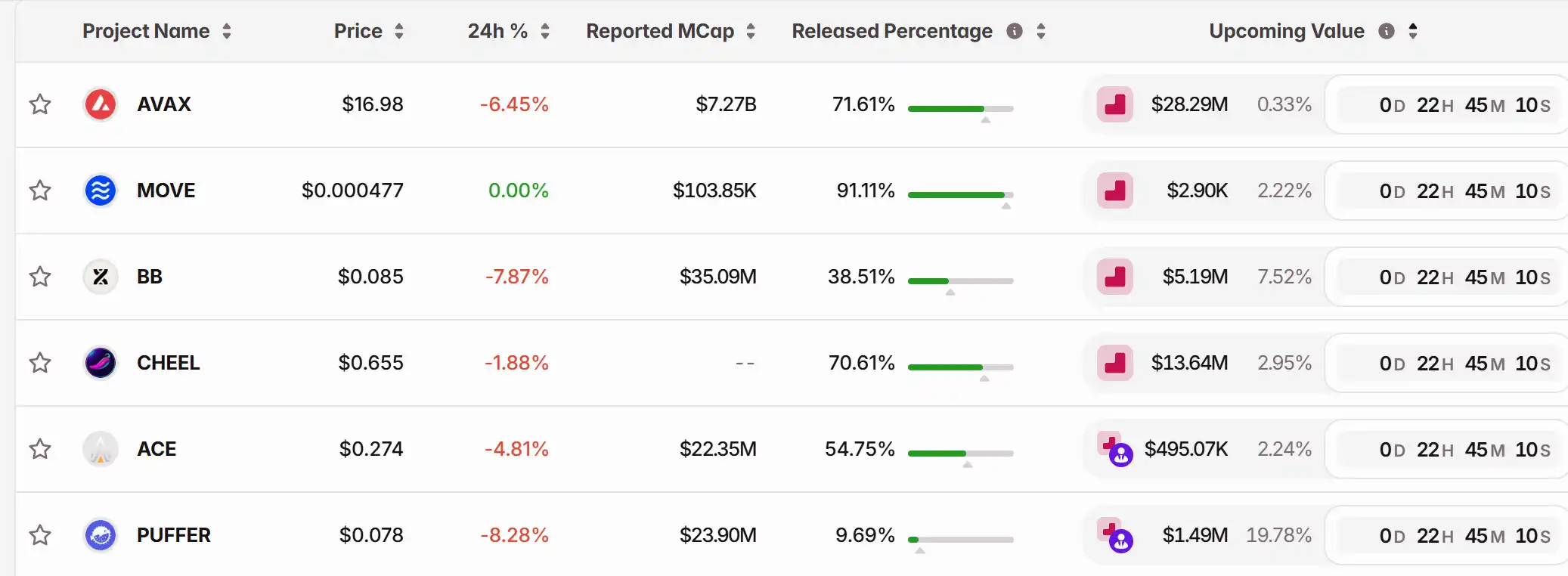

1. Top News: CFX Surpasses $0.14, Up Over 45% in 24 Hours 2. Token Unlock: $AVAX, $MOVE, $BB, $CHEEL, $ACE, $PUFFER

Featured News

1.CFX Breaks $0.14, Surges Over 45% in 24 Hours

2.US Stock Market Closing with Mixed Moves, Crypto Stocks Generally Down

3.$4.11 Billion Liquidated Across the Board in the Past 24 Hours, Mainly Longs

4.Coinbase Cancels $2 Billion Acquisition of Stablecoin Startup BVNK

5.SOL Reserves Strategy Firm Upexi Reveals "Record-Breaking" Quarterly Performance, Staking Rewards Reach $6.1 Million

Articles & Threads

1.《Destruction, Uniswap's Last Ace》

Waking up, UNI surged nearly 40%, leading the entire DeFi sector in a general uptrend. The reason for the rise is that Uniswap revealed its last ace. Uniswap founder Hayden proposed a new proposal focusing on the age-old "fee switch" topic. In fact, this proposal has been raised 7 times in the past two years, not new to the Uniswap community. However, this time is different, as the proposal is personally initiated by Hayden and covers a series of measures including fee switch, token burning, Labs and Foundation merger.

2.《Winning the Championship Thanks to Faker, He Earned Nearly $3 Million》

The League of Legends S15 Global Finals has come to an end, and Faker once again stood on the highest award podium, securing his 6th championship title, continuing to write his legend. In the crypto world, with the rise of prediction markets, players are enjoying esports events while participating in the prediction markets. Among the many crypto players participating in prediction markets, an ID named "fengdubiying (Sure Bet Sure Win)" has become a new legend. In the final prediction of T1 versus KT, he boldly wagered around $1.58 million on T1's victory, ultimately earning approximately $820,000 in profit.

Market Data

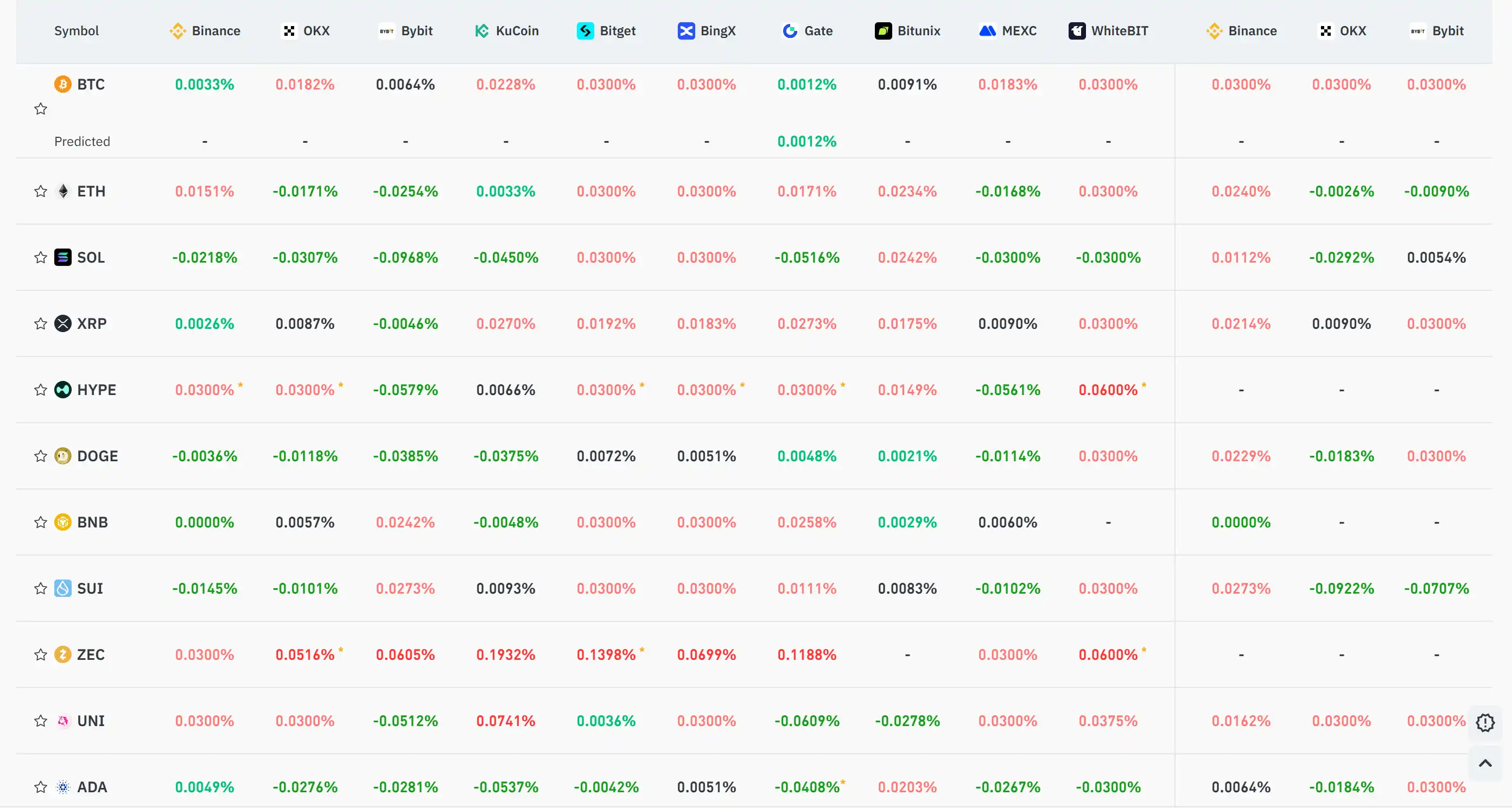

Daily Market Overall Fund Heat (Reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bolivia Turns to Stablecoins to Address Inflation and Currency Instability

- Bolivia legalizes stablecoin integration into banking , allowing crypto-based accounts and loans to combat inflation and currency devaluation. - Crypto transaction volumes surged 530% in 2025, driven by $15B in stablecoin use as businesses adopt USDT for cross-border payments. - Policy mirrors regional trends, with stablecoins recognized as legal tender to stabilize the boliviano amid 22% annual inflation and dollar shortages. - Challenges include AML safeguards, tax frameworks, and public trust, as regu

Bitcoin Updates: Bitcoin's Decline Sparks Altcoin Battle: ADA's $0.43 Support Faces Pressure

- ADA holds $0.43 support as Bitcoin’s seven-month low of $80,000 pressures altcoin market volatility. - Altcoin fragility stems from Fed’s high-rate signals, reduced institutional inflows, and technical breakdowns in key resistance levels. - Bitcoin’s $90,000 support breach triggered cascading liquidations, while ADA’s $0.43 level shows increased on-chain accumulation. - Infrastructure innovations like GeekStake’s staking protocol aim to stabilize networks during volatility without price forecasts. - Mark

Bolivia’s Digital Currency Bet: Navigating Volatility with Stable Solutions

- Bolivia's government permits banks to custody cryptocurrencies and offer crypto-based services, reversing a 2020 ban to combat inflation and dollar shortages. - Stablecoin transactions surged 530% in 2025, with $14.8B processed as Bolivians use USDT to hedge against boliviano depreciation (22% annual inflation). - State-owned YPFB and automakers like Toyota now accept crypto payments, while Banco Bisa launches stablecoin custody to expand financial inclusion for unbanked populations. - The policy faces c

Switzerland's Postponement of Crypto Tax Highlights Worldwide Regulatory Stalemate

- Switzerland delays crypto tax data sharing until 2027 due to ongoing political negotiations over OECD CARF partner jurisdictions. - Revised rules require crypto providers to register and report client data by 2026, but cross-border data exchange remains inactive until 2027. - Global alignment challenges exclude major economies like the U.S., China, and Saudi Arabia from initial data-sharing agreements. - Domestic legal framework passed in 2025, but partner jurisdiction negotiations delay implementation u