Tether’s Latest Gold Move Mirrors Central Banks

Tether is building a bullion desk like a central bank, signaling a shift toward gold-backed digital reserves amid global de-dollarization.

USDT stablecoin issuer Tether is deepening its exposure to physical gold as global monetary dynamics change. The company reportedly brought in two senior HSBC traders, Vincent Domien and Mathew O’Neill, to oversee its gold operations.

Both have decades of experience in metals trading and are expected to help Tether scale its bullion holdings.

Private Stablecoins, Public Strategy

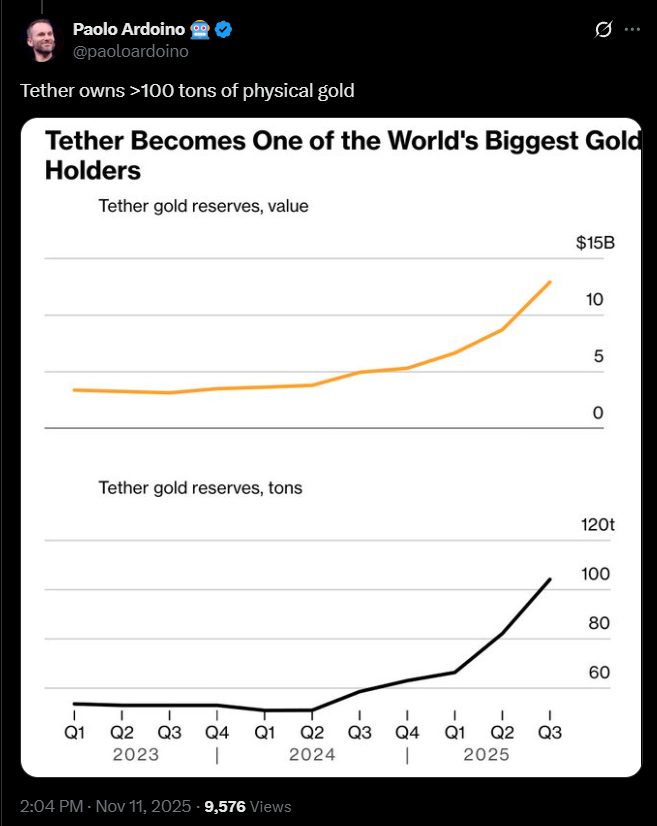

This move follows reports that Tether has already stockpiled billions in physical gold. The company is showing a strong preference for hard assets over fiat-based instruments.

Tweet From Tether CEO

Tweet From Tether CEO

The timing coincides with record central bank purchases of gold and rising global demand for non-dollar reserves.

While central banks diversify away from the US dollar, Tether appears to be following a similar path in the private sector. The company’s shift suggests it views gold as a strategic hedge—both against fiat volatility and regulatory pressure.

Unlike Circle’s USDC, which primarily holds short-term US Treasuries, Tether’s bullion reserves signal a break from dollar dependency.

Also, this divergence highlights a broader divide in stablecoin reserve philosophy: yield generation versus long-term security.

Tether’s bullion buildup could alter the perception of stablecoins from digital cash to privately managed reserve assets.

In effect, Tether is acting less like a payment processor and more like a sovereign wealth fund.

Tether isn’t stacking dollars. They’re stacking gold. $12.9B worth. If this ain’t your wake up call to go long gold I don’t know what is.

— Mr. Uppy (@MisterUppy) November 7, 2025

Tether’s Footsteps Echo of Central Bank Behavior

Central banks purchased more than 1,000 tonnes of gold in 2024, the second-highest annual total on record.

Much of that buying came from emerging economies seeking insulation from dollar-linked volatility. Tether’s accumulation of gold mirrors this pattern.

Tether’s bullion operations also introduce new logistical and security challenges. Managing physical assets within a tokenized framework demands strict custody, audit, and cyber resilience measures.

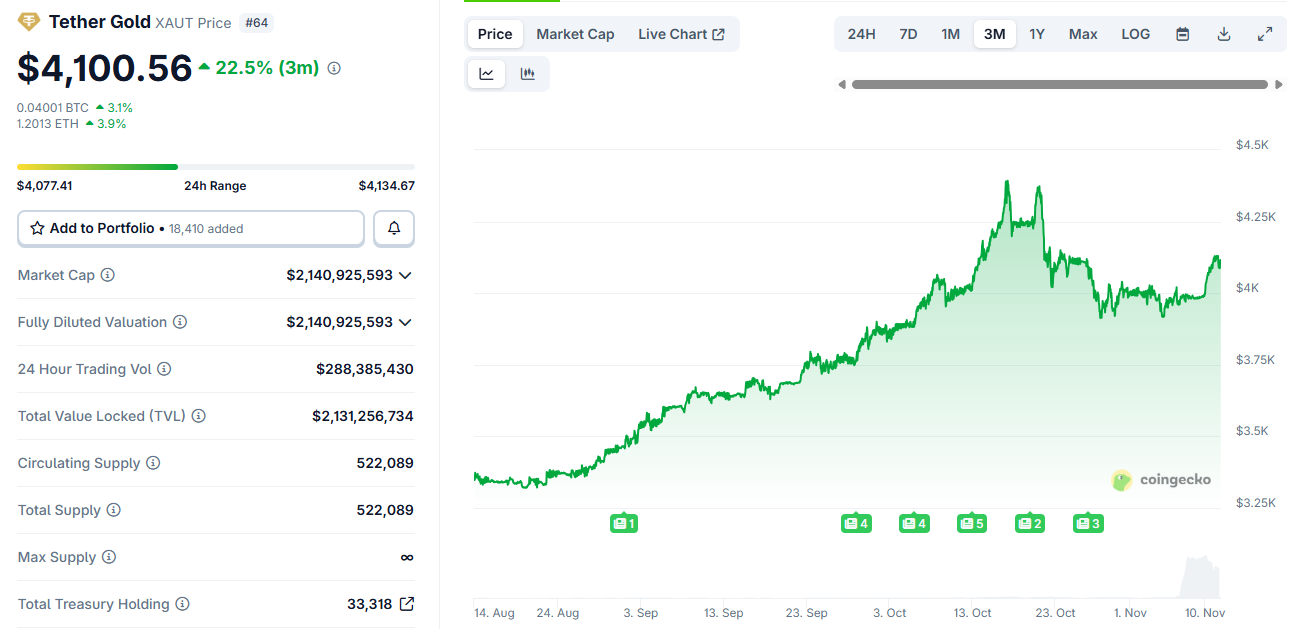

Tether Gold Token Price Chart. Source:

Tether Gold Token Price Chart. Source:

With HSBC veterans now on board, the company appears focused on building that institutional backbone.

However, transparency remains a concern. Critics argue that without frequent independent audits or full reserve disclosure, Tether’s gold strategy could face the same scrutiny that long surrounded its stablecoin reserves.

Overall, the move hints at a coming era where private entities hold diversified, multi-asset reserves rivaling national central banks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What Led to the Latest Bitcoin Price Drop?

- Bitcoin's late 2025 crash stemmed from $3B in ETF outflows and Fed rate uncertainty, triggering a 7.35% price drop. - Institutional exits from IBIT/GBTC contrasted with earlier Q3 2025 inflows that pushed BTC to $126,000, revealing shifting risk appetite. - Fed's 3.75%-4% rate hold and "mildly restrictive" policy eroded crypto confidence, accelerating capital flight to safer assets. - The crash highlighted crypto's growing dependence on macroeconomic cycles and institutional sentiment for price stability.

Bitcoin Leverage Liquidation Spike: A Warning Story on Heightened Risks in Derivatives Trading

- 2025's crypto derivatives market saw $17B in Bitcoin liquidations on October 10, driven by leveraged positions collapsing amid a 18.26% price drop. - November 2025 saw $2B+ daily liquidations as bearish sentiment intensified, with Bybit/Hyperliquid accounting for 50% of losses and long positions dominating. - Bybit and Binance faced leverage contraction post-crash, with open interest halving on Bybit and 30% declines at Binance, revealing structural fragility. - Rising USD and Treasury yields compounded

Cardano News Update: Frustrated Operator Uses AI to Disrupt Cardano Blockchain, Prompting Urgent Repairs

- Cardano (ADA) faced a chain split from a "premeditated attack" exploiting a 2022 ledger bug, forcing an emergency network upgrade. - A user submitted a malformed delegation transaction bypassing validation checks, creating competing "poisoned" and "healthy" chains. - ADA's price dropped 6% during the incident, with $91M in short leverage, as developers patched the bug and restored consensus. - The attacker, identified as "Homer J.", apologized for using AI-generated commands, while experts highlighted Ca

Solana Updates Today: Sunrise: Solana's Gateway to Online Capital Markets

- Wormhole Labs launches Sunrise, a Solana liquidity gateway enabling direct onboarding of external assets like Monad's MON token via NTT framework. - The platform unifies liquidity across Solana DEXs and block explorers, addressing fragmented bridging challenges through native token transfers. - By designating Sunrise as Monad's primary entry point, Wormhole aims to capture early trading flows and expand support to tokenized commodities and RWAs. - This initiative strengthens Solana's DeFi infrastructure,