What Crypto Whales Are Buying As The US Government Shutdown Nears Its End

As the US government shutdown nears its end, crypto whales are buying select DeFi tokens ahead of a potential market rebound. On-chain data shows heavy accumulation in Aster, Pendle, and Uniswap, with each showing technical setups hinting at strength beneath the surface. From rising whale holdings to bullish chart patterns, big money seems to be positioning early — signaling where confidence may be returning first in the post-shutdown crypto market.

The US government shutdown is finally nearing its end, and markets are already reacting. While traders expect policy clarity and a short-term liquidity boost once operations resume, crypto whales are buying ahead of the news — positioning early for what could be a volatile week.

On-chain data shows selective whale activity across a few major altcoins, hinting at confidence returning to risk assets. With sentiment shifting, these quiet accumulations may reveal where big money expects the next big moves to emerge.

Aster (ASTER)

As the US government shutdown nears its end, crypto whales are buying into key DeFi projects. And Aster (ASTER) stands out among them. In the past 24 hours, Aster whales have added about 4.93 million tokens, boosting their holdings by 8.72% to 61.45 million ASTER. At the current price, that’s an increase of roughly $5.52 million in just one day.

Aster Whales:

Aster Whales:

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

This fresh accumulation signals strong whale conviction that market conditions could improve as the shutdown uncertainty lifts in the coming days, as supported by the Polymarket odds.

BREAKING: U.S. Government shutdown now projected to end this Thursday or Friday. pic.twitter.com/kjgamZhczV

— Polymarket (@Polymarket) November 10, 2025

On the charts, ASTER is trading inside a descending channel, where both lower highs and lower lows converge. This is an otherwise bearish pattern that often flips bullish when broken upward. ASTER has recently cleared a key resistance at $1.11, and a breakout above the upper trendline could shift its structure from consolidation to expansion.

The On-Balance Volume (OBV) — which tracks whether volume supports price direction — adds to the optimism. OBV has been slowly trending up and now sits close to breaking its descending trendline. Rising OBV alongside price strength often confirms that the buying pressure is organic. Do note that the OBV indicator is making lower highs, which hints at a slow volume rise.

ASTER Price Analysis:

ASTER Price Analysis:

If whales are right and both OBV and price break out together, the ASTER price could aim for $1.29 first. That could be followed by $1.42 and $1.59. But if the price drops below $1.00, this bullish setup would fail, risking a correction toward $0.81.

For now, crypto whales are buying ASTER ahead of a potential market rebound — and the charts suggest they may be spotting strength before others do.

Pendle (PENDLE)

The second project attracting attention as the US government shutdown nears its end is Pendle (PENDLE) — a DeFi platform that lets users tokenize and trade future yield.

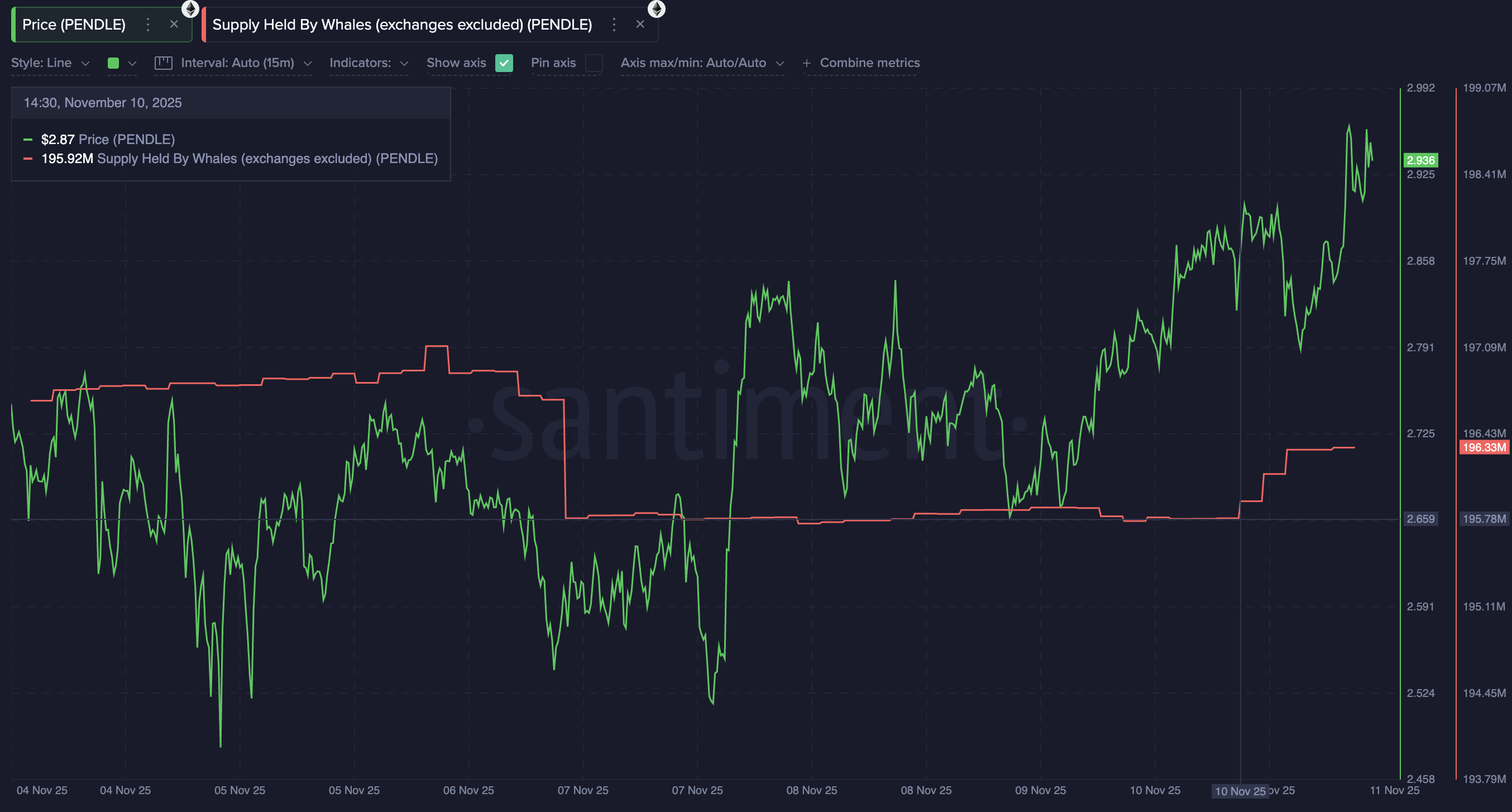

Over the past 24 hours, crypto whales have been buying PENDLE, increasing their holdings from 195.92 million to 196.33 million tokens, a rise of roughly 410,000 PENDLE. At the current price, that’s an addition worth about $1.19 million.

Pendle Whales:

Pendle Whales:

On the technical side, PENDLE has been holding firm at the $2.50 support level since November 4, with multiple bounces showing strong demand. The first key resistance to reclaim sits near $3.45 — a near 19% move from current levels. Clearing that would confirm short-term bullishness and could open the path toward $3.93, the next strong barrier. If momentum continues, a push to $5.23 would be possible in the short term.

Adding weight to this optimism, the Smart Money Index — a metric that tracks large, informed investors’ trading patterns — has been forming higher highs since November 5. The indicator is now nearing a breakout above its signal line, suggesting traders are quietly positioning for an upward move.

PENDLE Price Analysis:

PENDLE Price Analysis:

In short, with whales accumulating and smart money showing conviction, PENDLE’s setup hints at growing confidence. If price clears $3.45, the token could see a swift rebound — a move that might make it one of the stronger performers as the market shifts focus beyond the shutdown. Yet, if PENDLE loses $2.50, the near-term bullish trend might get invalidated.

Uniswap (UNI)

The last token seeing strong accumulation as the US government shutdown nears its end is Uniswap (UNI) — one of the largest DeFi and DEX projects in the crypto market. UNI has become one of the top performers this week, jumping 43% in the past 24 hours and nearly 84% over the past seven days, signaling renewed confidence among investors and whales alike.

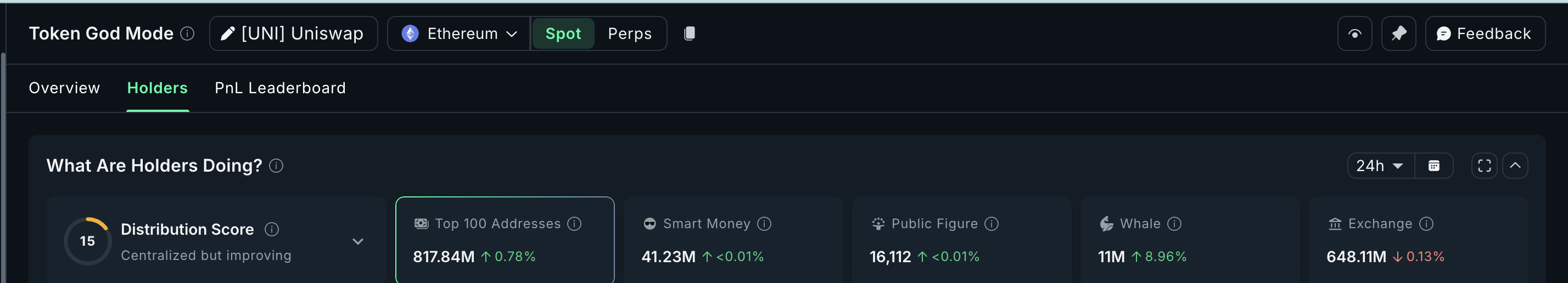

Over the past 24 hours, crypto whales have been buying UNI, increasing their holdings by 8.96%, taking their total stash to 11 million UNI. At the current price of $9.50, the addition is worth $9.37 million.

Uniswap Whales In Action:

Uniswap Whales In Action:

Technically, despite UNI’s explosive breakout-like move, the token is still trading within a falling broadening wedge. It is a pattern that often signals a full bullish reversal once the upper trendline is broken. The immediate resistance sits at $10.77, and a clean breakout above that could send UNI toward $12.34 or even higher.

However, traders should note a hidden bearish divergence visible on the Relative Strength Index (RSI). It is an indicator that measures the speed and strength of price changes to identify overbought or oversold conditions. Between August 13 and November 9, UNI’s price made lower highs while RSI made higher highs, suggesting the recent rally may slow or pull back briefly before resuming.

UNI Price Analysis:

UNI Price Analysis:

It will be important to see if a pullback occurs and whether whales continue accumulating during that phase. Consistent buying on dips would confirm strong conviction and further validate the bullish setup. For now, UNI must hold above $9.53 to maintain momentum; falling below $8.67 would weaken the short-term outlook.

Interestingly, like ASTER and PENDLE, UNI’s whale accumulation fits the emerging pattern. Big investors are favoring DeFi and DEX tokens as the shutdown’s end nears.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Today: Ethereum Faces $2,800 Test—Will It Surge to $3,000 or Retreat to $2,300?

- Ethereum tests $2,800 resistance, key threshold for November, with potential to rebound toward $3,000 if breakout succeeds. - Recent $55.7M inflow into ETH ETFs, led by Fidelity’s FBETH, signals cautious institutional interest after nine-day outflow streak. - Technical indicators show improved momentum with RSI rebound and MACD stabilization, but $2,800 remains critical for further gains. - Derivatives data and Coinbase’s ETH-backed lending expansion hint at conditional recovery, though liquidation risks

Ethereum Updates: Centralized DNS Compromise Highlights DeFi Weaknesses as Aerodrome Suffers $1 Million Loss

- Aerodrome Finance suffered a DNS hijacking attack on Nov 22, 2025, redirecting users to phishing sites that siphoned over $1M in assets through deceptive transaction approvals. - Attackers exploited vulnerabilities in centralized domain registrar Box Domains, forcing users to approve unlimited access to NFTs and stablecoins via two-stage signature requests. - The protocol shut down compromised domains, urged ENS-based access, and revoked recent token approvals, marking its second major front-end breach i

Trump and Mamdani’s Bet on Affordability: Uniting Opposing Ideologies

- Trump and Mamdani's Nov. 21 meeting highlights clashing ideologies on affordability and governance, with New York's $1.286T economy at stake. - Both leaders share focus on cost-of-living crises but differ sharply on solutions, with Trump threatening federal funding cuts and Mamdani advocating rent freezes. - Experts see the dialogue as critical for redefining strained city-federal relations, emphasizing urban centers' role as economic engines. - Mamdani's corporate tax proposals clash with Trump's deregu

Bitcoin News Update: Navigating Crypto’s Balancing Act to Steer Clear of 2018’s Downturn as Global Economic Conditions Evolve

- Crypto markets avoid 2018-style collapse as macro-driven cycles and reduced speculation prolong volatility, per Lyn Alden. - Fed policy uncertainty and leveraged ETF launches highlight risks and innovations amid $2.2B crypto outflows and $914M liquidations. - MSTR's BTC gains and Gunden's $1.3B sell-off reflect divergent investor strategies, while Munari's Solana project targets long-term adoption. - Analysts split between 65-70% Bitcoin retracement forecasts and prolonged cycles driven by institutional