Is the x402 Crypto Ecosystem Losing Steam? What the Data Shows

The AI-powered x402 network faces a sharp activity slowdown, yet new Chainlink and Bio Protocol integrations have kept adoption rising and pushed its market cap above $12 billion.

The x402 ecosystem has experienced a significant decline in activity, with its 30-day trading volume plummeting by nearly 90% and transaction counts falling in tandem.

The drop raises broader concerns about whether the crypto meta may finally be losing momentum.

Sharp Decline in Trading Activity Signals Waning Interest in x402

x402 is an internet payment protocol built to enable autonomous AI agents to execute verifiable, automated on-chain payments through standard web infrastructure.

BeInCrypto previously reported that the ecosystem gained significant traction in October, drawing widespread attention from the crypto community. In fact, many low-cap coins within the x402 ecosystem saw their values quadruple amid the surge in interest.

However, the latest data from x402scan highlights a modest downturn in ecosystem activity. On November 3, the protocol processed about 3 million transactions alongside $2.8 million in daily trading volume.

The latest snapshot shows the transaction counts slipped to 1.3 million, marking a 56% decrease. Meanwhile, the trading volume has also dropped to around ₹329,000. Coinbase accounted for most of the ecosystem activity, handling more than 873,500 requests and $306,730 in volume in the last day.

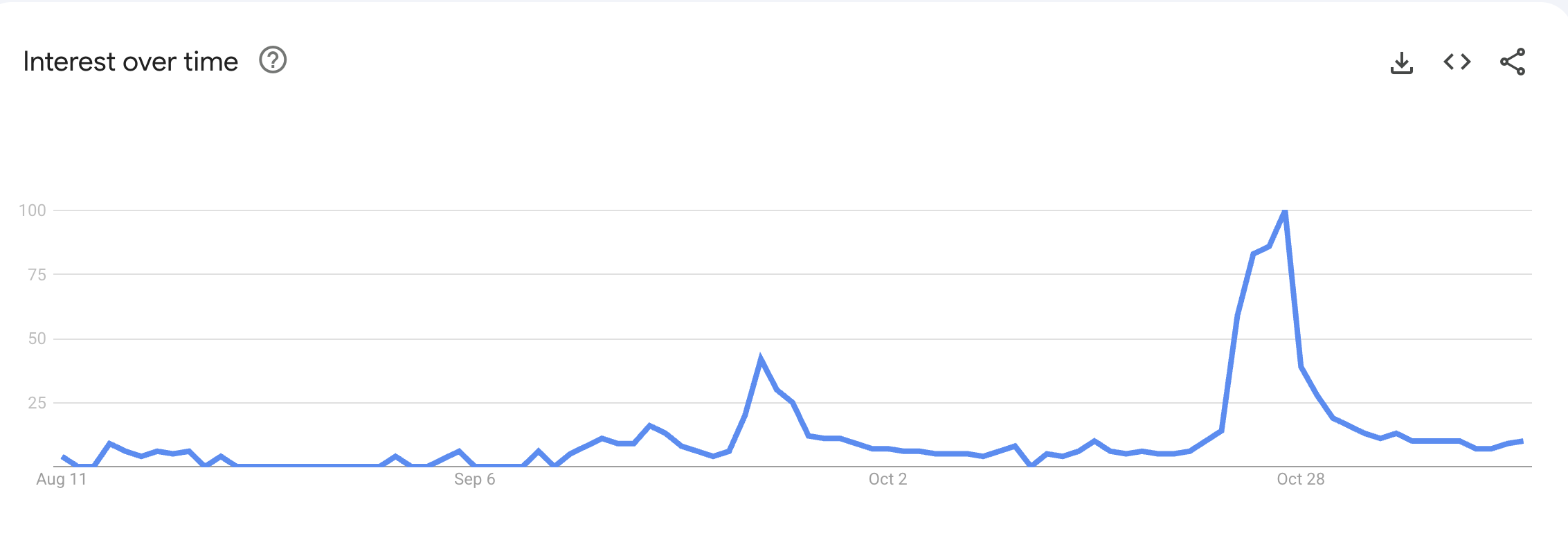

The contraction has also been echoed in retail sentiment. Google Trends shows that global search interest in “x402” dropped from a peak score of 100 to 10, signaling a decline in public attention.

x402 Retail Interest. Source:

Google Trends

x402 Retail Interest. Source:

Google Trends

Ecosystem Growth Remains Strong

Despite this, the x402 protocol has continued to build institutional credibility. Last week, Chainlink (LINK) integrated an X402 endpoint into its Chainlink Runtime Environment (CRE).

Through this update, autonomous agents can now discover CRE workflows, verify outcomes using Chainlink, and settle directly on-chain. Furthermore, it allows workflow creators to earn per use.

“This integration also unlocks programmatic payouts and a reusable workflow marketplace. For example, an insurer covering farmers against drought can verify rainfall through CRE and route instant onchain payouts all without a claim filed,” Coinbase posted.

In parallel, Bio Protocol (BIO), one of the notable projects in Decentralized Science (DeSci), revealed that its agents now use X402 and embedded wallets to enable instant USDC micropayments on Base, a clear sign of growing real-world adoption across emerging decentralized sectors.

“What this unlocks: Hypothesis review marketplaces, AI agents pay each other and human researchers for specialized analysis, Pay-per-query instead of subscriptions, On-demand access to premium datasets,” the team noted.

With these integrations, the total market capitalization of the X402 ecosystem has increased to over $12 billion from just $800 million in late October — a gain of more than 1,300% in approximately two weeks.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump and Mamdani’s Bet on Affordability: Uniting Opposing Ideologies

- Trump and Mamdani's Nov. 21 meeting highlights clashing ideologies on affordability and governance, with New York's $1.286T economy at stake. - Both leaders share focus on cost-of-living crises but differ sharply on solutions, with Trump threatening federal funding cuts and Mamdani advocating rent freezes. - Experts see the dialogue as critical for redefining strained city-federal relations, emphasizing urban centers' role as economic engines. - Mamdani's corporate tax proposals clash with Trump's deregu

XRP News Today: XRP Faces Uncertainty: Bearish Trends Clash with Optimism from ETF Prospects

- XRP faces critical juncture at $1.96 as bearish technical patterns clash with institutional optimism from new ETFs. - Descending triangle breakdown and RSI divergence signal potential 25% drop to $1.55, contradicting ChartNerd's reversal prediction. - Bitwise XRP ETF's $25.7M debut volume injects liquidity but risks accelerating forced selling from 41.5% of supply at a loss. - Analysts debate ETF-driven bullish potential vs. structural risks, with $2.20 support zone and $1.25 price floor as key battlegro

CFTC's Efforts in Crypto Encounter Staffing Shortages and Political Challenges as Selig Approaches Confirmation

- Trump's nominee Michael Selig advanced to Senate confirmation after a 12-11 party-line vote to lead the CFTC amid crypto regulatory debates. - Selig, an SEC crypto expert, emphasized balancing innovation with investor protection and aligning with Trump's pro-crypto agenda during his hearing. - The CFTC faces staffing gaps (543 vs. SEC's 4,200) and political pressure to maintain bipartisan balance while navigating crypto rule harmonization. - Selig deferred resource needs to post-confirmation assessment a

Bitcoin News Update: Cryptocurrency Company Seeks $100 Million Sale Following Founder’s Indictment for Money Laundering

- Crypto Dispensers, a Chicago-based Bitcoin ATM firm, faces a $100M sale amid a federal indictment accusing founder Firas Isa of laundering $10M through its network. - The DOJ alleges Isa converted illicit funds from fraud and drug trafficking into crypto via weak AML controls, despite claims of robust compliance since 2020. - Regulatory scrutiny intensifies as UK/SFO and Europol crack down on crypto fraud, signaling reduced anonymity for criminal transactions in digital assets. - Market uncertainty grows