From Hero to Zero: How Bitdeer Lost 32% Despite Mining 1,109 Bitcoin

Bitdeer shares dropped nearly 20% after reporting a $266.7 million Q3 loss, weeks after surging on AI expansion plans and record Bitcoin production, highlighting capital spending and non-cash debt impacts.

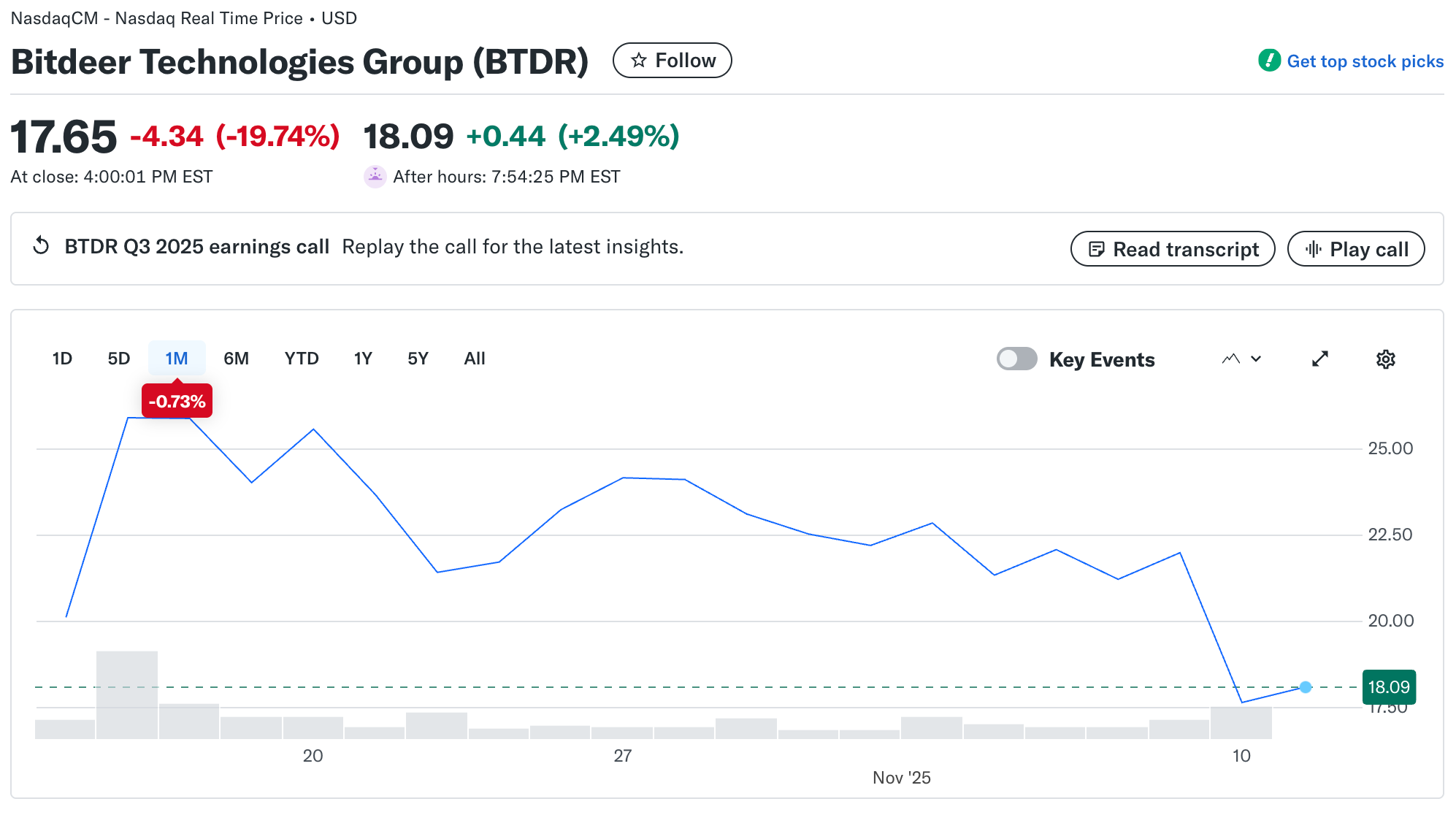

Bitdeer Technologies’ shares fell nearly 32%, closing at $17.65, after reporting a $266 million quarterly loss. The drop followed a 30% rally on October 15, when the stock hit $25.90, fueled by investor optimism over AI and data center expansion plans.

The reversal highlights tension between growing revenue and Bitcoin production, and the impact of non-cash losses, capital expenditures, and large-scale infrastructure investment on profitability.

October Rally Fueled by AI and Infrastructure Expansion

On October 15, Bitdeer (NASDAQ: BTDR) shares surged by more than 30% to $25.90 after announcing plans to expand into AI and high-performance computing (HPC) workloads. BTDR stock had fallen to $17.65 on Monday, marking a nearly 32% decline from its October peak.

Bitdeer stock price:

Bitdeer stock price:

The company said it will allocate 200 MW of energy to AI services. It targets annual revenues exceeding $2 billion by 2026. Bitdeer also added 241,000 mining machines across Norway, the US, and Asia. The firm mined 1,109 BTC during the quarter.

The expansion positioned Bitdeer alongside other miners such as MARA, IREN, and Core Scientific, which are increasingly integrating AI and HPC capabilities. Investors initially responded positively, seeing diversification into AI as a way to offset volatility in Bitcoin mining margins.

Quarterly Loss and Market Reaction

Bitdeer released unaudited Q3 2025 results, with revenue rising 174% year over year to $169.7 million. Adjusted EBITDA reached $43 million. The growth reflects higher Bitcoin production and efficiency gains from self-mining expansion.

“Q3 marked a quarter of strong execution and financial performance. Revenue, gross profit, and adjusted EBITDA improved significantly. Efficiency gains were driven by our self-mining expansion. Allocating 200 MW to AI cloud services could generate annualized revenue exceeding $2 billion by the end of 2026.” Matt Kong, Chief Business Officer at Bitdeer said.

However, the optimism reversed as the company posted a net loss of $266.7 million. This compares to a $50.1 million loss in the same quarter last year. It stemmed mainly from non-cash revaluation losses on convertible debt and elevated operational expenses.

Despite mining gains and expanded infrastructure, including the AI transition, which generated $1.8 million in revenue, investors focused on the impact of these paper losses. Following the report, Bitdeer shares dropped nearly 30% on the NASDAQ.

Continued AI Transition and Operational Highlights

In October, Bitdeer continued its progress on its AI-focused infrastructure buildout. Operational data confirm increased production capacity and a growing hash rate, signaling the company’s intent to scale AI workloads while maintaining mining operations. However, Q3 results show financial pressures from capital-intensive expansion and market volatility. This weighed on short-term investor sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PENGU Token Technical Review: Managing Immediate Market Fluctuations and Blockchain Indicators

- PENGU token faces critical juncture with conflicting technical indicators and accumulating on-chain activity in November 2025. - Short-term bearish signals (RSI 38.7, 12 sell signals) clash with bullish MACD/OBV divergence and whale accumulation ($273K acquired). - On-chain patterns suggest potential breakout above $0.0235 resistance, with $0.026 target if volume supports, but $0.01454 support remains vulnerable. - Risks persist due to unquantified NVT score and bearish pressure from broader indicators,

Bitcoin News Update: Retail Investors Panic While Whales Remain Confident as Bitcoin Hits Lowest Point in Seven Months

- Bitcoin fell to a seven-month low near $89,250, sparking debates over a potential bottom or prolonged correction amid mixed technical and institutional signals. - Analysts highlight a possible 40% rebound by year-end, driven by bullish figures like Michael Saylor and whale accumulation of 345,000 BTC since October. - Retail investors flee as fear metrics hit extremes, contrasting with institutional confidence seen in Czech National Bank's $1M Bitcoin pilot and ETF inflows. - Technical indicators warn of

COAI Experiences Significant Price Decline in Early November 2025: Combined Impact of Disappointing Earnings and Changing Market Sentiment

- COAI Index fell 88% YTD in 2025, sparking debates over AI/crypto AI sector revaluation vs. overreaction. - Mixed Q4 earnings: Cisco showed $14.7B revenue growth, while C3.ai reported $31.2M operating loss despite 26% revenue rise. - C3.ai's leadership crisis (CEO change, lawsuit) and governance issues amplified COAI's decline amid regulatory uncertainty. - CLARITY Act's ambiguous crypto regulations and institutional flight to stable tech stocks worsened sector sentiment. - Market re-rating of speculative

Hyperliquid (HYPE) Price Rally: Institutional Embrace and Changing Market Sentiment in Decentralized Trading

- Hyperliquid's HYPE token surged due to institutional adoption and shifting market sentiment, defying broader crypto slumps. - A $1B HYPE Digital Asset Treasury merger with Rorschach I LLC and partnerships like Hyperion DeFi's HAUS protocol boosted token utility and capital inflows. - Q3 2025 analysis shows HYPE trading between $35-$60 with strong on-chain metrics, though manipulation risks and Fed policy remain critical factors. - 21Shares' HYPE ETF application and Hyperliquid's expanded $1B fundraising