Biopharma raises $100M for crypto treasury to back cancer treatment

Australia-based Propanc Biopharma has announced that it has secured $100 million from a crypto-focused family office to launch a crypto treasury — a move its CEO described as “transformative” as its cancer therapy product enters human trials next year.

The private placement, structured through convertible preferred stock, provides Propanc with an initial $1 million investment and up to $99 million in follow-on funding over the next 12 months from Hexstone Capital, a family office that invests in several crypto treasury companies.

The cancer-treating biotech company stated that the proceeds will be used to build a digital asset treasury and accelerate the development of its lead cancer therapy, PRP, which aims to enter first-in-human trials in the second half of 2026.

Propanc CEO James Nathanielsz said the crypto treasury would assist a “transformative phase” for the company by strengthening its balance sheet and advancing its proenzyme-based oncology platform.

“We can target not only patients suffering from metastatic cancer from solid tumors, but several chronic diseases based upon the mechanism of action of proenzyme therapy.”

While Propanc didn’t say which digital assets it plans to buy for its crypto treasury, Hexstone’s clients have invested in everything from Bitcoin (BTC), Ether (ETH), Solana (SOL), Injective (INJ) as well as some lesser-known cryptocurrencies.

Biotech companies adopting a crypto strategy

Propanc joins Sonnet BioTherapeutics, Sharps Technology and other biotech companies that have turned to crypto to reignite investor interest.

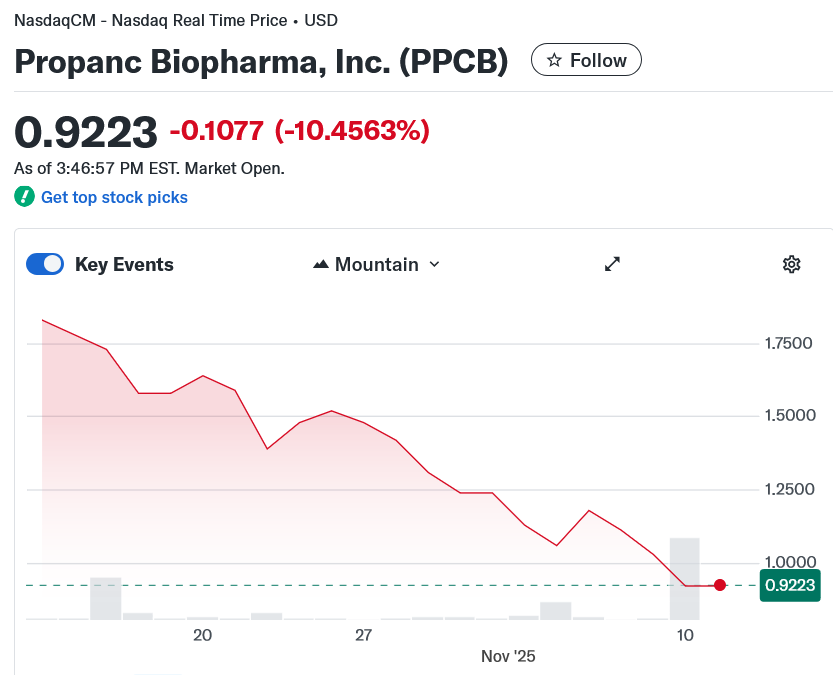

However, Propanc’s move was not received well by its investors, with PPCB shares diving 10.5% on the Nasdaq on Monday, according to Yahoo Finance data.

Crypto treasury strategies haven’t fared well lately

Bitcoin treasury holding companies have lost some of their sheen over the last few months as more companies flood into the space.

Related: ‘Most hated bull run ever?’ 5 things to know in Bitcoin this week

Even Strategy, the largest corporate Bitcoin holder, has seen its market cap slide over 43% from $122.1 billion in July to $69.1 billion today.

Metaplanet, one of the best-performing stocks on the Tokyo Stock Exchange to start the year, has been hit even harder, falling around 55% since late June, while other Bitcoin treasury companies have even had to offload some of their BTC holdings to pay outstanding debt.

Magazine: Bitcoin OG Kyle Chassé is one strike away from a YouTube permaban

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ALGO Falls 1.74% as 1-Month Results Remain Subdued

- Algorand (ALGO) dropped 1.74% on Nov 24, 2025, extending its 1-month decline to 20.35% amid sustained bearish sentiment. - The token’s annual price has fallen 57.76% from its peak, driven by macroeconomic volatility and uncertainty over potential interest rate cuts. - No ALGO-specific news or on-chain developments were reported, with price movements linked to broader economic factors and risk appetite shifts. - Analysts warn the bearish trend may persist unless major upgrades emerge, urging investors to

Aave News Today: The Two Sides of DeFi: Aave's Expansion Increases Volatility Concerns

- Aave's AAVE token faces volatility risks near 0.57 support level, with whale accumulation and leveraged positions amplifying short-term instability. - A major Aave whale added 24,000 AAVE tokens (total 276,000) at $165 average cost, but remains vulnerable to repeat October 11 liquidation risks. - A $80M WBTC long position on Aave approaches $65,436 liquidation threshold, threatening forced selling and downward price pressure. - Tangem's Aave-integrated stablecoin yield feature highlights protocol's DeFi

Chainlink: The Bridge Connecting Crypto Isolates with Wall Street

- Grayscale positions Chainlink (LINK) as critical infrastructure linking crypto and traditional finance, citing its role in tokenization, cross-chain settlement, and RWA integration. - LINK's modular middleware enables secure data access and compliance, elevating it to the largest non-layer 1 crypto asset by market cap (excluding stablecoins). - Grayscale highlights Chainlink's partnerships with S&P Global and FTSE Russell, alongside a $35.6B tokenized asset market, as catalysts for institutional blockcha

CITES and Instant DNA Technology Aim to Uncover Covert Shark Trade and Prevent Species Disappearance

- CITES CoP20 in Uzbekistan proposes historic protections for 12 shark/ray species via Appendix I listings and stricter Appendix II monitoring. - Genetic testing reveals illegal shark trade volumes exceed official records by 10-70x, with Hong Kong as a key trafficking hub despite zero-export claims. - Portable DNA tools now enable real-time identification of 38 CITES-listed species, aiding enforcement in Indonesia, Ecuador, and other source countries. - Experts stress CITES is critical to prevent extinctio