Fetch.ai Lawsuit Challenges Ocean Protocol Operations

- Fetch.ai’s lawsuit targets Ocean Protocol for alleged fund misuse.

- 10%+ of circulating FET supply impacted by token sales.

- Potential governance and market repercussions for ASI Alliance noted.

Fetch.ai filed a lawsuit against Ocean Protocol on November 4, 2025, in the Southern District of New York, alleging misuse of community funds and unauthorized token trades.

The lawsuit potentially disrupts AI blockchain alliances, affecting token trust and community governance, with noticeable FET market volatility since the complaint filing.

Introduction

Fetch.ai lawsuit against Ocean Protocol highlights a significant rift in the Artificial Superintelligence Alliance. Filed on November 4, 2025, it accuses Ocean Protocol of misusing DAO funds and impacting the FET token price.

Fetch.ai, led by CEO Humayun Sheikh, accuses Ocean Protocol, co-founded by Bruce Pon and Trent McConaghy, of converting community tokens without authorization. This action allegedly devalued the FET token, challenging governance models.

Market Impact and Governance Challenges

The lawsuit’s immediate effects are notable for the cryptocurrency markets, specifically affecting FET and OCEAN tokens. Conflicts in governance approaches and token management strategies have gained industry attention.

The financial implications include the release of 263 million FET into the market, representing over 10% of its circulation. Existing funding channels for both networks remain uncertain, pending further transparency and official responses.

Response and Future Speculations

Bruce Pon cited “legal and governance differences” for Ocean’s exit from the ASI Alliance. Ocean Protocol dismissed the lawsuit as “exaggerated” in social media but issued no formal statement as of this writing. CryptoRank alert: Major updates in the crypto market.

Industry watchers speculate on possible regulatory actions, further legal challenges, or governance reform within involved networks. Past disputes like The DAO hack in 2016 have shown the potential for significant volatility and trust erosion.

Statements and Interpretations

Humayun Sheikh, CEO of Fetch.ai, stated, “Ocean misrepresented that hundreds of millions of OCEAN tokens would be reserved for DAO rewards, but instead converted and sold those tokens after joining the Artificial Superintelligence Alliance, thereby depressing the value of FET and undermining the DAO’s stated governance model.” Fetch.ai sues Ocean for $263 million over community sales.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Turmoil and AI Breakthroughs: Grok 4.1, Gemini 3, Cloudflare Outage

AI Confidence and Economic Concerns Set Crypto Strength Against Market Downturn

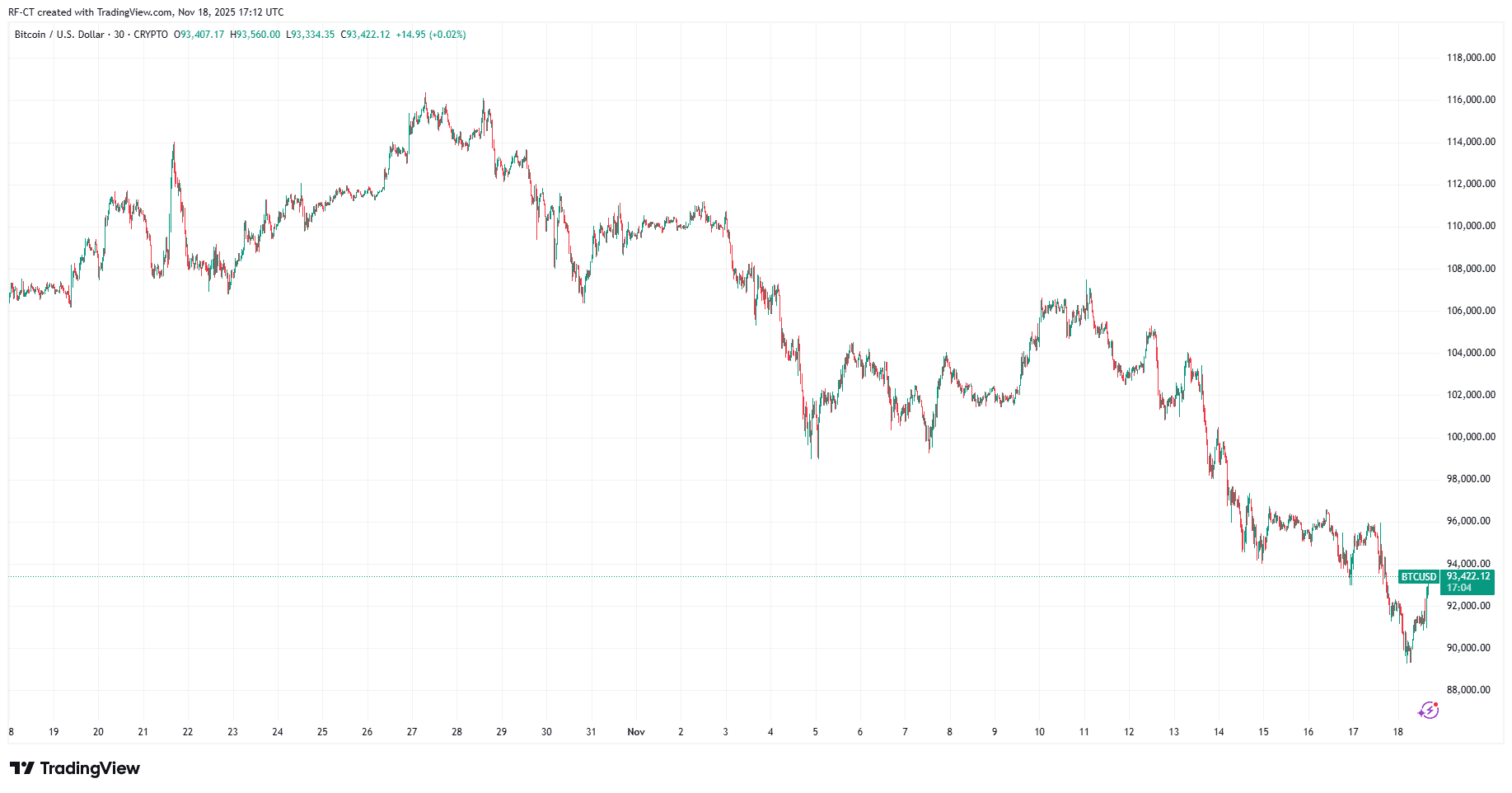

- U.S. stock indexes fell on Nov. 18, 2025, while crypto and AI-linked stocks showed resilience amid broader market weakness. - Nvidia's upcoming earnings and 54% YOY EPS forecast fueled gains in correlated stocks like TSMC (+41% YTD) and SMCI (+15% YTD). - Bitcoin rebounded 1% temporarily, but analysts warned crypto remains vulnerable to inflation fears and $1B+ leveraged liquidations. - Home Depot's 3% premarket drop dragged on the Dow after missing Q3 earnings and slashing profit forecasts amid housing

Solana's Breakthrough: Ushering in a New Age of Fast and Scalable Smart Contracts?

- Solana's 2025 upgrades (Firedancer, Alpenglow) achieved 1M TPS and sub-150ms latency, outperforming Ethereum and Sui . - Enterprise partnerships with Visa , PayPal , and Stripe leverage Solana's speed and low fees for payments and remittances. - Institutional ETF inflows and energy-efficient proof-of-history consensus boost Solana's appeal for green finance. - Challenges include competition from Ethereum upgrades, stablecoin liquidity declines, and regulatory risks.

Trump’s Federal Reserve Shakeup Raises Concerns Over Stagflation and Divides Within GOP

- Trump announced his Fed chair pick but withheld the name, criticizing resistance to removing Powell before his 2026 term ends. - Shortlisted candidates include Waller, Bowman, and Rieder, with Trump hinting at a "standard" choice amid political tensions. - The dispute with Rep. Greene over Epstein files highlights GOP fractures, as Trump accused her of betraying party loyalty. - Critics warn politicizing the Fed risks stagflation, while the Epstein files debate underscores transparency vs. loyalty tensio