3 Altcoins Facing Major Liquidation Risk in the Second Week of November

XRP, Zcash, and Starknet are showing strong momentum but carry high liquidation risks for leveraged traders this week. Analysts warn that overleveraged longs could face steep losses if market sentiment turns.

While the altcoin season has yet to return, a few altcoins are showing stronger performance than the rest of the market in the second week of November. However, these same tokens also face the risk of triggering massive liquidations for short-term traders.

Which altcoins are they, and what risks are involved in trading their derivatives?

1. XRP

Short-term trader sentiment for XRP remains highly optimistic as Canary Capital prepares to launch its Spot XRP ETF on November 13.

Additionally, five XRP spot ETFs from Franklin Templeton, Bitwise, Canary Capital, 21Shares, and CoinShares have appeared on the DTCC list. This development strengthens investor confidence that multiple XRP ETFs could soon receive approval.

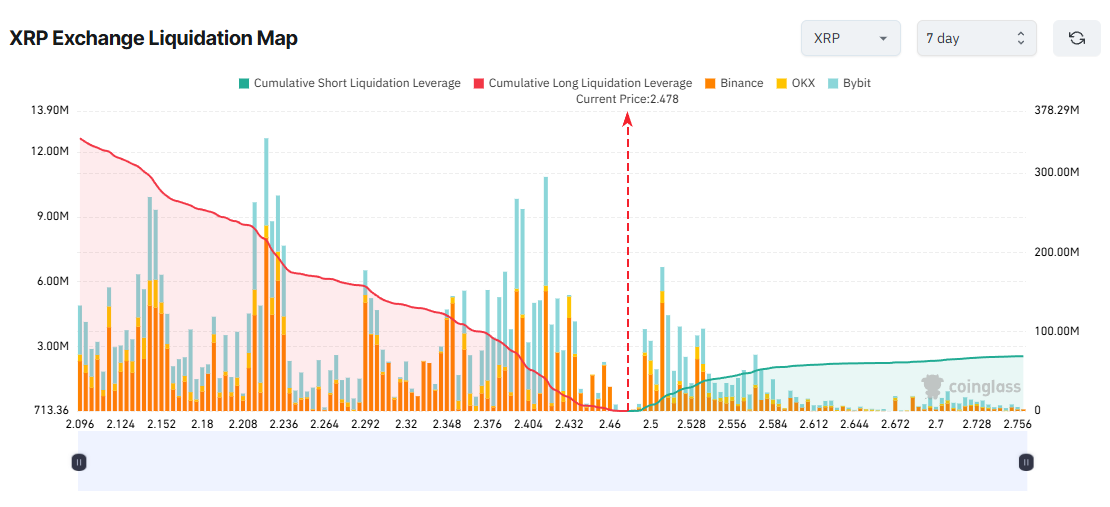

XRP Exchange Liquidation Map. Source:

Coinglass

XRP Exchange Liquidation Map. Source:

Coinglass

The 7-day liquidation map indicates a significant concentration of potential long liquidations, suggesting that many traders are anticipating an XRP price rally this week.

However, BeInCrypto’s latest analysis reveals a sharp decline in new XRP addresses over the past week, indicating a weakening of interest from new investors. Moreover, the MVRV Long/Short Difference has dropped, increasing the likelihood of a price correction.

If XRP falls toward $2.10 this week, long positions could face more than $340 million in liquidations. Conversely, if XRP rises to $2.75, short positions may be liquidated for around $69 million.

2. Zcash (ZEC)

The rally in Zcash (ZEC) shows no sign of slowing down in the second week of November. Although ZEC reached $750 before correcting to around $658, many traders still expect the price to climb toward $1,000.

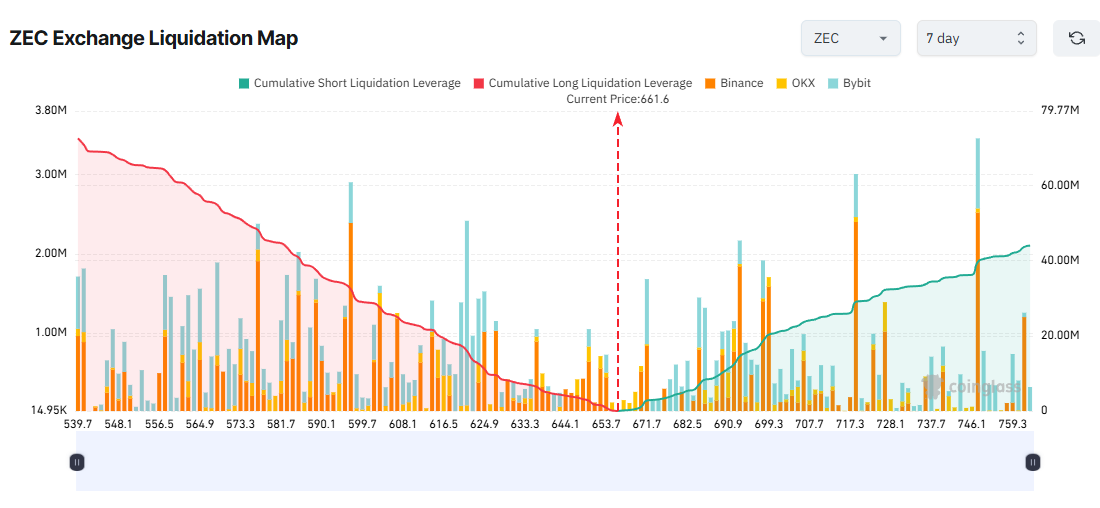

The 7-day liquidation map reveals that short-term derivatives traders are allocating more capital and leverage toward long positions. This means they could face larger losses if ZEC experiences a correction this week.

ZEC Exchange Liquidation Map. Source:

Coinglass

ZEC Exchange Liquidation Map. Source:

Coinglass

If ZEC drops to $540, over $72 million in long positions could be liquidated. Conversely, if ZEC surges to $760, roughly $44 million in shorts could be wiped out.

Analysts warn that ZEC may be forming a classic parabolic uptrend after a 10x rally, possibly nearing the final stage of the pattern.

“Just sold 90% of my ZEC. I’m bullish on the privacy thesis, but parabolic charts rarely sustain in the short run without a meaningful retrace. Too much short-term FOMO imo,” investor Gunn said.

3. Starknet (STRK)

Starknet (STRK) surprised the market in the second week of November with a 30% daily surge, recovering losses from last month’s sharp decline.

Several analysts suggest STRK may be breaking out of a long-term resistance line, potentially kicking off a strong new bull run.

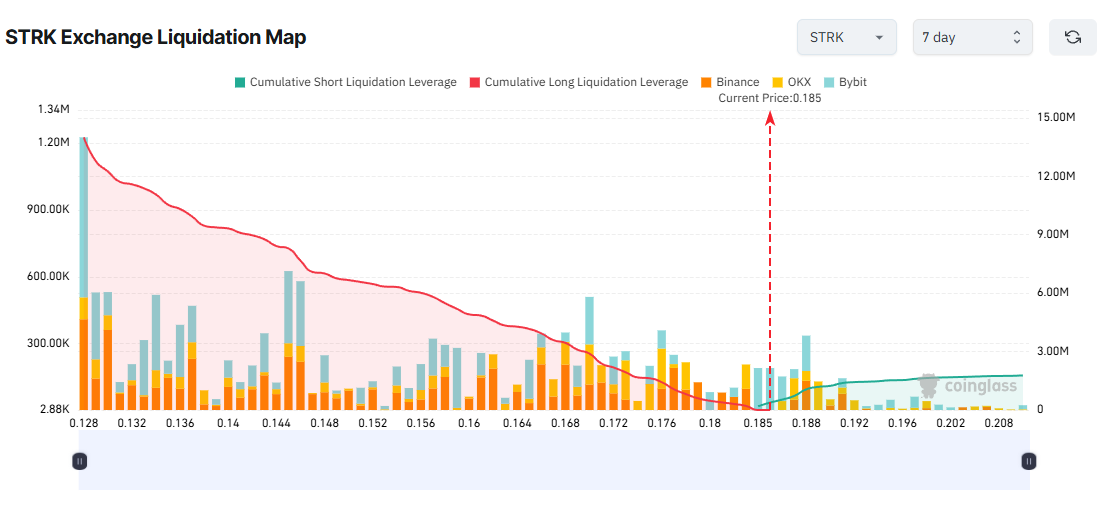

Liquidation map data reflects this short-term bullish sentiment, showing a dominance of potential long liquidations over shorts.

STRK Exchange Liquidation Map. Source:

Coinglass

STRK Exchange Liquidation Map. Source:

Coinglass

However, CryptoRank reports that STRK is among the top 7 altcoins with major token unlocks this week. More than 127 million STRK tokens will be unlocked, potentially adding significant selling pressure and disrupting the plans of leveraged long traders.

If STRK falls to $0.128, approximately $14 million in long positions could be liquidated. Conversely, if it breaks above $0.20, about $1.78 million in shorts could be wiped out.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Milei's $LIBRA Endorsement Reportedly Led to $100M Cryptocurrency Crash, Investigation Suggested

- Argentine President Javier Milei faces investigation for promoting $LIBRA, a collapsed crypto linked to $100M+ investor losses. - Congressional report claims his endorsement boosted the token's visibility, enabling a "rug pull" and draining liquidity pools. - The probe also ties Milei to prior crypto projects and corruption allegations involving his sister at the National Disability Agency. - Legal actions freeze assets of $LIBRA organizers, while political challenges persist amid a new Congress dominate

Bitcoin Updates: U.S. Crypto Mining Companies Face Espionage Concerns and Growth Challenges During Bitmain Investigation

- U.S. authorities investigate Bitmain's ASICs for potential espionage risks, impacting miners reliant on its 80% market-dominant hardware . - American Bitcoin's Trump-linked purchase of 16,299 Bitmain miners raises conflict concerns amid strained U.S.-China supply chains. - Canaan Inc. reports record $30.6M Bitcoin mining revenue and 31% North American hardware sales growth despite industry challenges. - SOLAI pivots to infrastructure-as-a-service, earning $2.9M in data center fees as self-mining revenue

Fed's Split Between Doves and Hawks Fuels Crypto's Unsteady Surge

- NY Fed's John Williams hinted at potential December rate cut, sparking crypto market surge as traders priced in 60% cut probability. - Dallas Fed's Lorie Logan warned against premature cuts, highlighting FOMC divisions revealed in October meeting minutes. - BofA's Hartnett linked crypto's 35-45% declines to liquidity risks, noting $2.2B in record fund outflows as caution grows. - Former Fed adviser El-Erian cautioned against overreacting to dovish signals, citing delayed inflation data and hawkish resist

Solana News Today: Solana Faces Key Price Challenge: Can Strong Fundamentals Ignite a Bull Rally?

- Solana shows reversal signals via wallet growth and partnerships expanding real-world crypto utility. - Mastercard's Solflare debit card and 21shares' Solana ETF highlight institutional adoption amid 83% developer growth. - Latin American expansion through MiniPay's local payment integration boosts Solana's low-cost settlement appeal. - Price remains pressured near $125-$130 support, with mixed forecasts predicting 10-30% rebounds by 2025-2026. - Fear & Greed Index at 11 (Extreme Fear) contrasts RSI neut