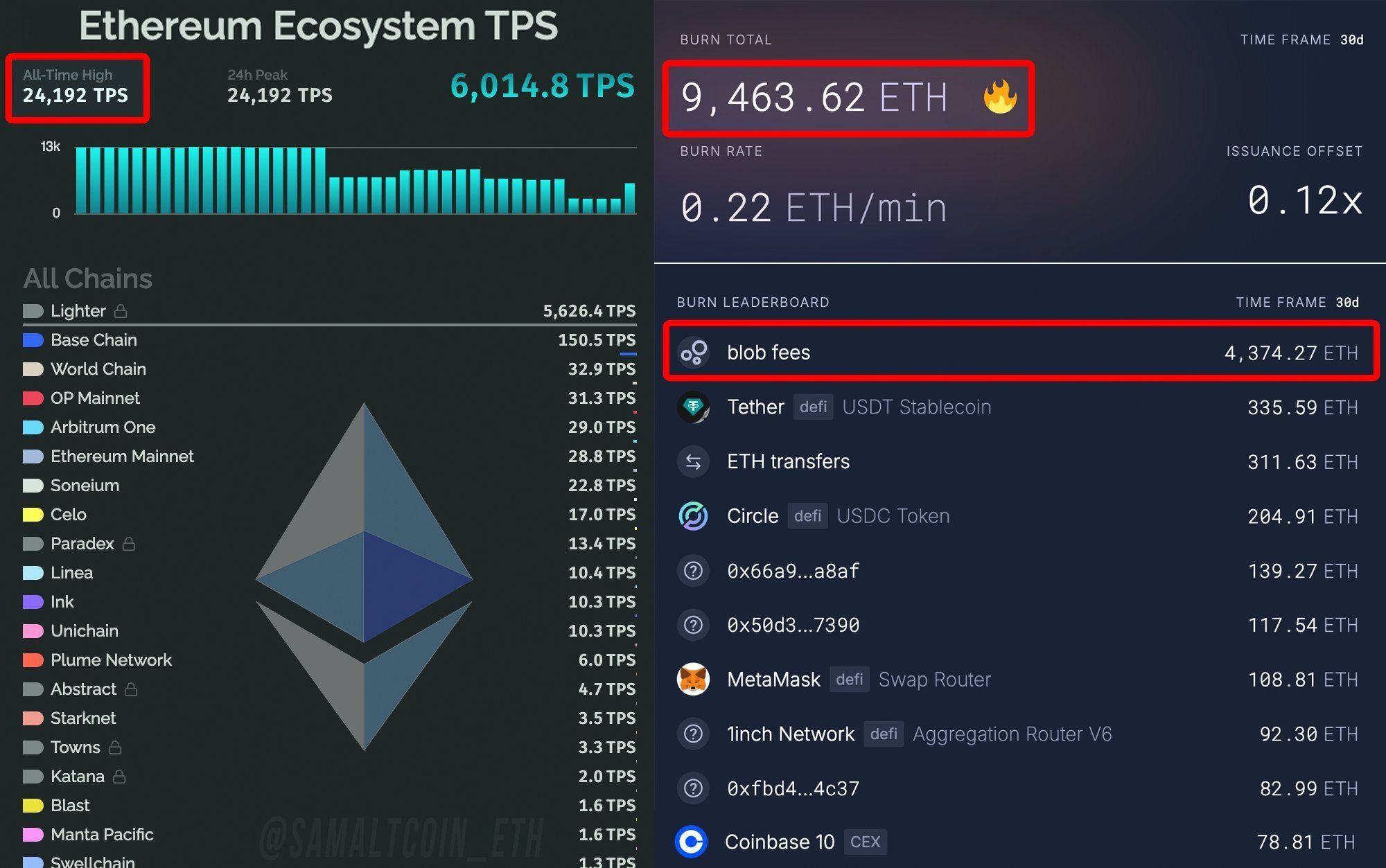

Ethereum Burns $32 Million in ETH as Network Hits Record 24,192 TPS

Ethereum has achieved a historic milestone, processing 24,192 transactions per second, the highest ever recorded for the network.

The data, compiled by analytics platform Growthepie, attributes this record to the inclusion of Lighter. The protocol is a Layer 2 solution that recently joined Ethereum’s scaling ecosystem.

Lighter alone is processing about 4,000 TPS, far outpacing Base Chain, which typically handles between 100 and 200 TPS. Consequently, the surge highlights the influence of Layer 2 platforms. In particular, these solutions extend Ethereum’s scalability, achieving performance levels the base layer alone could not reach.

Waidmann noted that “blobs are scaling L2s at warp speed,” which indicates that more user activity across Layer 2s directly translates into more ETH being burned, reducing supply and potentially influencing long-term price dynamics.

Community Reactions

In a tweet, Ethereum co-founder Vitalik Buterin celebrated the development. “Ethereum is scaling,” he wrote, highlighting how the network handles increasing transaction volumes more efficiently.

Ryan Sean Adams, the voice behind the Bankless podcast, emphasized that Layer 2 solutions now offer a 200 times scaling factor for Ethereum. He attributed the breakthrough to the increasing adoption of zero-knowledge proofs (ZK tech).

Based on this advancement, he predicted that the network could soon reach 100,000 TPS, and ultimately 1 million TPS.

Pectra and Dencun Upgrades Power Layer 2 Growth

Notably, Ethereum’s improved performance is rooted in the recent Pectra and Dencun upgrades, which significantly enhanced the throughput and efficiency of Layer 2 (L2) networks. These updates enable faster and cheaper transactions, laying the groundwork for Ethereum’s record-breaking performance.

By optimizing data handling and supporting zero-knowledge technology, these upgrades enable L2 networks to process transactions with unprecedented speed and efficiency, thereby reinforcing Ethereum’s multi-layer scaling model.

While Lighter is driving much of Ethereum’s record performance, the platform has faced several network outages since its October 1 launch. The disruptions have drawn comparisons to Solana’s early instability.

Following an outage on October 28, Lighter’s team compensated 3,900 wallets with $774,872 in USDC. Despite these challenges, Lighter remains a central player in Ethereum’s recent scaling success.

Debate Over Ethereum’s Value Capture

Meanwhile, the rise of Layer 2s has raised strategic questions for Ethereum’s long-term economic model. Rezso Schmiedt, founding partner at ₿RRR Capital, questioned where the value accrual lies for Ethereum’s mainnet if Layer 2 networks capture most transaction fees.

Nevertheless, some community members argue that new mechanisms, such as fee sharing, MEV capture, and protocol-level integrations, are needed to ensure that Layer 1 continues to benefit financially from Layer 2 growth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Supreme Court Decision Challenges Party Tactics in Racial Gerrymandering Cases

- Supreme Court Justice Alito blocked a lower court ruling that found Texas' 2026 redistricting plan racially discriminatory, preserving its implementation for the 2026 midterms. - Texas argued the lower court erred by conflating political and racial motivations, citing logistical challenges of changing the map 91 days before the primary. - The case tests boundaries between partisan strategy and racial gerrymandering, with LULAC criticizing the Supreme Court's pause as undermining fair representation for m

XRP News Today: Death Cross Emerges: XRP's Sharp Decline Highlights Broader Crypto Market Fragility

- XRP's price fell below $2.20 on Nov 19, 2025, signaling a "death cross" technical pattern linked to prolonged declines. - The bearish crossover of 50-day and 200-day EMAs suggests intensified selling pressure and potential 55% drop to $1.25. - The decline mirrors weakness in Bitcoin and Ethereum , reflecting systemic crypto market fragility amid macroeconomic and regulatory risks. - Analysts warn of erratic crypto behavior near key levels, emphasizing unpredictable volatility during this bearish phase.

XRP News Today: The Growth of Crypto: Institutional Funding Compared to Market Fluctuations and Risks of Delisting

- Bitwise launches XRP ETF (XRP) to offer institutional exposure to Ripple's blockchain, navigating risks like token depreciation and market volatility. - ARK Invest defies crypto pessimism by injecting $39M into crypto-linked stocks, adjusting its 2030 Bitcoin price target to $1.2M from $1.5M. - Coinbase acquires Solana-based DEX Vector (ninth 2025 deal), aiming to become an "everything exchange" amid surging DEX volume exceeding $1T. - GSR upgrades institutional platform with treasury workflows and marke

Solana News Today: Solana's Emission Reform: Charting a Course for Long-Term Blockchain Economic Stability

- Solana proposes SIMD-0411 to cut $2.9B token emissions over six years, accelerating inflation reduction to 1.5% by 2029. - The "leaky bucket" plan aims to curb supply growth by 3.2% annually, stabilizing market dynamics through scarcity-driven value. - Staking yields may drop from 6.41% to 2.42% by Year 3, risking 47 validators' profitability and forcing industry consolidation. - Institutional adoption surges with $421M in Solana ETF inflows and Coinbase's acquisition of Solana-based DEX Vector. - The ov