Zcash Overtakes Stellar: What's Next for XLM?

The price of the privacy-focused token Zcash (ZEC) has risen in several weeks. This price growth has caused its market capitalization to increase, currently at $9.41 billion.

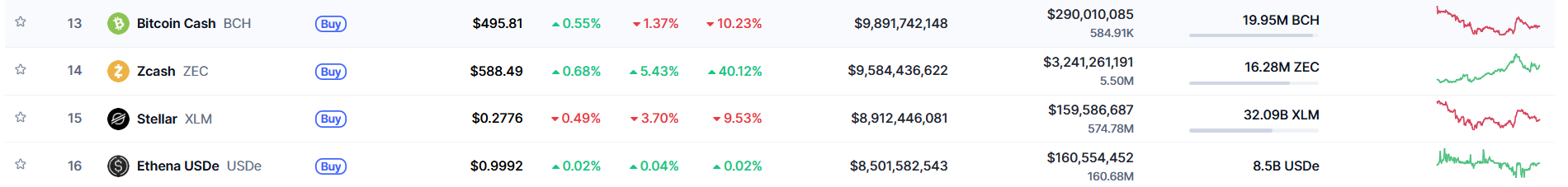

At its current market valuation, Zcash has surpassed Stellar (XLM), ranking the 14th largest cryptocurrency ahead of XLM, which has a market cap of $8.88 billion.

Zcash, created in 2016 via a fork of Bitcoin’s codebase, supports anonymous transactions with zero-knowledge proofs.

Zcash has surged 1,172% yearly, surpassing Monero to become the largest privacy token. Unlike past rallies, the current rise seems driven by real usage, increasing shielded adoption and shifting perceptions of privacy in crypto.

Zcash, until recently a fairly obscure cryptocurrency, started rising in late September, and has risen over tenfold since then.

From under $54 in late September, Zcash rose unrelentingly to reach a high of $748 on Friday, last seen in January 2018.

At the time of writing, Zcash was up 5.59% in the last 24 hours to $589 as the larger crypto market traded down, and up 41% weekly.

What's next for XLM?

Stellar network saw 37% growth in full-time developers in the last quarter, about eight times faster than the industry growth rate. The network added 1,450 new developers in Q3, a 70% quarterly increase. Daily smart contract invocations on the network rose nearly 100%, surpassing 1 million per day. By the end of Q3, total invocations hit 157 million.

The Stellar Ambassador program also continued to scale in Q3, with 400 new signups, 160 community events and double-digit regional growth across Latin America and Asia Pacific.

The figures suggest increased developer activity, which demonstrates growing momentum on the network. However, this is yet to translate into price growth for XLM, which is just up 175% yearly.

In the coming days, attention will be paid to XLM's price, with a break above $0.5 sparking a fresh uptrend for the token.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: JPMorgan's Shutdown of Strike Opposes Trump's Directive Against Debanking

- JPMorgan's closure of Strike CEO Jack Mallers' accounts contradicts Trump's August executive order banning crypto "debanking," sparking regulatory scrutiny. - Mallers criticized the lack of transparency, noting JPMorgan cited "concerning activity" without specifics and warned against future account access. - Industry experts argue such actions risk pushing crypto innovation to unregulated markets, undermining U.S. financial leadership and democratic systems. - The incident highlights contradictions in JP

Bitcoin News Update: With Trump's Crypto Faltering, Investors Turn to Stablecoins for Security

- Trump's crypto investments lost $1B as ABTC and TMTG collapsed, prompting a shift to stablecoins exceeding $300B market cap. - Trump Media's $250M Bitcoin investment initially boosted shares but was overshadowed by broader crypto market declines. - SEC probes and central bank warnings highlight risks in politically connected crypto projects and stablecoin redemption vulnerabilities. - Despite losses, Trump family members remain bullish on Bitcoin, while DOGE meme coin surged post-program termination. - M

Investors Abandon HBAR Due to Instability, Turn to Small-Cap Options

- HBAR price collapsed below $0.1440, triggering bearish signals as key support levels failed to hold amid surging trading volume. - Zero-volume trading halts and distribution patterns highlight liquidity risks, with critics questioning market depth infrastructure. - Investors shift toward low-cap alternatives as HBAR's volatility contrasts with gains in fintech (SoFi +87.7%) and space-tech (BlackSky $71.4M revenue). - Analysts warn further downside to $0.1340 remains likely without institutional support,

ECB Cautions That Fluctuations in Tech and Crypto May Trigger a Market Crash Similar to 2000

- ECB warns U.S. tech and crypto volatility risks triggering a 2000-style market crash, citing sharp asset corrections and AI-driven valuation fragility. - ECB officials stress central banks must retain rate-cut flexibility amid rising risks, as crypto outflows and equity inflows highlight market divergence. - JPMorgan analysis flags crypto panic-selling risks spilling into broader systems, while MSCI warns a 63% sector collapse could follow AI confidence loss. - ECB and BIS caution stablecoin growth threa