Hyperliquid’s Push Into Lending Meets Rising Security Risks From Fake App

The fake Hyperliquid app has already stolen more than $281,000, underscoring the vulnerability of traders as official mobile support remains absent.

Hyperliquid is experimenting with a borrowing and lending module on its Hypercore testnet, signaling a potential expansion of the platform’s core offering.

The development surfaced after on-chain researcher MLM noted that the team has begun running tests for a feature labeled BLP, which he believes stands for BorrowLendingProtocol.

Is Hyperliquid Exploring a Native Lending Market?

His finding suggests that Hyperliquid may be preparing to introduce a native money-market layer on Hypercore. This layer would support borrowing, supplying, and withdrawing assets.

MLM said the testnet version of BLP currently lists only USDC and PURR, but he noted that even limited asset support creates a foundation for something larger.

The Hyperliquid team is currently testing something called BLP on the Hypercore testnet – which I assume stands for BorrowLendingProtocol. It appears to be a native borrowing and lending market on Hypercore, with functions like borrowing, supplying, and withdrawing.Currently,…

— MLM (@mlmabc) November 8, 2025

He argued that integrating a lending layer could help Hyperliquid introduce multi-margin trading more safely. In his view, margin positions would sit on top of verifiable lending pools rather than isolated balance sheets.

That architecture would mirror systems already used across established DeFi money markets and could make leverage more transparent for traders.

If rolled out, this feature would expand Hyperliquid’s footprint beyond perpetuals and provide users with access to DeFi functions currently missing from the ecosystem.

The move could also consolidate activity on a single platform, creating a more integrated trading environment for users who now rely on external lending markets.

Fake Hyperliquid App Sparks Security Concerns

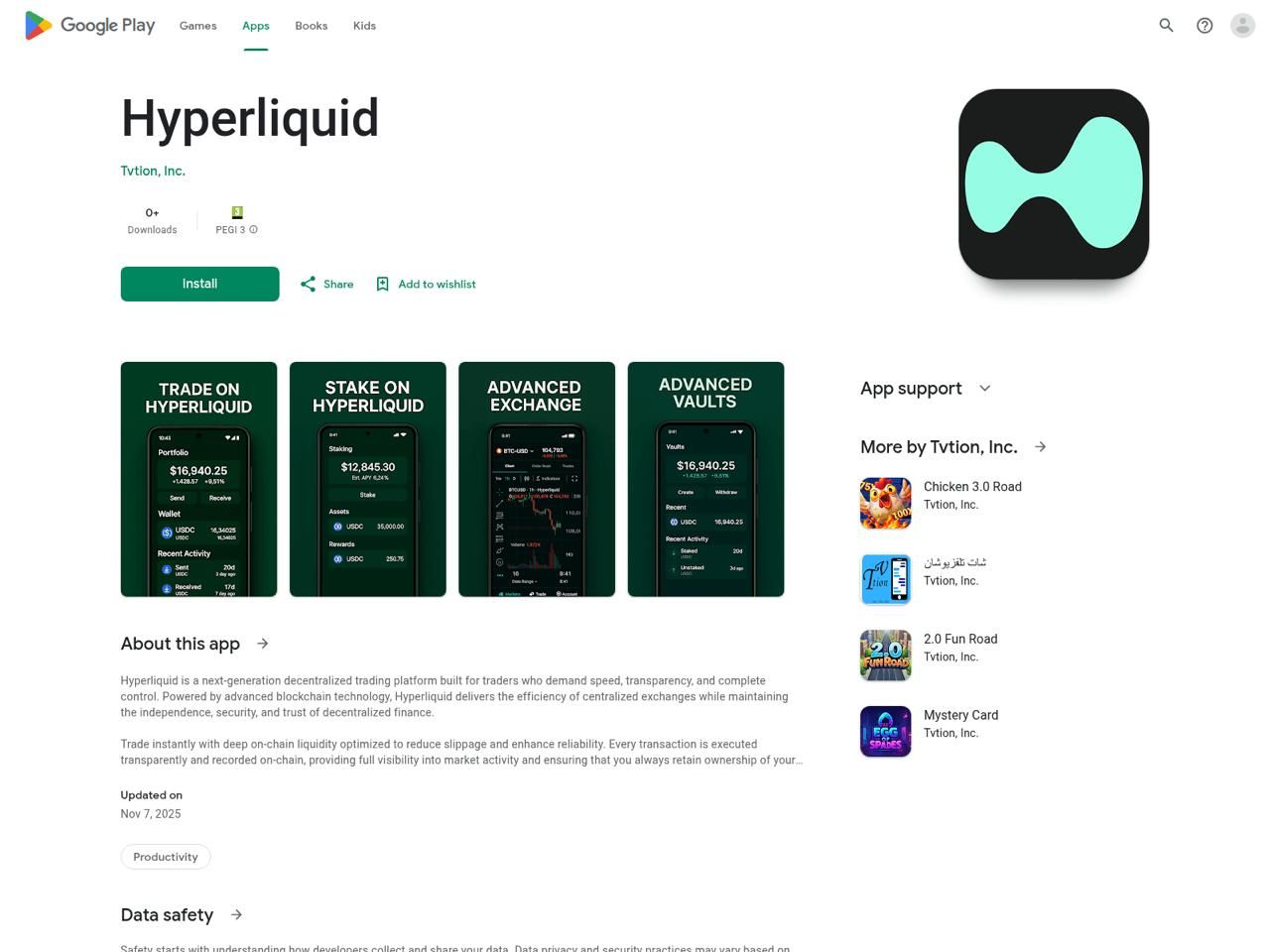

While the team experiments with new functionality, Hyperliquid users are battling a separate threat: a fraudulent mobile application that has appeared on the Google Play Store.

The app mimics Hyperliquid’s branding despite the exchange not offering an official Android or iOS product. Its presence has raised questions about app-store screening standards, especially as users increasingly rely on mobile platforms for financial activity.

Crypto investigator ZachXBT warned that the fake app is designed to steal funds by phishing wallet credentials and private keys.

He identified an Ethereum address linked to the operation that has already collected more than $281,000 in stolen assets. His alert prompted users to check recent downloads and revoke permissions to avoid further losses.

Fake Hyperliquid App On Google Play Store

Fake Hyperliquid App On Google Play Store

The fake listing fits into a broader pattern. Several malicious developers have created look-alike applications for projects such as SushiSwap and PancakeSwap, exploiting the convenience of mobile access to mislead users.

Scammers often combine these apps with sponsored ads on Google, ensuring that fraudulent links appear above legitimate search results. This increases the likelihood that unsuspecting users click through.

As Hyperliquid experiments with new infrastructure and users search for easier access points, the coordinated wave of impersonation attempts highlights a persistent risk.

Attackers continue to target platforms as they grow, and users remain vulnerable when official mobile apps do not exist.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Removal from Index May Undermine MSTR’s Bitcoin-Based Strategy

- JPMorgan warns MSTR faces $8.8B in forced selling if MSCI excludes it from indices due to 50%+ digital asset threshold. - MSTR's stock dropped 67% since November 2024 peak as its valuation increasingly aligns with Bitcoin holdings (mNAV ~1.1). - CEO Saylor defends MSTR as "Bitcoin-backed enterprise," but critics argue its financial model lacks sustainability outside benchmarks. - Retail backlash against JPMorgan intensified, with figures like Grant Cardone closing accounts amid short-selling allegations.

Bitcoin News Update: MSTR's Business Role Under Scrutiny as MSCI Considers $8.8B Removal

- MSCI's proposed exclusion of MicroStrategy from global indices could trigger up to $8.8B in outflows due to its 50%+ bitcoin asset allocation. - JPMorgan warns the removal would damage MSTR's liquidity and capital-raising ability, with shares down 67% since November 2024. - CEO Michael Saylor defends MSTR's operational identity, rejecting "passive bitcoin fund" claims while adding $835M in crypto holdings. - MSCI's Jan. 15 decision could disrupt index-linked investor exposure to bitcoin, with MSTR shares

Bitcoin News Update: Institutions Acquire Crypto Shares Amid Rising Bearish Bets on Bitcoin

- Bitcoin's $80,000 put options dominate trading with $2B open interest, signaling sharp bearish reversal after its worst monthly drop since 2022. - ETF outflows accelerated declines, with $3.8B November redemptions, while Ark Invest added $38.7M in crypto equities amid market fragmentation. - Analysts warn leveraged losses ($19B in October) and forced liquidations amplify downturn, with Citi noting critical support at $80,000. - Market remains divided: Binance calls pullback "healthy," while Peter Brandt

Hyperliquid News Today: Speculation Drives Meme Coin Rally Despite Regulatory Alerts

- Meme coins surged on Nov 24, 2025, with PIPPIN rising 80% in 2 hours to $0.053 and $53.15M market cap. - BANANA (+20%) and TNSR (+50%) joined the frenzy, reflecting speculative flows shifting to high-risk assets amid Bitcoin stabilization. - Perpetual DEX protocols hit $4.24M daily revenue while Fed rate-cut expectations and token unlocks fueled volatility. - Regulators warned of risks as India exposed an AI-generated deepfake fraud, highlighting sector instability and regulatory scrutiny. - Analysts cau