New SEC Filing Shows Trump Media’s Total Bitcoin Holdings

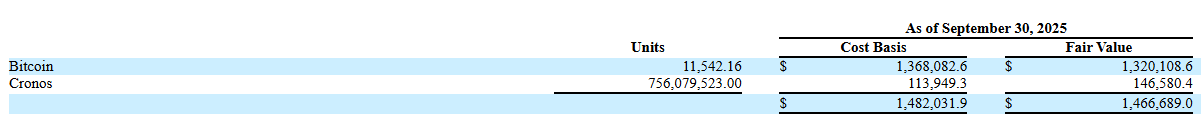

Trump Media and Technology Group (TMTG), the media company associated with US President Donald Trump, now holds more than 11,500 Bitcoin, valued at over $1.3 billion.

The disclosure marks the company’s largest confirmed allocation to date and places it among the biggest public-sector corporate holders of Bitcoin.

TMTG Bitcoin Holdings Fail to Yield Gains

TMTG accelerated its pivot earlier this year when it formally adopted Bitcoin as a core reserve asset.

At the time, TMTG said the company turned to BTC to protect itself from what he described as harassment and discriminatory treatment by financial institutions.

That argument tied Trump Media’s strategy to a wider corporate trend in which firms use Bitcoin to limit perceived dependence on banks that can freeze, slow, or scrutinize accounts.

Meanwhile, the company’s holdings extend beyond Bitcoin. TMTG reported owning roughly 756 million Cronos (CRO) tokens, worth approximately $110 million.

The position reflects the company’s growing alignment with Crypto.com, a relationship that has already produced several crypto-focused initiatives, including exchange-traded products and promotional tie-ins.

These initiatives helped position TMTG as a more active participant in the crypto economy, even though they have not reversed the firm’s financial challenges.

TMTG posted a $54.8 million net loss in the third quarter of 2025, extending its stretch of multi-million-dollar quarterly losses.

This suggests that the company’s crypto-heavy strategy has therefore served more as a political and operational statement than a source of near-term financial relief.

Trump’s Family Crypto Holdings Surge

As TMTG increased its exposure, other Trump-connected ventures expanded theirs as well, creating a broader cluster of politically adjacent crypto holdings.

Data from Arkham Intelligence indicates that several affiliated entities now hold substantial balances.

Other notable Trump Family entities:

— Arkham (@arkham) November 8, 2025

Donald Trump: holds $861K in crypto

World Liberty Fi: holds $5.76B in crypto

Official Trump Meme: holds $6.30B in crypto

Official Melania Meme: holds $19.65M in crypto

Trump Cards: holds $29.72K in crypto pic.twitter.com/T12F6yP4Oh

Trump personally holds about $861,000 worth of digital assets, while World Liberty Financial, one of the largest Trump-associated projects, controls more than $5.7 billion in crypto.

Additional holdings include $6.3 billion tied to Official Trump Meme, $19.65 million linked to Official Melania Meme, and nearly $30,000 associated with the Trump Cards collection.

These positions grew as the White House intensified its pro-crypto messaging, which shaped both the political environment and the commercial incentives for Trump-aligned ventures to deepen their involvement.

Taken together, the holdings show a coordinated embrace of digital assets across Trump-linked entities. They also reflect the administration’s broader effort to position crypto as both a strategic asset and a policy priority.

The post New SEC Filing Shows Trump Media’s Total Bitcoin Holdings appeared first on BeInCrypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

November Sees a Dual Tech Revolution Fueled by Blockchain Accessibility and Sustainable Mobility

- Pi Network announces November 28 event as user base hits 60 million, promoting mobile mining without hardware costs. - Platform faces criticism for unlisted token, social recruitment model, and comparisons to multi-level marketing schemes. - Zeekr Group accelerates merger to build global new energy ecosystem, emphasizing software innovation and e-powertrain development. - Dual developments highlight blockchain democratization and green mobility as contrasting yet parallel tech innovation paths.

ALGO Falls 19.05% Over the Past Month After Allegro Secures $35 Million Veterinary Licensing Agreement

- ALGO fell 19.05% in 1 month as Allegro signed a $35M licensing deal for Synoglide™ in equine osteoarthritis. - The agreement grants American Regent global veterinary rights while Allegro retains human application rights and manufacturing responsibilities. - Synoglide™, based on INTRICATE nanotechnology, will launch in early 2026 after a December 2025 AAEP conference marketing push. - Despite milestone payments and cross-species translational potential, ALGO's decline reflects investor caution amid ongoin

Delaware Court Orders Edtech Founder to Pay $1 Billion for Failing to Meet Legal Obligations in Debt Case.

- Delaware court awarded $1.07B against Byju Raveendran for noncompliance in TLPL's $1B loan dispute involving Alpha Funds misdirection. - Judgment includes $533M principal, $540.6M penalties, and $10K/day contempt fines for refusing to disclose Camshaft LP transactions. - Raveendran's team claims denied due process, plans $2.5B counterclaims against GLAS Trust for alleged contractual and legal violations. - Case highlights cross-border governance tensions, with GLAS Trust alleging fund "roundtripping" whi

Bitcoin News Today: Bitcoin ETF Outflows Drive Price Drop, Yet New Inflows Hint at Potential Recovery

- Bitcoin faces extreme oversold conditions as record ETF outflows drive price declines, with $3.5B withdrawn in November 2025 alone. - Citi estimates $1B in outflows correlates to 3.4% price drops, creating self-reinforcing downward pressure on crypto markets. - Solana ETFs attract $531M through competitive staking yields, highlighting shifting investor priorities toward risk-adjusted returns. - Market analysts note early stabilization signs with $225M Bitcoin ETF inflows, though 36% price declines from O