Pi Coin Price Recovery Appears Difficult Despite Investor Support

Pi Coin’s price recovery remains uncertain as inflows rise modestly but fail to cross key levels, leaving the token consolidating near $0.229 and awaiting stronger investor participation.

Pi Coin’s price has struggled to gain stable momentum in recent sessions, showing heightened volatility as investors wait for a clear direction.

While the altcoin has seen a gradual improvement in inflows, it has yet to demonstrate sufficient strength to fuel a sustained price recovery.

Pi Coin Holders Are Coming Back

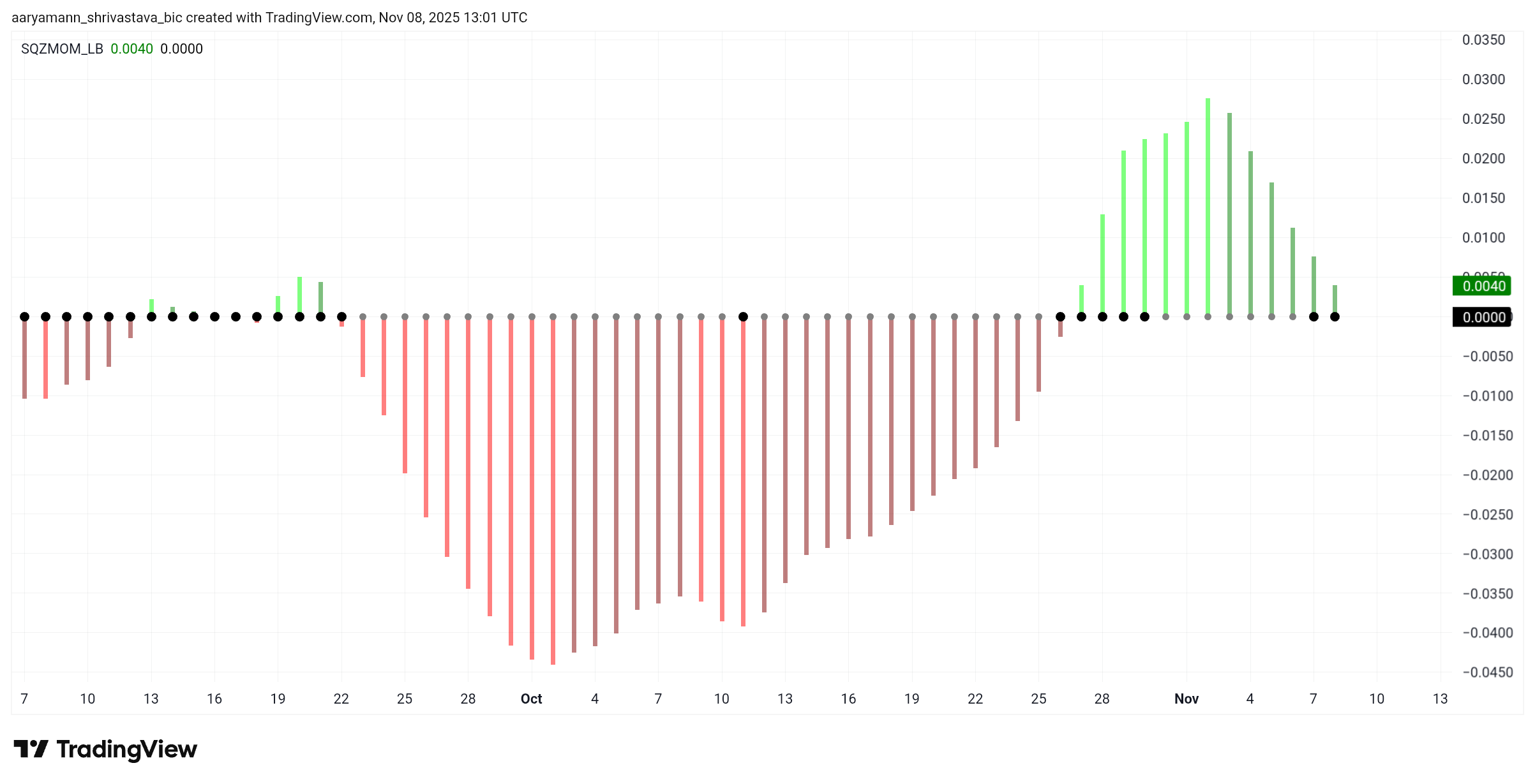

The Squeeze Momentum Indicator is showing that a squeeze is building up, suggesting that a major price move could be imminent. However, the indicator also signals a shift in momentum from bullish to bearish, which could lead to downside risks for Pi Coin if confirmed.

This confirmation would arrive once the histogram transitions into red bars, typically an early sign of selling pressure building up in the market. If the squeeze releases under these bearish conditions, Pi Coin could face a notable dip, delaying any short-term recovery attempts.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Pi Coin Squeeze Momentum Indicator. Source:

Pi Coin Squeeze Momentum Indicator. Source:

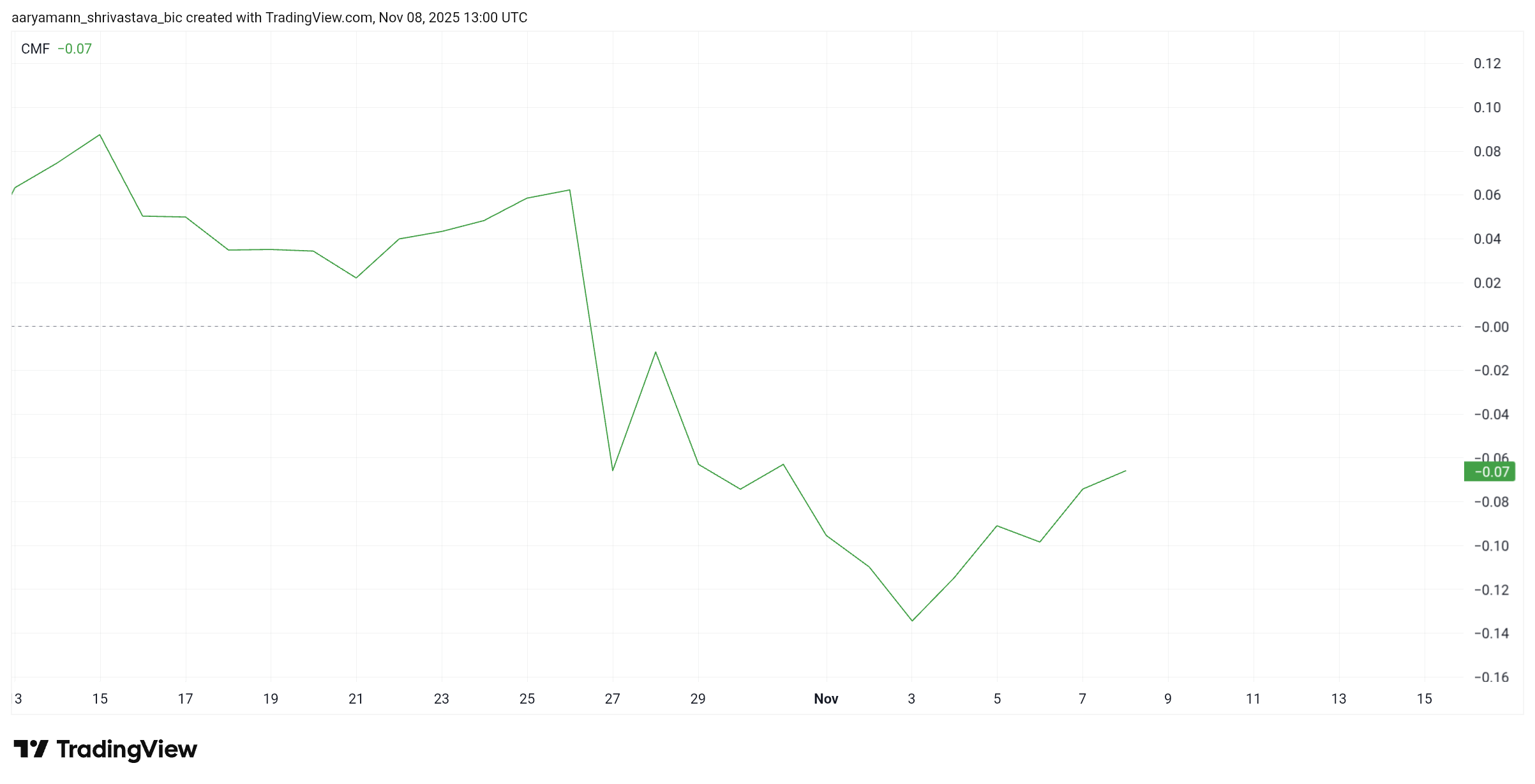

The Chaikin Money Flow (CMF) is showing encouraging signs, with a modest uptick over the past few days indicating improving inflows. However, the indicator remains below the zero line, meaning that outflows are still stronger than inflows for now. To confirm a trend reversal, the CMF must cross into positive territory.

Crossing the zero line would represent growing accumulation by investors, a key requirement for driving price recovery. While the decline in outflows is a positive step, Pi Coin still needs stronger market participation and sustained buying interest to offset recent selling pressure.

Pi Coin CMF. Source:

Pi Coin CMF. Source:

PI Price Awaits A Strong Push

Pi Coin is trading at $0.228 at the time of writing, sitting just below the $0.229 resistance level. The altcoin has held above the crucial $0.217 support for several days. This signals cautious optimism among traders despite the prevailing uncertainty.

Given these conditions, Pi Coin will likely continue consolidating between $0.229 and $0.217 in the near term. A sharp breakdown below this support is improbable unless broader market sentiment turns sharply bearish.

Pi Coin Price Analysis. Source:

Pi Coin Price Analysis. Source:

However, if investor participation strengthens and inflows cross the required threshold, Pi Coin could push past $0.229 resistance. This would open the door for a rally toward $0.246, effectively invalidating the bearish thesis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Update: XRP ETF Buzz vs. Death Cross: Can the $1.75 Support Level Remain Intact?

- XRP faces critical junctures near $2.14 as Grayscale's spot ETF (GXRP) launch looms, with $1.75 support level pivotal for short-term stability. - A death cross pattern raises bearish concerns, suggesting potential 55% price drop to $1 if technical indicators fail to hold. - Institutional crypto products like Leverage Shares' 3x ETFs and 1inch's liquidity pools highlight growing institutional interest amid market volatility. - DeFi struggles with $12B idle capital while projects like Mutuum Finance aim to

Bitcoin Experiences Sharp Decline as Macroeconomic Conditions Change: The Impact of Increasing Interest Rates and Heightened Regulatory Oversight on Cryptocurrency Values

- Bitcoin's 2025 late-year drop from $126,000 to $80,000 reflects heightened sensitivity to Fed policy shifts and regulatory pressures. - Fed officials like Susan Collins signaled "mildly restrictive" policy, crushing rate cut expectations and triggering 70% decline in December cut odds. - Regulatory crackdowns on crypto mixing and mining contrasted with institutional buying (e.g., Cardone Capital's $15. 3M Bitcoin purchase) amid market volatility. - Political uncertainty (60% expect Trump-era crypto gains

Bitcoin’s Abrupt Price Swings and Institutional Outflows: An In-Depth Analysis of Market Dynamics and Liquidity Challenges

- Institutional investors are shifting capital from Bitcoin to AI infrastructure, driven by higher returns in 2025. - Bitcoin's liquidity has declined, with order book depth dropping to $14M by mid-2025, exacerbating volatility. - Structural shifts, including mining repurposing and AI-focused capital flows, threaten Bitcoin's hash rate and market stability. - Alternative projects like XRP Tundra and AI-driven risks challenge Bitcoin's dominance, complicating investor strategies.

X Financial Shifts to Risk-First Approach: Third Quarter Revenue Drops 13.7% Amid Strategic Change

- X Financial reported 23.9% YoY revenue growth to RMB1.96B in Q3 2025, but saw 13.7% sequential decline due to cautious lending and risk prioritization. - Net income rose 12.1% annually to RMB421M but fell 20.2% sequentially, driven by higher credit provisions and operating costs. - Share repurchases under $100M buyback program totaled $67.9M, with $48M remaining as the company emphasizes disciplined risk management. - Strategic pivot to risk mitigation contrasts with broader fintech sector caution, refle