- World Chain reached a record 1,000,000 monthly active addresses in 2025, up 170% since January.

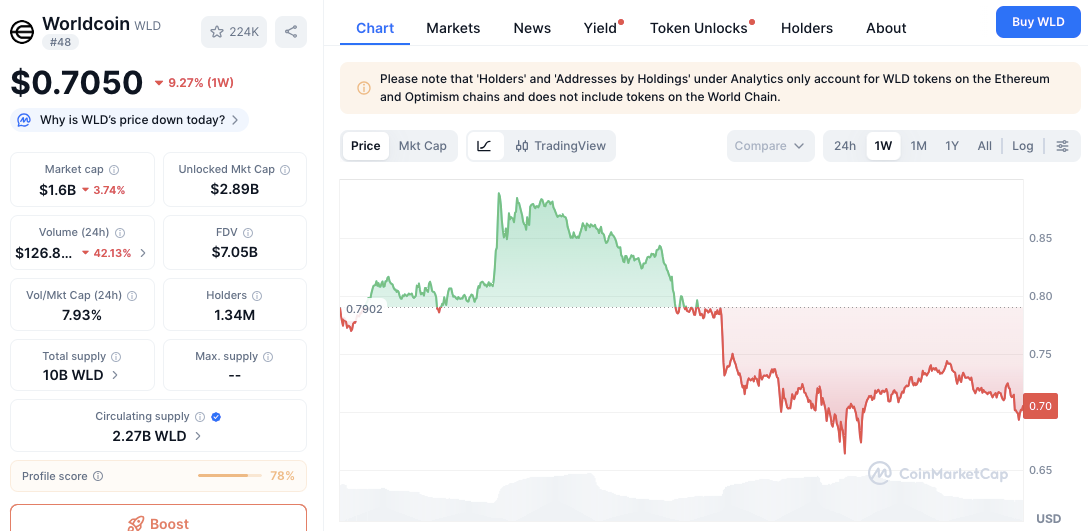

- WLD slipped 9% on the week to about $0.705 as trading volume fell 42%.

- Key levels sit at $0.68 support and $0.75 to $0.80 resistance while MACD and RSI stay weak.

World Chain’s on-chain usage climbed to 1,000,000 monthly active addresses, the highest level since launch. Token Terminal data shows that figure is 170 percent higher than January, confirming that the network kept adding new wallets through 2025 even as broader crypto liquidity was mixed.

Activity began to lift from the 500,000 range in May and has risen steadily since, pointing to apps and community flows that are still attracting new users.

Adoption Trend Stayed Positive Through 2025

World Chain maintained positive network growth during a period when several Layer 1 blockchains reported flat address counts. Rising active wallets together with steady wallet creation suggests broader platform participation and developer engagement on World Chain.

The consistent increase in user activity strengthens World Chain’s position among 2025 high-growth networks.

Related: Will Sam Altman’s World Project Redefine Cross-Chain $WLD Transfers?

WLD Drops 9% As Volume Thins

While network usage has soared, Worldcoin’s native token, WLD, faces renewed selling pressure. The token currently trades at $0.705, down 9.27% this week. It slipped from a high of $0.86 to a low near $0.68, reflecting a persistent bearish trend. The 42% decline in trading volume further indicates a cooling market, with fewer participants entering positions.

Source: CoinMarketCap

Source: CoinMarketCap

Immediate support lies at $0.68, where short-term buying interest has emerged. However, a drop below this level could extend losses toward $0.62, a prior accumulation zone.

On the upside, resistance stands at $0.75, followed by a stronger barrier near $0.80, aligning with the 20-day moving average. Bulls need to reclaim this range to confirm any short-term rebound.

Technical Indicators Reflect Bearish Momentum

WLD/USD daily price chart, Source: TradingView

WLD/USD daily price chart, Source: TradingView

Technical Indicators Still Point To Weak Momentum

The MACD line remains below the signal line, signaling sustained negative momentum. Histogram readings suggest limited recovery potential in the near term.

Additionally, the RSI stands near 34, indicating oversold conditions but not yet confirming a reversal. Hence, a brief consolidation may occur before any upward retracement develops.