Date: Thu, Nov 06, 2025 | 06:10 PM GMT

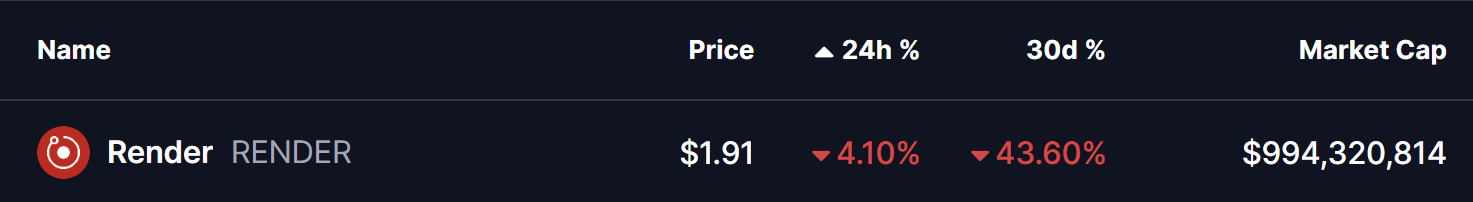

The cryptocurrency market is showing a mixed performance today, with both Bitcoin (BTC) and Ethereum (ETH) trading in the red. ETH has slipped by 3%, adding notable pressure on several altcoins — including the AI-focused Render (RENDER).

RENDER has registered a steep 43% monthly decline, but despite the heavy sell-off, its technical setup is now hinting at the possibility of a short-term rebound as it continues to hold a crucial support zone.

Source: Coinmarketcap

Source: Coinmarketcap

Descending Broadening Wedge in Play

On the 4-hour chart, RENDER remains inside a descending broadening wedge, a bullish reversal pattern that often forms during extended corrective phases.

During the latest pullback, the token was rejected from the wedge’s upper boundary near $2.3537, triggering a drop toward the lower trendline around $1.72. Encouragingly, buyers stepped in at this level — a reaction zone that has acted as dynamic support multiple times in the past.

Render (RENDER) 4H Chart/Coinsprobe (Source: Tradingview)

Render (RENDER) 4H Chart/Coinsprobe (Source: Tradingview)

As a result, RENDER has bounced back to $1.91, showing early signs that bulls are attempting to stabilize the price above both the support trendline and recent local lows.

What’s Next for RENDER?

If bulls continue protecting the lower boundary of the wedge, RENDER could attempt a move toward $2.04, the next key resistance area. A confirmed breakout above the wedge’s upper boundary would signal a bullish continuation pattern — potentially triggering a stronger recovery rally towards its 200 ma at $2.5939 in the coming sessions.

However, traders should also watch for risks. A decisive breakdown below $1.72 would invalidate the wedge structure, exposing RENDER to deeper downside pressure as sellers reclaim control.

For now, RENDER’s technical picture leans cautiously optimistic. The descending broadening wedge remains intact, and the repeated defense of support suggests that a rebound attempt could soon develop — provided the broader market stabilizes.