XRP Profits Fall To November 2024 Low But New Investors Attempt To Revive Price

XRP’s profitability has sunk to a yearly low, yet growing participation from new investors may help stabilize prices and set the stage for a potential rebound if key support holds.

XRP continues to struggle under growing bearish pressure, as its price action remains subdued following a prolonged downtrend. The altcoin has fallen 10% in recent days, with traders showing caution amid broader market volatility.

Yet, despite the weakness, new investors appear to be stepping in, signaling potential optimism ahead.

XRP Investors Show Mixed Signals

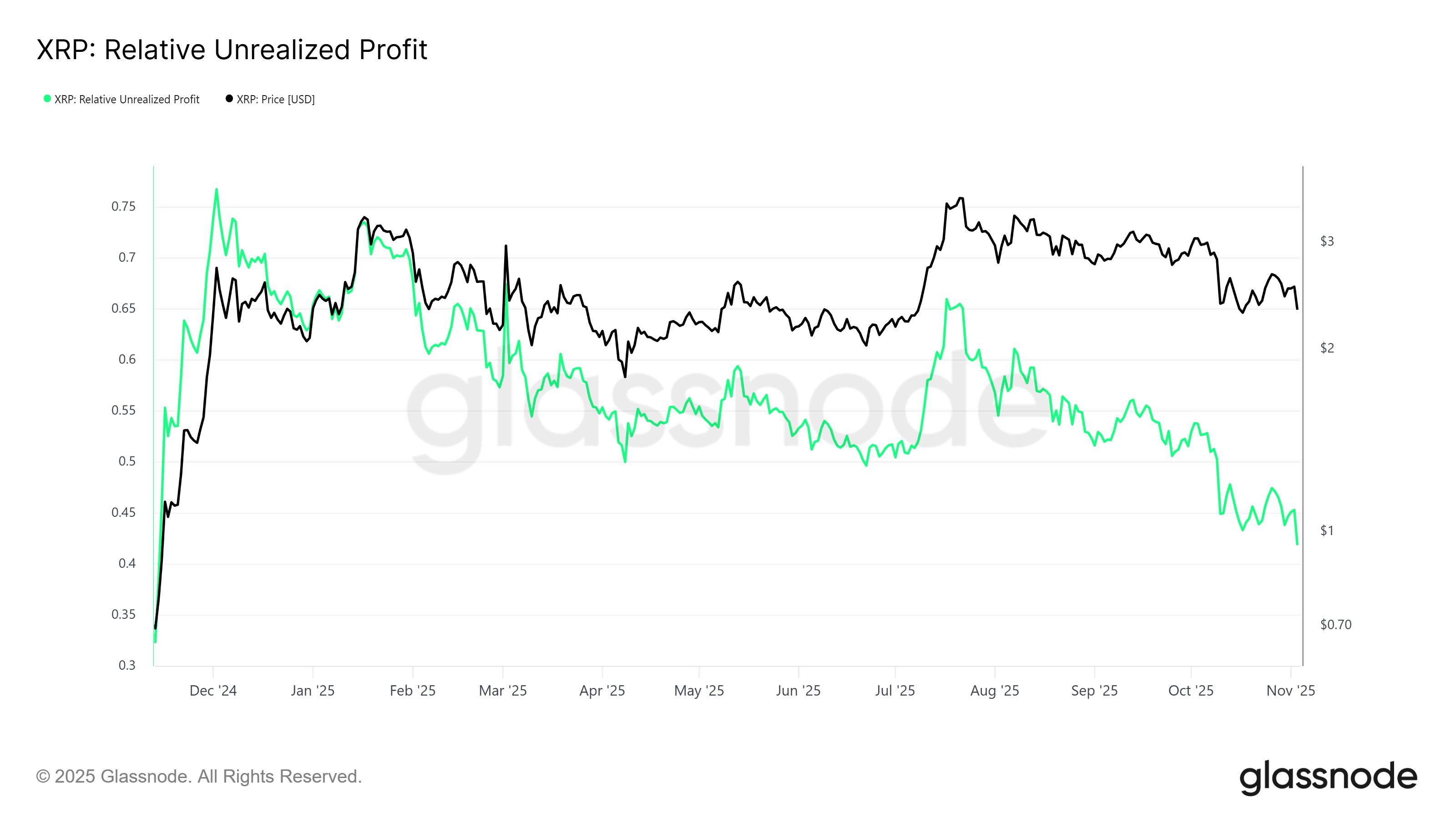

Unrealized profits for XRP holders have dropped to a 12-month low, reflecting a worrying trend across the asset’s investor base. Unrealized profits refer to paper gains based on the asset’s purchase price rather than actual sales. The decline suggests that most investors are now holding XRP either at a loss or with minimal gains.

This indicator’s sharp drop often sparks panic selling, particularly when confidence in the market weakens. If long-term holders begin liquidating positions to avoid deeper losses, XRP could face added downward pressure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP Unrealized Profit. Source:

Glassnode

XRP Unrealized Profit. Source:

Glassnode

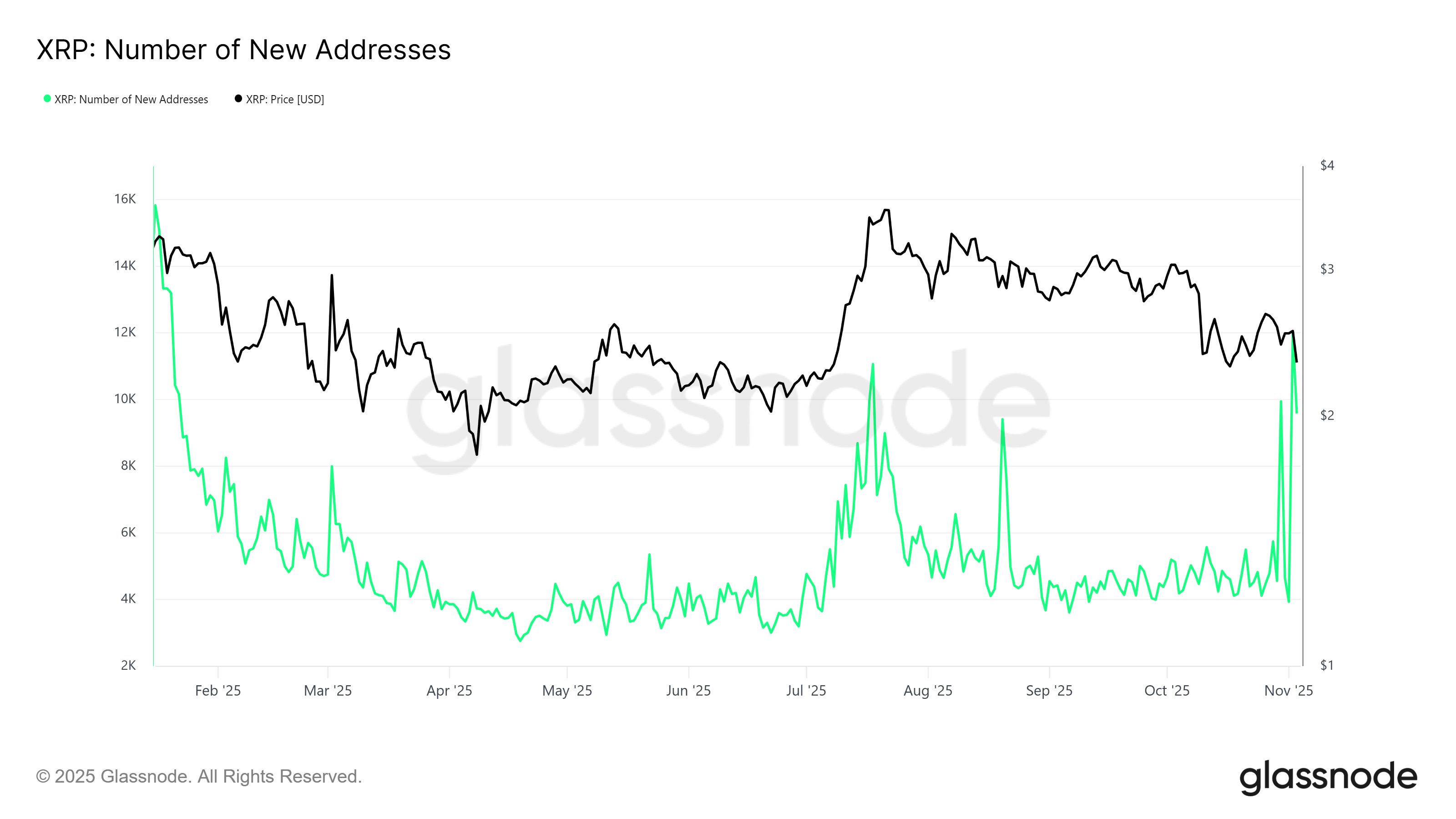

Amid the bearish outlook, an interesting trend is emerging — a surge in new addresses accumulating XRP. The lower price appears to be attracting new investors who see current levels as an opportunity to enter the market before a potential recovery. These fresh inflows could help stabilize selling pressure in the near term.

New investors, reaching 12,000 at their peak, also inject liquidity into the ecosystem, creating demand that may offset profit-taking from older holders. Historically, periods of low profitability followed by an influx of new participants have often preceded rebounds in XRP’s price.

XRP New Addresses. Source:

Glassnode

XRP New Addresses. Source:

Glassnode

XRP Price Could Bounce Back

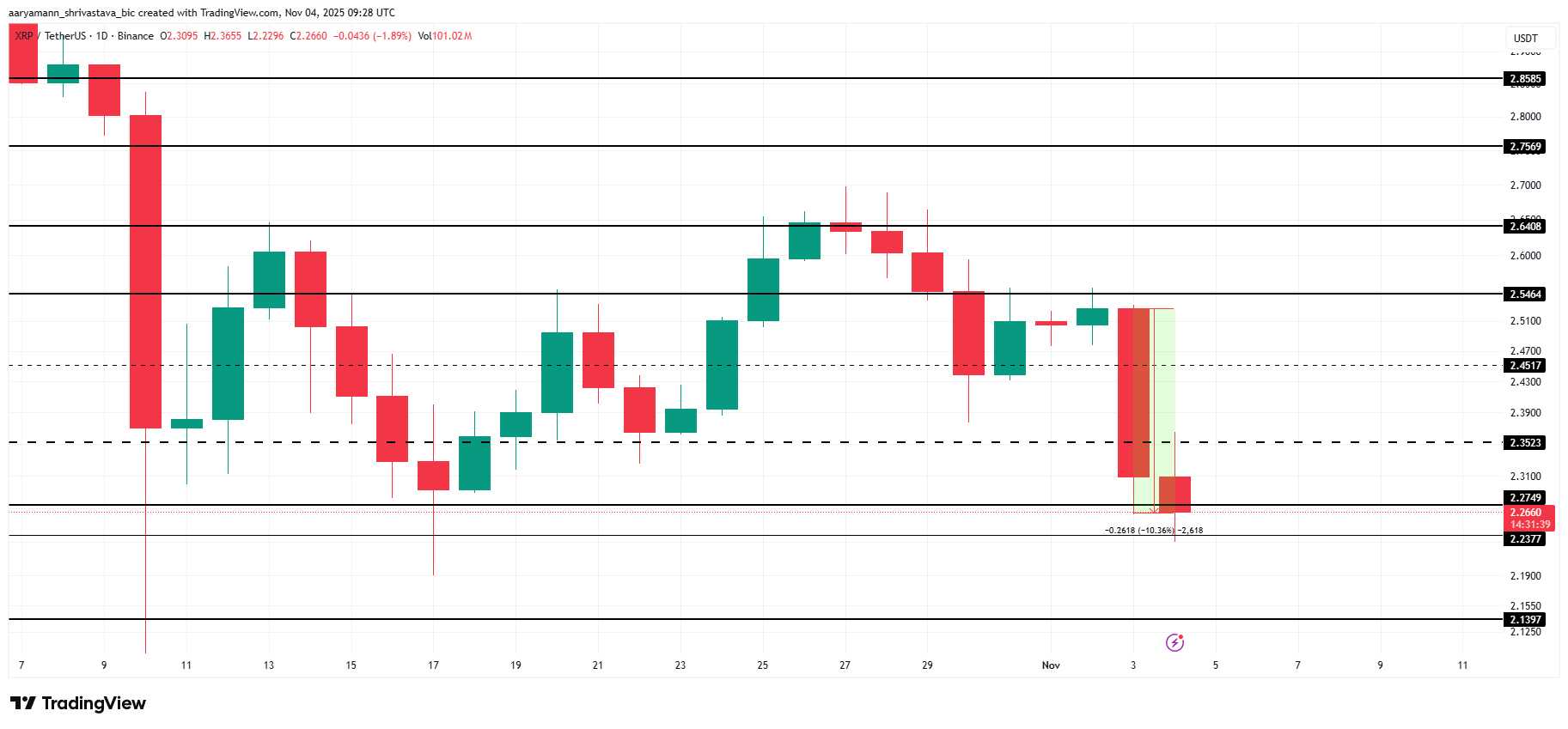

At the time of writing, XRP trades at $2.26, down 10% over the past 24 hours. The altcoin continues to face resistance amid broader bearish market sentiment. However, strong support remains near the $2.27 mark, offering hope for a potential recovery.

If XRP maintains this key support level, it may move sideways in the short term, with possible rebounds to $2.35 or $2.45 as buyers regain confidence. This consolidation could set the stage for a stronger move upward later in November.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

However, if selling pressure intensifies, XRP could fall below $2.27, slipping through $2.23 and hitting $2.13. Such a drop would invalidate the bullish scenario and confirm a deeper corrective phase.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell faces the ultimate test: At least three dissenters at the December meeting, Federal Reserve consensus collapses!

The "Fed mouthpiece" reported that internal divisions within the Federal Reserve have intensified amid a data vacuum, with three board members appointed by Trump strongly supporting a dovish stance, while the hawkish camp has recently expanded.

Weekly Hot Picks: Data Disappearance Doesn’t Stop the Fed’s Hawkish Stance! Global Multi-Asset Markets Face “Backstabbing”

The U.S. government shutdown has ended, but the release of key data remains chaotic. The Federal Reserve has sent frequent hawkish signals, causing significant declines in gold, silver, stocks, and currencies on Friday. The U.S. has launched Operation "Southern Spear". Buffett delivered his farewell letter, and the "Big Short" exited abruptly. What exciting market events did you miss this week?

SignalPlus Macro Analysis Special Edition: Is It Going to Zero?

Over the past week, cryptocurrency prices declined once again. BTC briefly reached $94,000 on Monday due to lighter selling pressure before pulling back, and major cryptocurrencies saw further week-on-week declines...