Date: Sun, Nov 02, 2025 | 06:00 AM GMT

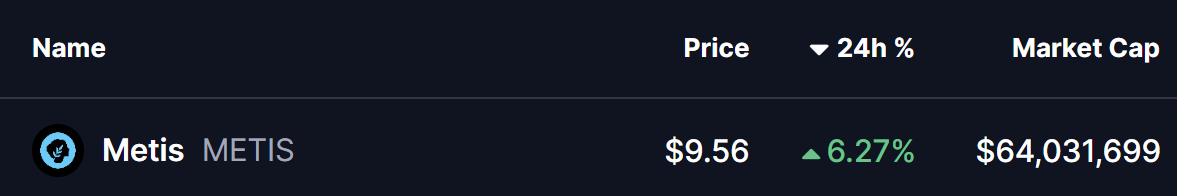

The cryptocurrency market continues its steady start to November, with both Bitcoin (BTC) and Ethereum (ETH) trading in green. Major altcoins are following the broader bullish sentiment — including Metis (METIS), the layer-2 scaling token that is showing early signs of strength.

METIS is up around 6% today, signaling improving momentum, but the bigger story lies in its technical setup — a key bullish chart pattern that hints at a potential breakout in the sessions ahead.

Metis (METIS) 2H Chart/Coinsprobe (Source: Tradingview)

Metis (METIS) 2H Chart/Coinsprobe (Source: Tradingview)

Descending Broadening Wedge Pattern in Play

On the 2-hour chart, METIS has been forming a descending broadening wedge — a bullish technical pattern that typically emerges during downtrends and often signals a potential reversal once the price breaks upward.

In its latest pullback, METIS found strong support near $8.47, which coincided with the wedge’s lower boundary. Buyers stepped in at that level, helping the token stage a solid rebound to around $9.56, where it currently trades just below the upper wedge resistance line.

Metis (METIS) 2H Chart/Coinsprobe (Source: Tradingview)

Metis (METIS) 2H Chart/Coinsprobe (Source: Tradingview)

The price action is tightening near this resistance area — a technical condition often seen before a breakout move. If confirmed, this could set the stage for an upward momentum shift in the coming hours or days.

What’s Next for METIS?

If buyers succeed in breaking above the wedge’s upper trendline and reclaim the 100 MA ($9.76), it could spark a bullish breakout, with a potential upside target around $11.77 — marking an estimated 23% gain from current levels.

However, if the token fails to clear the resistance and faces a pullback, consolidation within the wedge could continue in the short term. In that case, the $8.90 level will be an important support zone to monitor for a possible rebound.

For now, the technical outlook remains constructive. If broader market momentum holds and Bitcoin maintains its upward trajectory, METIS could soon join the list of altcoins leading the next leg of the crypto rally.