October concluded on a sour note for cryptocurrencies , yet ZK Coin investors were greeted with an exciting start to November. While zero-knowledge proof capabilities have gained immense popularity over recent years, intensified competition and dwindling liquidity led many altcoins to new lows. However, as of November, ZK Coin managed to distinguish itself positively.

Why is ZKsync (ZK) Soaring?

Since yesterday, ZK Coin experienced an almost 140% increase, reaching a fresh local peak at $0.0633. The primary reasons behind this ascent are related to major developments surrounding the ZKsync Atlas upgrade, enabling 15,000 TPS. Essentially, this allows 15,000 transactions per second to be securely executed with minimal cost through zero-knowledge proof. The one-second interaction time, enhancing Ethereum’s main net scalability, ensures secure transactions.

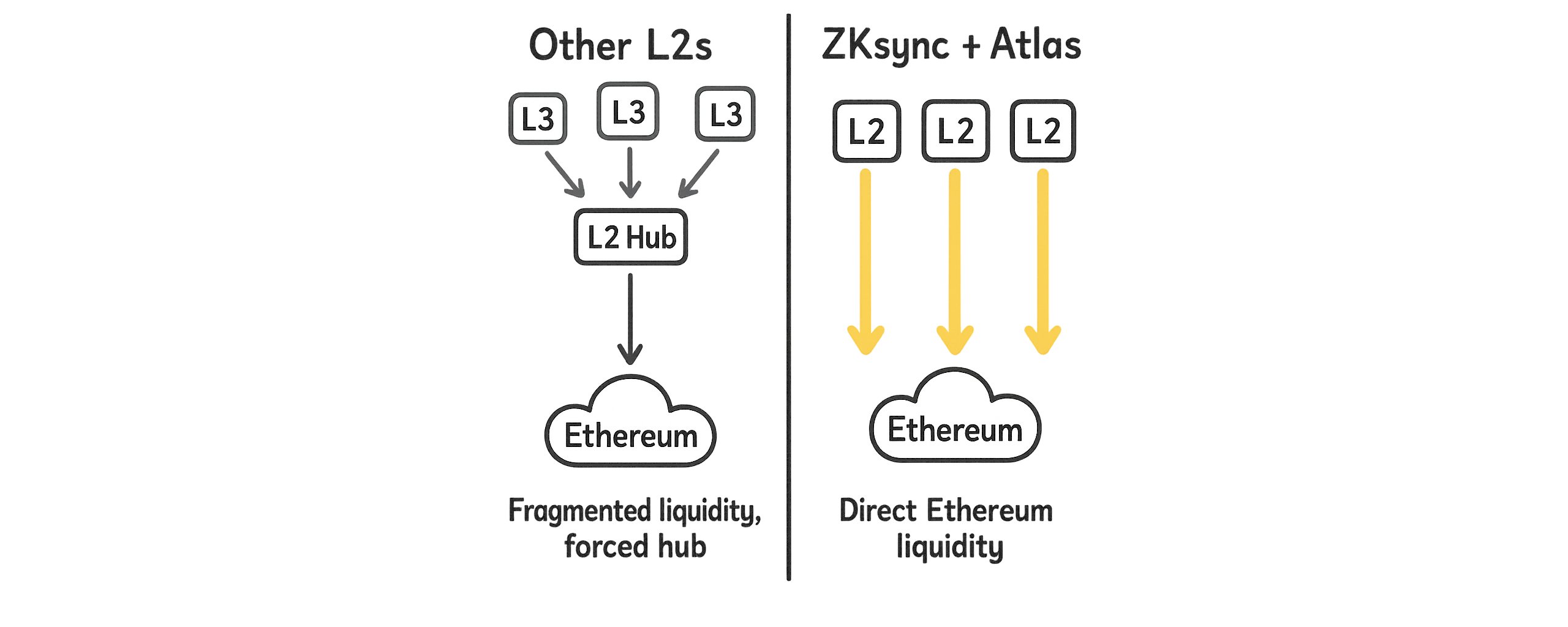

For the first time, L2 platforms can rely on Ethereum $3,875 as a real-time liquidity hub for institutional capital.

Atlas dramatically reduces the interaction time between L2s to approximately one second and minimizes the interaction latency between L1 and L2 below Ethereum’s block finalization time. Consequently, participant flows related to real-world assets no longer need a separate liquidity hub, enhancing Ethereum’s inherent capabilities.

Before Atlas, each L2 ecosystem had to establish a central liquidity hub (such as ZKsync Era, Base, or Arbitrum One). Liquidity was duplicated, relying on internal pools—a necessity with optimistic rollups where L1 and L2 interaction finalization could take up to seven days.

With Atlas, this problem is eradicated. Chains built on ZKsync can now directly leverage Ethereum’s liquidity. Private hubs and application chains will still be built, transitioning from mandatory, general-purpose liquidity engines to enriched, specialized assets. Instead of recreating Ethereum’s liquidity, they will enhance it.” – ALEX | ZKsync

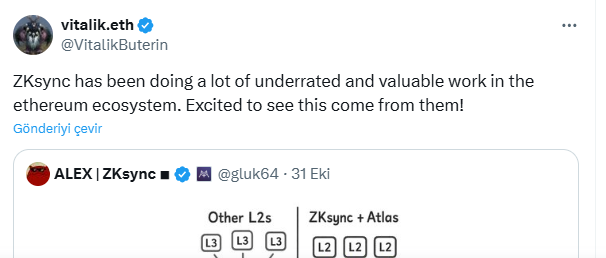

The second major reason for the price increase was Ethereum founder Vitalik Buterin’s high praise for ZKsync. His enthusiastic remarks following the Atlas update significantly boosted investor excitement regarding ZK Coin.

“ZKsync is conducting numerous underrated and valuable operations within the Ethereum ecosystem. Witnessing such news from them is incredibly exciting!” – Vitalik Buterin

ZK Coin Price Forecast

ZKsync (ZK) now eagerly awaits stronger and larger partnerships. The technical enhancements available may lead to notable collaborations, further elevating the price if confirmed. As more protocols benefit from ZKsync’s capabilities, visibility and interest will continue to surge.

The chart suggests conditions are ripe for an upward move, particularly following the recovery from recent oversold levels. Major news arrived at the market’s nadir. If the price closes consistently above $0.0547, analysts anticipate reclaiming $0.0784, aiming toward the $0.116 support base.