Key Market Information Discrepancy on October 31st, a Must-See! | Alpha Morning Report

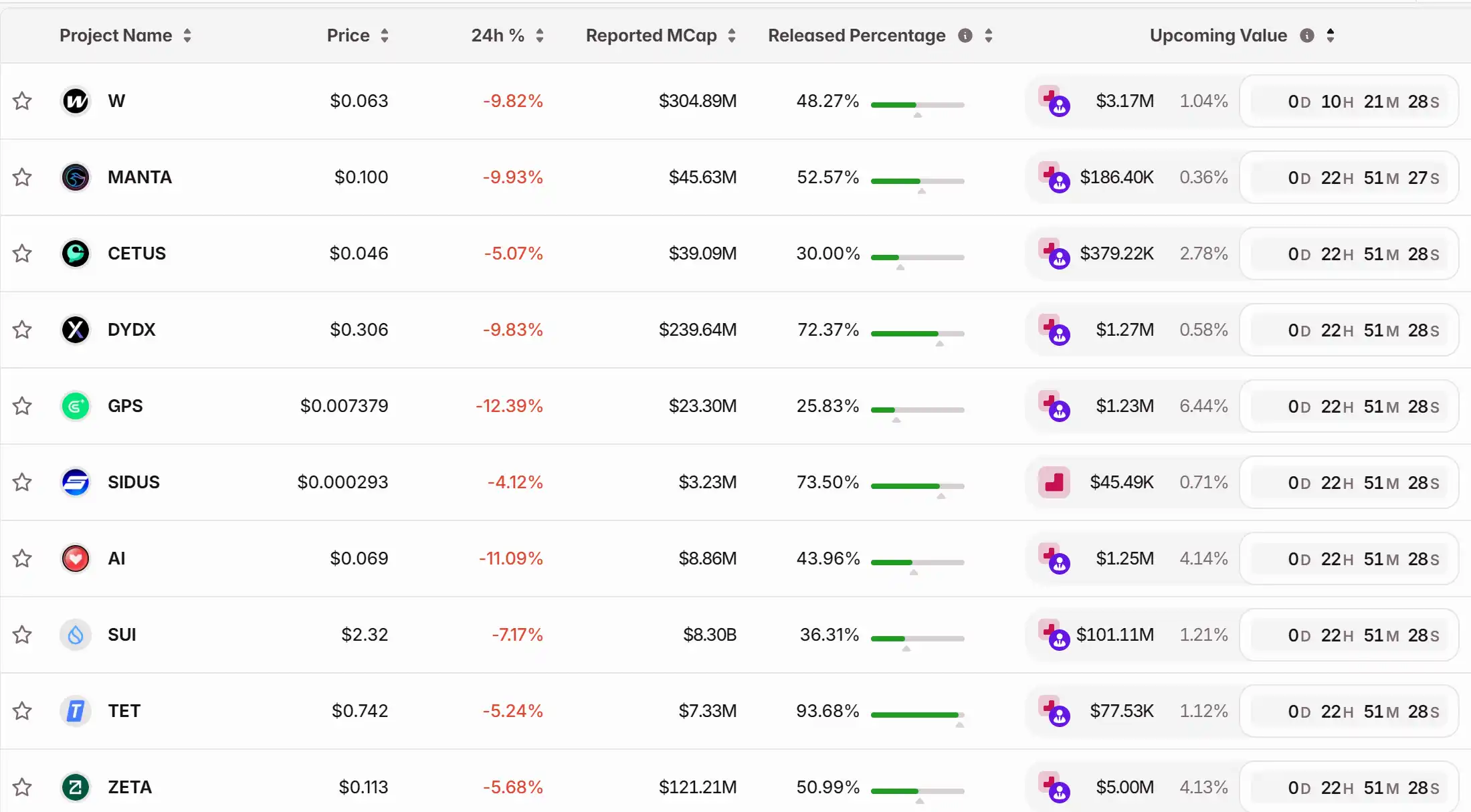

1. Top News: Ethereum's next major upgrade "Fusaka" is scheduled to go live on December 3rd 2. Token Unlock Schedule: $W, $MANTA, $CETUS, $DYDX, $GPS, $SIDUS, $AI, $SUI, $TET, $ZETA

Top News

1.Ethereum's Next Major Upgrade 'Fusaka' Scheduled to Go Live on December 3

2.Bitcoin Surges Past $110,000

5.$1.134 Billion Liquidated Across the Network in the Last 24 Hours, Mainly Long Positions

Articles & Threads

1. "Making Money While Giving Away Money: Recent Developments in Top Perp DEXs"

According to the latest on-chain data, the market landscape of decentralized perpetual contract exchanges (Perp DEXs) has become relatively clear. In terms of 24-hour trading volume, Aster leads with $121.2 billion, followed by Lighter at $86.16 billion in second place, Hyperliquid at $59.58 billion in third, with edgeX and ApeX Protocol ranking fourth and fifth with $50.6 billion and $21.22 billion, respectively. For investors and traders looking to delve deeper into the Perp DEX track, monitoring the developments of these top five platforms should provide a good sense of the overall direction of the industry.

2. "A Mysterious Team That Dominated Solana for Three Months Is Going to Launch a Coin on Jupiter?"

An anonymous team without a website or community that consumed nearly half of the transaction volume on Jupiter in 90 days. To better understand this mysterious project, we need to first delve into an on-chain transaction revolution quietly happening on Solana.

Market Data

Daily Marketwide Funding Rate (as reflected by funding rates) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum News Update: Ethereum Surges Past $3,000, Bulls Eye $3,400 Target

- Ethereum (ETH) surged past $3,000 in early November 2025, with technical and on-chain data indicating potential for further gains toward $3,400 if the level holds. - Institutional inflows, including $88M into BlackRock's ETHA ETF, contrast with broader crypto outflows, while valuation models suggest a 57-90% undervaluation. - Mixed on-chain signals show recovering active addresses and a low MVRV Z-Score (0.29), historically preceding accumulation phases, but stagnant new address growth limits upside pote

Blockchain Connects K-pop's Worldwide Fans and Investors, Transforming the Concept of Entertainment Ownership

- WITCH blockchain partners with SBI, DIOD , and Kyobo Life to tokenize K-pop real-world assets like concert revenue and merchandise rights. - The initiative aims to democratize entertainment investments via blockchain, enabling fractional ownership and global accessibility for fans and crypto investors. - Challenges include regulatory compliance across jurisdictions and educating traditional fans about blockchain's value proposition. - Initial products will launch in months, starting with small-scale offe

The Growing Convergence of Legal Studies and Social Impact Investment

- Berkeley Law's PISP offers full-tuition scholarships to JD students pursuing public interest careers, reducing debt barriers for social justice work. - Graduates earn median $72,000 salaries but maintain debt-free careers in criminal justice reform, reproductive rights, and corporate accountability. - The program creates long-term societal impact through sustained public service, aligning with social impact investing principles prioritizing systemic change over short-term profits. - By embedding scholars

PENGU USDT Selling Alert and Stablecoin Price Fluctuations: An Important Reminder for Investors

- PENGU USDT's 28.5% plunge in late 2025 exposed systemic risks in stablecoin ecosystems, highlighting vulnerabilities in USDT-backed tokens amid regulatory scrutiny. - USDe's October 2025 depegging to $0.65 triggered $20B losses in DeFi, revealing algorithmic stablecoins' fragility during market stress and leverage-driven feedback loops. - EU's MiCA ban on algorithmic stablecoins and U.S. GENIUS Act reforms aim to mitigate risks, but large stablecoins like USDT remain exposed to liquidity crises and cross