HBAR Price Jumps 26% in a Week — Momentum Is Hot, But Inflows Are Not

Hedera’s 26% surge has fueled optimism after its spot ETF debut, but on-chain data shows limited inflows—hinting that HBAR’s rally may be running hot without solid investor backing.

Hedera (HBAR) has recorded an impressive 26% weekly gain, sparking optimism among traders and investors. The sudden surge has lifted market sentiment and added momentum to portfolios holding the altcoin.

However, on-chain data and technical indicators suggest that the rally might not be as organic as it appears, raising questions about its sustainability in the days ahead.

Hedera Investors Need To Step Up

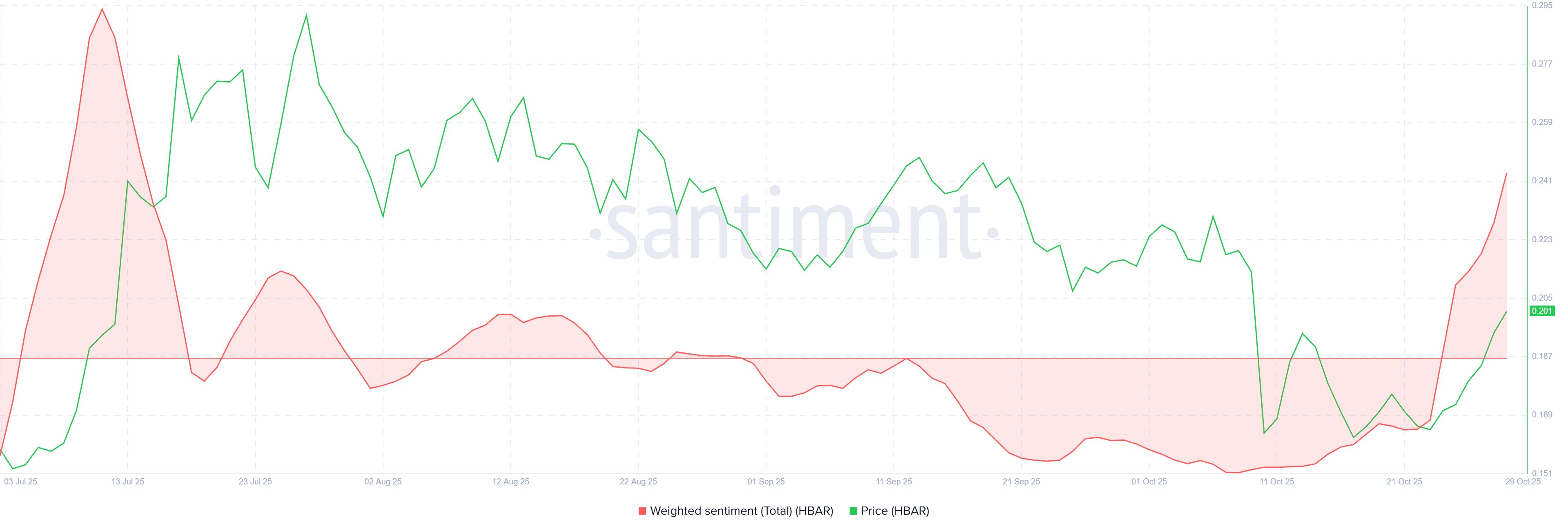

The weighted sentiment for HBAR has seen a sharp spike in recent days, reflecting rising investor optimism. This increase in positive sentiment coincides with the launch of Canary Capital’s spot HBAR exchange-traded fund (ETF), which began trading earlier this week.

The ETF’s debut has significantly amplified social discussions around the token, fueling bullish expectations in the short term. However, history suggests that sudden spikes in investor enthusiasm can be double-edged.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

HBAR Weighted Sentiment. Source:

HBAR Weighted Sentiment. Source:

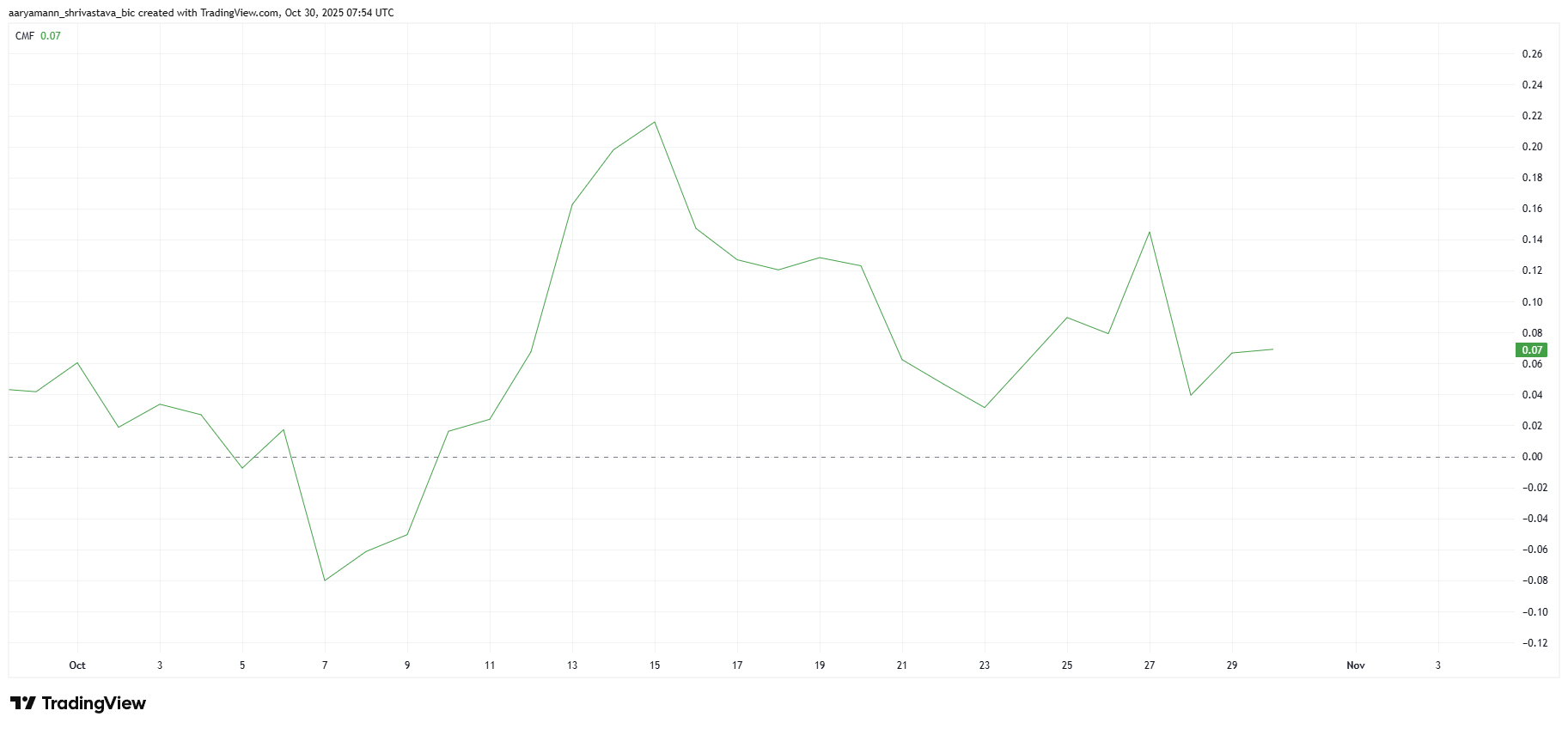

From a macro perspective, the Chaikin Money Flow (CMF) indicator paints a more cautious picture. Despite the price rally, CMF data shows no corresponding surge in inflows, suggesting that the bullish momentum is not backed by substantial capital movement.

Low inflows paired with heightened network activity often indicate an overheated asset. This imbalance tends to precede short-term reversals as traders take profits and market liquidity tightens. Unless new capital enters the market soon, HBAR’s upward trend could struggle to maintain its current pace.

HBAR CMF. Source:

HBAR CMF. Source:

HBAR Price Reclaims $0.200

At the time of writing, HBAR trades at $0.2048 after a 26% rise this week, testing resistance near $0.212. The strong uptrend positions the token just below a key breakout zone that could determine its next direction.

If investors begin taking profits without a fresh wave of inflows, HBAR could lose support at $0.200 and decline toward $0.178. Such a move would reflect cooling momentum and renewed caution among traders.

HBAR Price Analysis. Source:

HBAR Price Analysis. Source:

Alternatively, if the rally gains support from increased inflows driven by the spot ETF, HBAR could extend its rise past $0.217 and aim for $0.23. Sustaining this level would signal a continuation of the bullish trend and renewed investor confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

This Week's Preview: BTC Returns to 86,000, Trump’s Epic Showdown with Major Shorts, Macro Turmoil Just Settled

After last week's global market panic and subsequent recovery, bitcoin rebounded to $86,861. This week, the market will focus on new AI policies, the standoff between bears and bulls, PCE data, and geopolitical events, with intensified competition. Summary generated by Mars AI. The accuracy and completeness of this summary, produced by the Mars AI model, are still being iteratively improved.

At risk of being removed from the index? Strategy faces a "quadruple squeeze" crisis

Strategy is facing multiple pressures, including a significant narrowing of mNAV premiums, reduced coin hoarding, executive stock sell-offs, and the risk of being removed from indexes. Market confidence is being severely tested.

VIPBitget VIP Weekly Research Insights

How to plan a perfect TGE launch?

Most TGE failures are not due to poor products or inexperienced teams, but because their foundations were never prepared to face public scrutiny, competition, and shifts in narrative.