FourMeme Surpasses Pumpfun With $43 Million in Monthly Revenue

Mutlichain memecoin launchpads continue to pop up, and with BNB Smart Chain (BSC) activity taking off, the chain’s go-to memecoin launchpad, FourMeme, is now earning more revenue than Solana-based pumpfun.

Over the last 30 days, FourMeme has earned $43 million in fees, outpacing pumpfun by 13%, making it the fourth-largest revenue generator in DeFi, trailing only Hyperliquid, Circle, and Tether.

While memecoin trading activity has fallen off significantly from the beginning of the year, memecoin trading infrastructure continues to rake in profits, with FourMeme, Pumpfun, Jupiter, Axiom, and PancakeSwap accounting for five of the top ten revenue generators in DeFi over the last month.

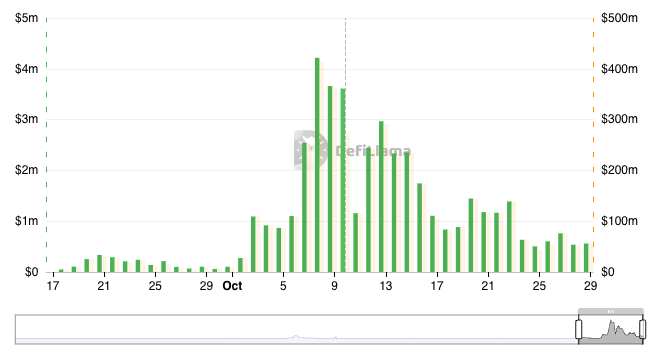

The rotation to Binance memecoin trading was potentially catalyzed by two token launches, ASTER and STBL, which both released on BSC and rallied more than 10x after traders bridged to the network to buy them. Aster furthered its hold on the BSC ecosystem through its post-TGE airdrop farm, which concluded in the first week of October, right when FourMeme volumes began to rise.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Institutional ETFs and Derivatives Indicate a Positive Shift for XRP Above Crucial Support Levels

- XRP rebounds above $2.20 as buyers defend key support, supported by $107.92M in ETF inflows and rising institutional confidence. - Technical analysis highlights a bullish "Staircase to Valhalla" pattern, with $2.26-$2.52 resistance levels and Fibonacci targets signaling potential for $2.69. - Derivatives data shows aggressive long-positioning (OI: $4.11B), with Binance's 2.56 long-short ratio and 57% options OI surge reinforcing bullish momentum. - Institutional ETF conversions (e.g., Grayscale Zcash) an

Why Switzerland's Temporary Halt on Crypto Highlights Worldwide Regulatory Disunity

- Switzerland delays crypto tax data-sharing until 2027, highlighting global regulatory fragmentation amid CARF adoption challenges. - Two-phase approach prioritizes domestic law alignment before reciprocal agreements with key economies like U.S., China, and Saudi Arabia. - 75 CARF signatories progress unevenly, with U.S. and Brazil proposing alternative frameworks, complicating cross-border compliance. - Swiss crypto firms face operational risks during transition, as critics warn of regulatory arbitrage b

Thailand’s Bold No-Crypto-Tax Move: Shaping a Future Southeast Asian Crypto Center

- Thailand imposes 0% capital gains tax on local crypto trading (2025-2029) to boost its digital economy and attract investors. - The policy aligns crypto profits with tax-exempt stock trading, supported by a 2024 Bitcoin ETF and Tourist DigiPay pilot for foreign visitors. - Regulatory caution is evident through biometric data shutdowns and PDPA compliance, balancing innovation with security amid regional competition. - Projected $1B annual economic gains aim to position Thailand as a top Southeast Asian c

The Transformation of Webster, NY: Targeted Property and Infrastructure Initiatives After the Xerox Era

- Webster , NY, secured a $9.8M FAST NY grant to transform the former Xerox campus into a shovel-ready industrial hub, part of Governor Hochul’s upstate revitalization strategy. - Infrastructure upgrades, including road and sewer improvements, aim to attract advanced manufacturing and logistics firms by reducing development risks and costs. - The Xerox campus redevelopment includes mixed-use projects, projected to create 250 jobs and boost property values through residential and commercial integration. - W