Key Market Insights for October 29th, how much did you miss?

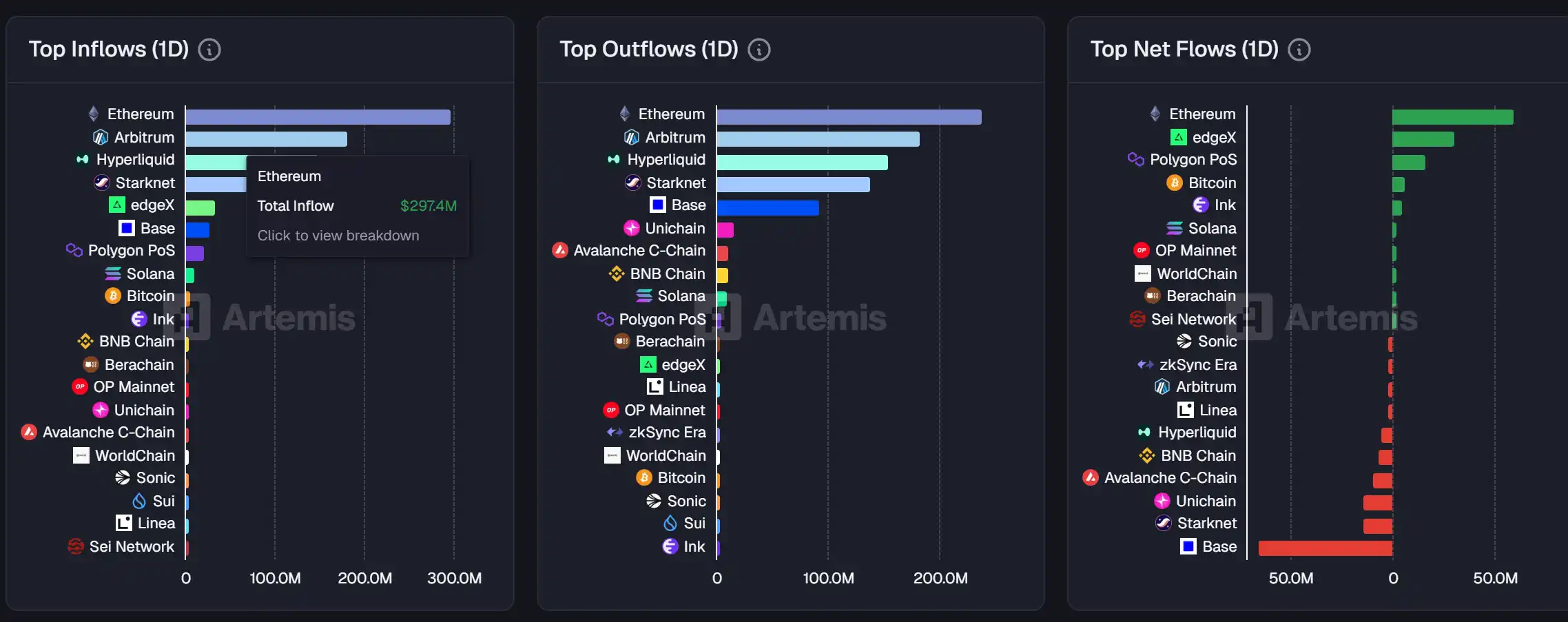

1. On-chain Fund Flow: $59.2M inflow to Ethereum today; $65.1M outflow from Base 2. Largest Price Swings: $FACY, $VULT 3. Top News: Zhihu x Ludong jointly hosted a roundtable on "Stablecoin Transparency" today, with a total view count of 25 million

Top News

1. Zhihu x Eudemonia Co-hosted Roundtable on "Penetrating Stablecoins" is now online today, with a total views of 25 million

2. MegaETH's public sale has raised over $700 million, with an oversubscription of 14.2 times

3. A total of $376 million has been liquidated across the network in the past 12 hours, with long positions being the main liquidations

4. FLM surged over 30% briefly and then retraced, with a market cap currently at $11 million

5. Users with at least 240 points in Binance Alpha can claim 2,688 BOS airdropped tokens

Featured Articles

1. "Chillhouse Leading Alone: The Past and Present of "Web3 Fun People""

The long-lost Solana meme hasn't been as lively for a long time, and it's happening in a way we can hardly imagine—a Solana meme coin "abstraction" involving Jesse Pollak, Base Protocol's lead, well-known crypto KOL Cobie, Solana's founder Toly, and pump.fun's founder alon. Especially with the addition of the Base camp, there is a sense of "breaking the taboo barrier." In the current environment where each chain is enthusiastically competing with each other, it is beyond players' expectations.

2. "The Best Market Performance in the Last Two Months of the Year? Is it Time to Surge or Retreat?"

As October draws to a close, the cryptocurrency market seems to be showing some signs of an uptrend. Over the past two months, "caution" has almost become the theme of the cryptocurrency market, especially after experiencing the 10/11 crash. The impact of this major drop is gradually fading, and market sentiment seems not to have further deteriorated but instead gained new hope. Starting from the latter part of the month, some signals of an uptrend have gradually emerged: positive net inflow data, approval of a batch of altcoin ETFs, and increasing rate cut expectations.

On-chain Data

Chain data for the week of October 28th

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: ETF Withdrawals Reveal the Unstable Base of Crypto Treasuries

- Bitcoin's 27% price drop since October has triggered massive ETF outflows, with BlackRock's ETHA losing $421.4M in November 2025. - BitMine Immersion Technologies faces $3.7B unrealized ETH losses as crypto treasuries struggle with collapsing valuations and limited capital expansion. - Bitcoin Munari (BTCM) emerges as a Bitcoin-pegged Layer 1 blockchain with EVM compatibility, fixed 21M supply, and 2027 mainnet roadmap. - BlackRock's staked Ether ETF filing aims to disrupt treasury models by offering yie

Bitcoin Updates: Institutions Pull Out and $2 Billion Wiped Out—Is This a Crypto Catastrophe or a Strategic Market Reset?

- Bitcoin ETFs face $3.79B outflows in November, triggering a $2B liquidation crisis as prices drop 9% below $84K. - Institutional profit-taking, fading Fed rate-cut hopes, and $4.2B options expiry amplify crypto market fragility. - $120B daily market loss highlights sector vulnerability amid regulatory scrutiny and geopolitical risks under Trump. - Analysts warn ETF outflows, stalled listings, and leveraged trading pressures pose ongoing rebound risks.

Bitcoin Updates: BTC's Sharp Decline Spurs Institutional Wagers on a $200K Recovery

- Bitcoin's sharp selloff and extreme fear metrics have triggered cautious optimism among analysts and institutional investors, who see potential rebounds and long-term demand signals. - Historical patterns show market bottoms often follow Fear and Greed Index readings below 20, with institutional buyers typically stepping in during retail capitulation phases. - Despite $3.79B in Bitcoin ETF outflows, technical indicators suggest oversold conditions and potential bullish patterns, with some experts forecas

Bitcoin News Update: MSCI Faces Index Challenge as Saylor’s Bitcoin Strategy Confronts $8.8B Withdrawal Threat

- Michael Saylor reaffirms MicroStrategy's Bitcoin-focused strategy amid MSCI's review of index eligibility for firms with major digital-asset holdings. - JPMorgan warns index exclusion could trigger $8.8B in outflows, risking liquidity, capital costs, and investor confidence for the $59B market cap company. - Saylor highlights $7.7B in Bitcoin-backed digital credit issuance and treasury expansion, aiming to build a "trillion-dollar Bitcoin balance sheet" despite 60% stock decline. - MSCI's January 2026 de