Visa’s growth in stablecoin adoption is propelling digital assets into the worldwide marketplace

- Visa expands stablecoin payments across Ethereum, Solana, Stellar, and Avalanche, supporting USD/EUR-pegged assets convertible to 25+ fiat currencies. - Partnerships with Circle and PayPal enable financial institutions to mint/burn stablecoins via Visa's tokenized platform, accelerating $140B+ crypto flows since 2020. - CEO highlights 400% YoY growth in stablecoin-linked card spending, with $2.5B+ annualized settlement volumes in Q4 2025, driven by cross-border payment demand. - Strategic expansion align

Visa Inc. (V) is broadening its stablecoin payment network to enable transactions on four leading blockchains—Ethereum,

This move fits into Visa’s larger strategy to embrace blockchain technology, which has enabled the company to process over $140 billion in stablecoin and crypto transactions since 2020. CEO Ryan McInerney pointed out the accelerating adoption of stablecoins, highlighting that Visa’s cards linked to stablecoins have seen spending multiply fourfold year-over-year, with settlement volumes exceeding a $2.5 billion annualized pace in Q4 2025, as also mentioned by Yahoo Finance. By utilizing the efficiency and transparency of blockchain, Visa seeks to streamline cross-border payments—a segment that significantly contributes to its revenue growth, as detailed in the

The rollout covers four stablecoins: Circle’s

Visa’s Q4 2025 financials demonstrate its robust performance, with net revenue climbing 12% year-over-year to $10.7 billion and adjusted earnings per share up 10%, according to

Looking forward, Visa anticipates that stablecoin-driven innovation will remain central in 2026. CFO Christopher Suh shared that the company aims for adjusted net revenue growth in the low double digits, with stablecoin features expected to play a significant role throughout the year as digital payment adoption accelerates, according to the Bitcoin World report. This expansion also reflects global shifts, such as stablecoin transaction volumes reaching $46 trillion annually and rising institutional interest in blockchain-powered remittances.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC Turmoil and AI Breakthroughs: Grok 4.1, Gemini 3, Cloudflare Outage

AI Confidence and Economic Concerns Set Crypto Strength Against Market Downturn

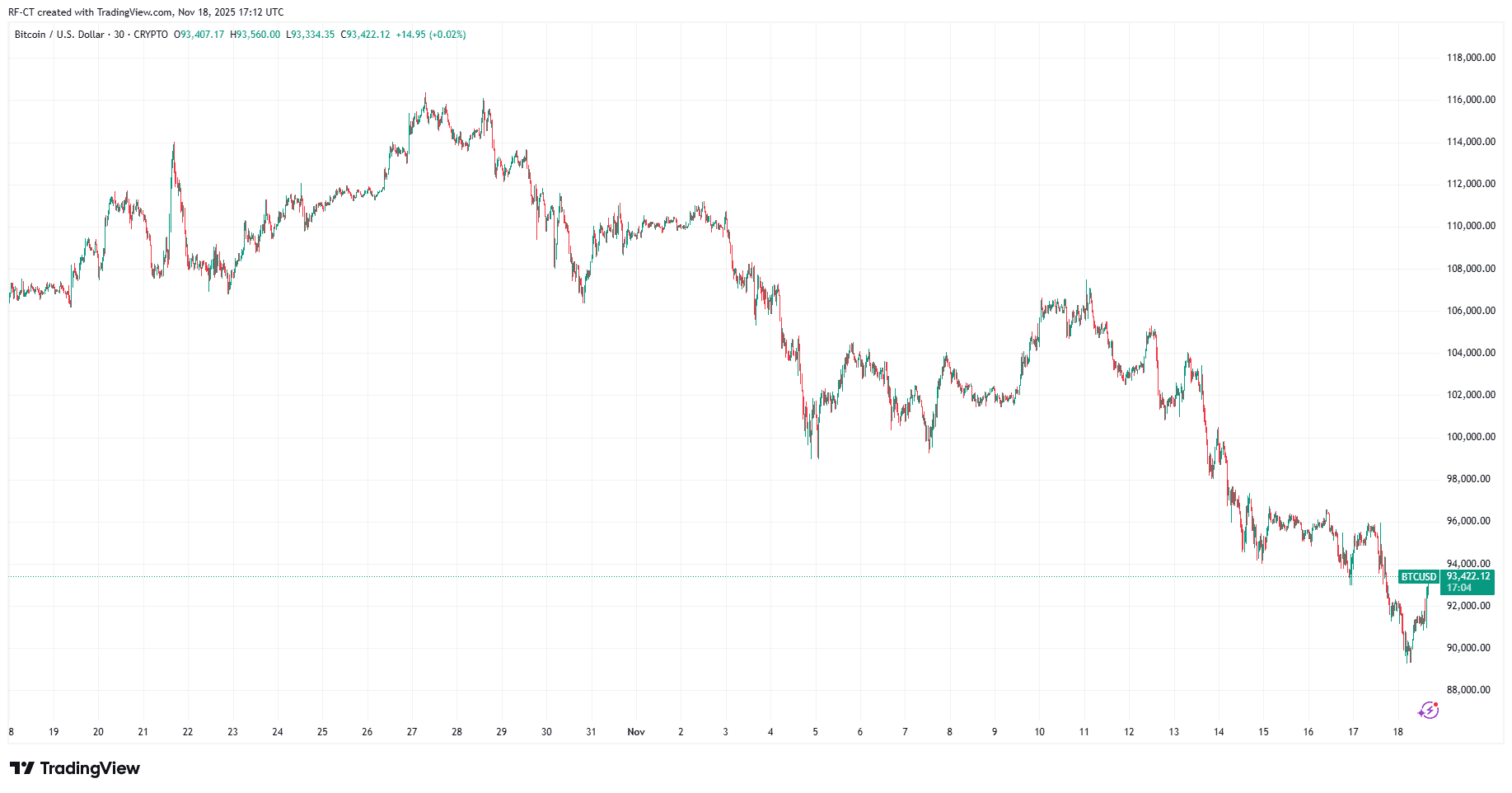

- U.S. stock indexes fell on Nov. 18, 2025, while crypto and AI-linked stocks showed resilience amid broader market weakness. - Nvidia's upcoming earnings and 54% YOY EPS forecast fueled gains in correlated stocks like TSMC (+41% YTD) and SMCI (+15% YTD). - Bitcoin rebounded 1% temporarily, but analysts warned crypto remains vulnerable to inflation fears and $1B+ leveraged liquidations. - Home Depot's 3% premarket drop dragged on the Dow after missing Q3 earnings and slashing profit forecasts amid housing

Solana's Breakthrough: Ushering in a New Age of Fast and Scalable Smart Contracts?

- Solana's 2025 upgrades (Firedancer, Alpenglow) achieved 1M TPS and sub-150ms latency, outperforming Ethereum and Sui . - Enterprise partnerships with Visa , PayPal , and Stripe leverage Solana's speed and low fees for payments and remittances. - Institutional ETF inflows and energy-efficient proof-of-history consensus boost Solana's appeal for green finance. - Challenges include competition from Ethereum upgrades, stablecoin liquidity declines, and regulatory risks.

Trump’s Federal Reserve Shakeup Raises Concerns Over Stagflation and Divides Within GOP

- Trump announced his Fed chair pick but withheld the name, criticizing resistance to removing Powell before his 2026 term ends. - Shortlisted candidates include Waller, Bowman, and Rieder, with Trump hinting at a "standard" choice amid political tensions. - The dispute with Rep. Greene over Epstein files highlights GOP fractures, as Trump accused her of betraying party loyalty. - Critics warn politicizing the Fed risks stagflation, while the Epstein files debate underscores transparency vs. loyalty tensio