ISM Manufacturing PMI suggests Bitcoin cycle may extend beyond historical norm

The Institute for Supply Management’s (ISM) Manufacturing Purchasing Managers’ Index (PMI) has historically aligned with major peaks in Bitcoin’s market cycles — a pattern that, if repeated, could imply a longer-than-usual cycle this time around.

The correlation between the ISM PMI and Bitcoin’s (BTC) price was first popularized by Real Vision’s Raoul Pal and has since gained traction among macro-focused crypto analysts.

“All 3 past Bitcoin cycle tops have broadly aligned with this monthly, oscillating index,” analyst Colin Talks Crypto noted, referencing the recurring overlap between Bitcoin’s market highs and the PMI’s cyclical peaks.

If that relationship holds, Colin added, “it would indicate a considerably longer cycle than bitcoin cycles typically run for.”

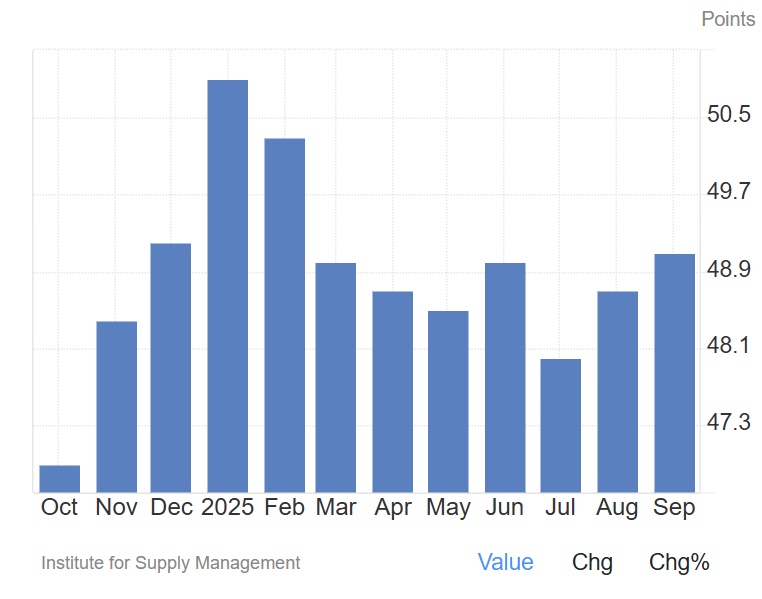

The ISM Manufacturing PMI, which measures US industrial activity, has remained below the neutral 50 mark for seven consecutive months, signaling contraction. A sustained move above 50 would suggest renewed economic expansion, historically associated with stronger Bitcoin price performance.

Earlier this year, the PMI briefly climbed above 50 before slipping back into contraction territory, underscoring continued weakness in the manufacturing economy.

Related: Bitcoin treasuries can earn more Bitcoin, says Willem Schroé

US manufacturing struggles to sustain momentum amid tariffs, weak demand

The manufacturing PMI signaled a strong rebound in business sentiment at the start of the year, partly attributed to optimism surrounding the incoming Trump administration and expectations of business-friendly policy.

However, the continued drag from high tariffs, uncertain trade policy and soft global demand has weighed on the sector, potentially extending the business cycle rather than accelerating it.

ISM’s latest report showed a modest uptick in September, with prices rising while exports and imports contracted, suggesting uneven conditions across manufacturing subsectors.

Despite the weakness, ISM noted that manufacturing’s shrinking share of US economic output means a contraction in the PMI does not necessarily signal a recession. ISM has previously observed that a sustained reading above 42.3 generally corresponds with growth in the broader economy.

One purchasing manager from the transportation equipment industry told ISM in September that “business continues to be severely depressed,” citing shrinking profits and “extreme taxes” in the form of tariffs that have raised costs across the supply chain.

“We have increased price pressures both to our inputs and customer outputs as companies are starting to pass on tariffs via surcharges, raising prices up to 20 percent,” they added.

Related: Crypto Biz: Bitcoin whales trade keys for comfort

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Risks and Insights from the COAI Token Fraud: A 2025 Handbook for Cryptocurrency Due Diligence and Safeguarding Investors

- COAI Token's 2025 collapse caused $116.8M losses, exposing systemic risks in algorithmic stablecoins and centralized governance. - Project's 96% supply concentration in ten wallets, opaque team identities, and weak tokenomics flagged regulatory red flags. - Global regulators froze $150M in assets but exposed jurisdictional gaps, while EU and US introduced crypto frameworks with conflicting standards. - Investors now prioritize AI audits, multi-sig wallets, and KYC compliance to mitigate risks in speculat

COAI's Unexpected Downturn in Late 2025: A Warning Story on AI Stock Valuations and Governance Risks

- COAI Index's 88% YTD drop highlights systemic risks in speculative AI equities and crypto assets amid strong AI infrastructure growth. - C3 AI's Q3 revenue growth contrasts with non-GAAP losses, underscoring AI sector's profitability challenges vs. disciplined tech peers like Benchmark Electronics. - CLARITY Act's regulatory ambiguity and EU AI Act compliance costs deter institutional investment, exacerbating COAI's governance and liquidity issues. - COAI's "fake decentralization" and C3 AI's leadership

Vanguard opens platform to Bitcoin ETFs and ends two-year blockade

3 Strong Altcoin Picks Showing Clear Growth Momentum — GIGA, ALGO, and NOT