Ethereum News Update: Positive Ethereum Trends Face Challenges from Regulatory and Economic Ambiguities

- Ethereum near $3,896 with bullish forecasts targeting $4,200+ amid ETF inflows and whale accumulation. - Analysts project 2025 prices from $3,499.54 to $6,540, averaging mid-term upward trends with $12,000+ long-term targets. - Technical analysis highlights $3,781 support and "triple bottom" patterns, while ETFs added $141.6M in inflows, signaling renewed investor confidence. - Risks persist from SEC delays, institutional staking dominance, and macroeconomic volatility, with price below $3,700 threatenin

Ethereum’s price movement has once again captured the interest of both analysts and investors as it trades close to $3,896. Optimistic projections point to a possible climb toward $4,200 or higher. Recent positive factors—such as increased ETF investments, accumulation by large holders, and a rebound in network activity—have fueled this sentiment. However, experts from a

Price Projections and Analyst Sentiment

Experts from leading institutions have issued a range of

Technical and On-Chain Signals

Technical analysis identifies important support and resistance zones for Ethereum. The asset is currently above the 0.618 Fibonacci retracement at $3,781, and a “triple bottom” pattern has formed near $3,600–$3,700, indicating robust buying activity, based on a

Recent ETF trends further support this perspective. On October 21, U.S. spot Ethereum ETFs saw net inflows of $141.6 million, led by Fidelity’s FETH and BlackRock’s ETHA. This shift follows three consecutive days of outflows and coincides with increased investments in

Network Strength and Upgrade Drivers

Ethereum’s underlying network metrics are also on the rise. Daily transaction counts have exceeded 1.2 million, and the total value locked (TVL) in decentralized finance (DeFi) has increased by 8% over the past week. Gas fees, which reflect demand on the network, have edged up, leading to a higher burn rate that reinforces Ethereum’s deflationary mechanism after the Merge, as previously noted.

Forthcoming upgrades, such as the Fusaka testnet phase, are expected to further boost the network. This last step before the main upgrade aims to improve scalability and efficiency, which could spark renewed interest in ETH and related altcoins, according to a

Risks and Obstacles

Despite the positive outlook, several risks remain. Delays in regulatory approval from the SEC and shifting global compliance standards could create uncertainty. There are also concerns about centralization due to the growing influence of institutional staking. Broader economic factors—such as changes in Federal Reserve policy and overall market sentiment—add further unpredictability, as mentioned in earlier price analyses. If ETH drops below $3,700, technical indicators suggest a possible decline toward the $3,300–$3,400 range.

Perspective

The medium-term forecast for Ethereum remains cautiously optimistic. Analysts point to the adoption of Layer-2 solutions, deflationary trends, and ETF inflows as primary growth drivers. Nonetheless, investors are advised to keep an eye on the ETH/BTC ratio, on-chain storage patterns, and macroeconomic developments to better understand the future direction.

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Updates: Saylor’s Bitcoin-Linked Strategy Encounters Index Removal and Industry-Wide Sell-Off Challenges

- Michael Saylor of MicroStrategy (MSTR) defends Bitcoin-centric strategy despite 41% stock decline, claiming resilience against 80% drawdowns. - MSCI's proposed index exclusion rule (for crypto-heavy firms) threatens $8.8B in losses for MSTR , which holds 90% Bitcoin on its balance sheet. - Bitcoin treasury sector faces "player-versus-player" selloff, with 26/168 firms trading below reserves and peers like Metaplanet launching buyback facilities. - Saylor envisions $1T Bitcoin balance sheet for financial

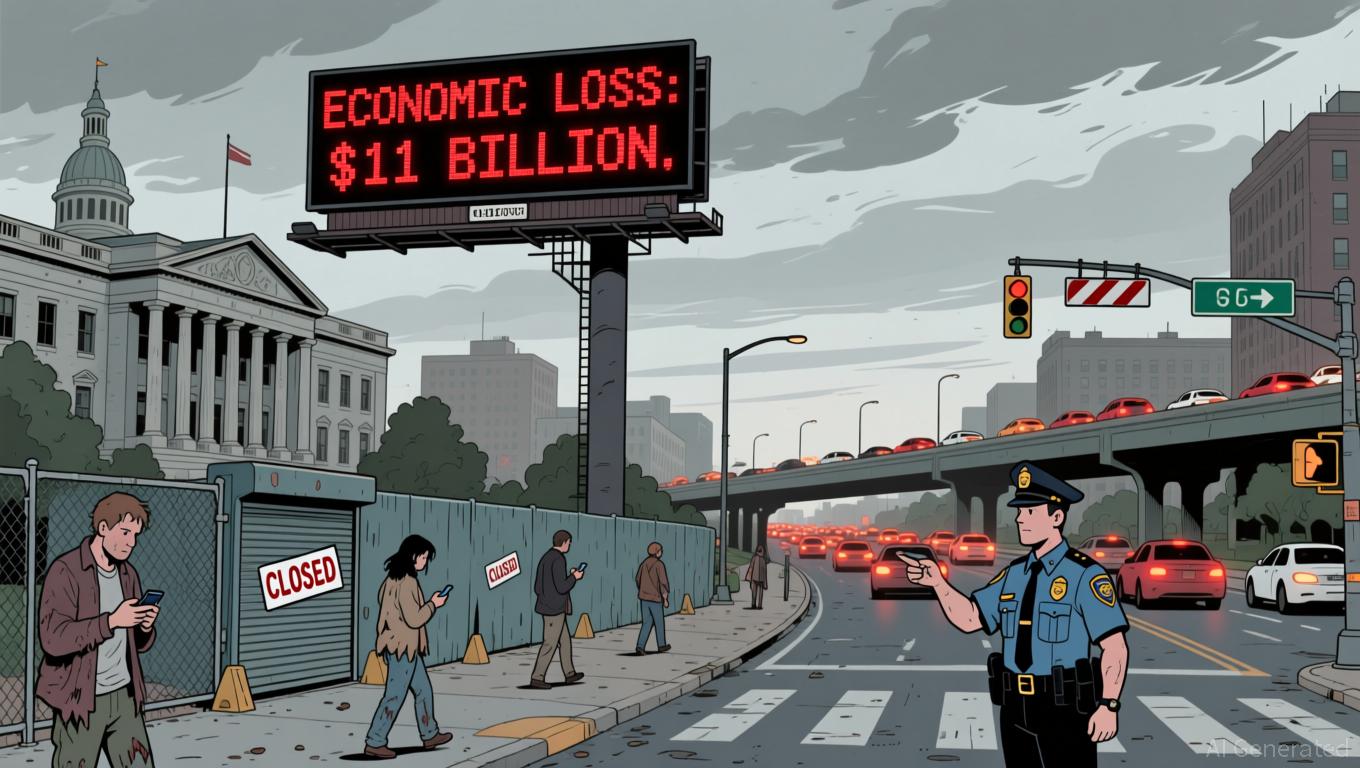

Political Stalemate Results in $11 Billion Loss, Highlighting Deep-Rooted Flaws in the System

- U.S. government shutdown in late 2025 caused $11B economic loss, disrupted critical data collection for CPI and employment reports. - Treasury Secretary Bessent highlighted recession risks in rate-sensitive sectors but emphasized services-driven inflation, not Trump trade policies. - "One Big, Beautiful Bill" tax cuts aim to boost incomes, with analysts projecting 0.4pp growth boost despite Fed rate constraints. - Shutdown intensified calls for congressional reform to end gridlock, as prediction markets

XRP News Today: XRP ETFs Ignite Discussion: Could Institutional Investments Drive a 465% Price Increase?

- Franklin Templeton and Grayscale's XRP ETFs cleared NYSE Arca approval, set for Nov 24 launch, marking institutional adoption of digital assets. - XRPZ ETF (0.19% fee) and Grayscale's entry boost institutional credibility, with XRP rising 5% amid 26% higher trading volume. - Analysts project 465% XRP price potential by 2028 via ETF-driven demand, though BlackRock's potential entry could strain XRP's 60B token supply. - Regulatory clarity and pro-crypto policies, including the Genius Act, reinforce invest

Ethereum Updates Today: DATs Buyback Strategy May Surpass Liquidity Challenges Amid Rising Debt

- FG Nexus sold $32.7M in ETH to repurchase 8% of shares amid 94% stock price drop, reflecting DAT sector struggles with NAV discounts. - Industry-wide $4-6B in forced crypto liquidations by DATs highlights systemic risks as debt rises and liquidity tightens across firms like ETHZilla and AVAX One . - Analysts warn debt accumulation and stalled corporate buying could worsen instability, while companies pivot to tokenization to address declining investor appetite. - Market skepticism persists as FG Nexus tr