CLAIM: Is the Bitcoin Price Following the Gold Chart 188 Days Behind? So, When It Catches Up to Gold, How Much Will the BTC...

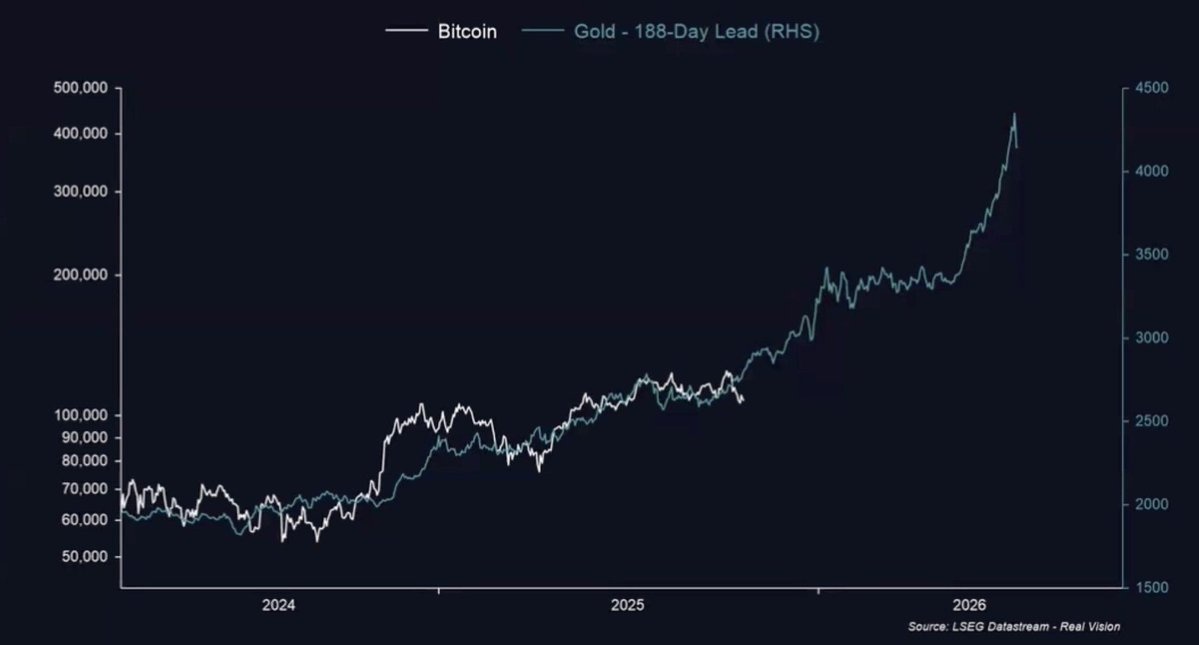

A recently shared chart claims that Bitcoin lags gold price movements by approximately 188 days.

According to analysts, this situation is considered a bullish signal for the cryptocurrency market.

The chart, based on LSEG Datastream and Real Vision data, compares Bitcoin and gold rates over the 2024–2026 period. Despite the time difference, Bitcoin's line is above gold's adjusted curve.

Amidst ongoing economic uncertainty, gold has risen 45% since the beginning of 2025, while Bitcoin has gained approximately 20% during the same period. However, analysts argue that the 188-day gap indicates an imminent acceleration in Bitcoin's price action.

This trend is also thought to be linked to the rise in institutional investment in Bitcoin ETFs. Analysts like Real Vision founder Raoul Pal frequently cite such historical correlations.

On the other hand, the correlation between Bitcoin and gold is only 0.09, indicating that Bitcoin still has a similar movement structure to technology stocks.

Considering the image shared by Real Vision, it is claimed that the BTC price may exceed $400,000 in 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: The Delicate State of Bitcoin: Surrender or Stabilization

- Bitcoin fell below $87,000, triggering $900M+ liquidations as long positions collapsed amid extreme retail fear metrics. - Analysts highlight oversold conditions, historical parallels to 2025 Q1 reversals, and potential $85k–$100k consolidation ahead of year-end $100k retests. - MicroStrategy faces MSCI index exclusion risks over Bitcoin holdings, while Rental Coins' bankruptcy underscores crypto sector fragility. - $75M ETF inflows and short-squeeze potential at $98k offer cautious optimism despite macr

Bitcoin Updates: Crypto Market Loses $2 Billion—Is This a Fresh Start or the Beginning of a Lengthy Downturn?

- Crypto markets crashed on Nov. 21, 2025, wiping $2B in leveraged positions as Bitcoin fell to $82,000, its lowest since April. - The sell-off was driven by macroeconomic pressures, ETF outflows, and algorithmic liquidations exacerbating price dislocations. - Over 396,000 traders lost $1.78B in long positions, while exchanges underreported liquidations due to partial reporting practices. - Institutional analysts warn of deeper structural risks, with some predicting further 50% declines to flush out specul

Chainlink price hits support as exchange supply dives ahead of ETF launch

Don’t fear the FDV: How real revenue creates sustainable value | Opinion