Experts call for Hong Kong and China collaboration on crypto: report

Industry experts are reportedly calling for Hong Kong and mainland China regulators to collaborate more on advancing the crypto sector within the two regions.

- Industry leaders at the Global Blockchain Summit in Shanghai emphasized the need for greater collaboration between Hong Kong and mainland China, which could significantly advance Asia’s crypto and fintech sectors.

- Despite China’s ongoing crypto trading ban, growing interest in yuan-pegged stablecoins and potential joint initiatives suggest that both regions may be moving toward closer cooperation in digital finance and blockchain innovation.

According to a recent report by South China Morning Post, the two regions could potentially elevate the crypto and financial technology sector in Asia by teaming up. Industry experts who attended the 11th Global Blockchain Summit in Shanghai stated that the two markets would benefit greatly from joint collaborations.

Despite implementing a ban on cryptocurrency in the mainland since 2021, China has allowed for the special administrative region of Hong Kong to develop itself into a crypto hub. The region has seen a surge in investor interest, particularly in stablecoins, ever since it passed the Stablecoin Ordinance on August 1.

According to the report , while Hong Kong has established itself as a digital assets hub, China has been making moves into the digital finance sector by developing digital payments and capitalizing on artificial intelligence technology.

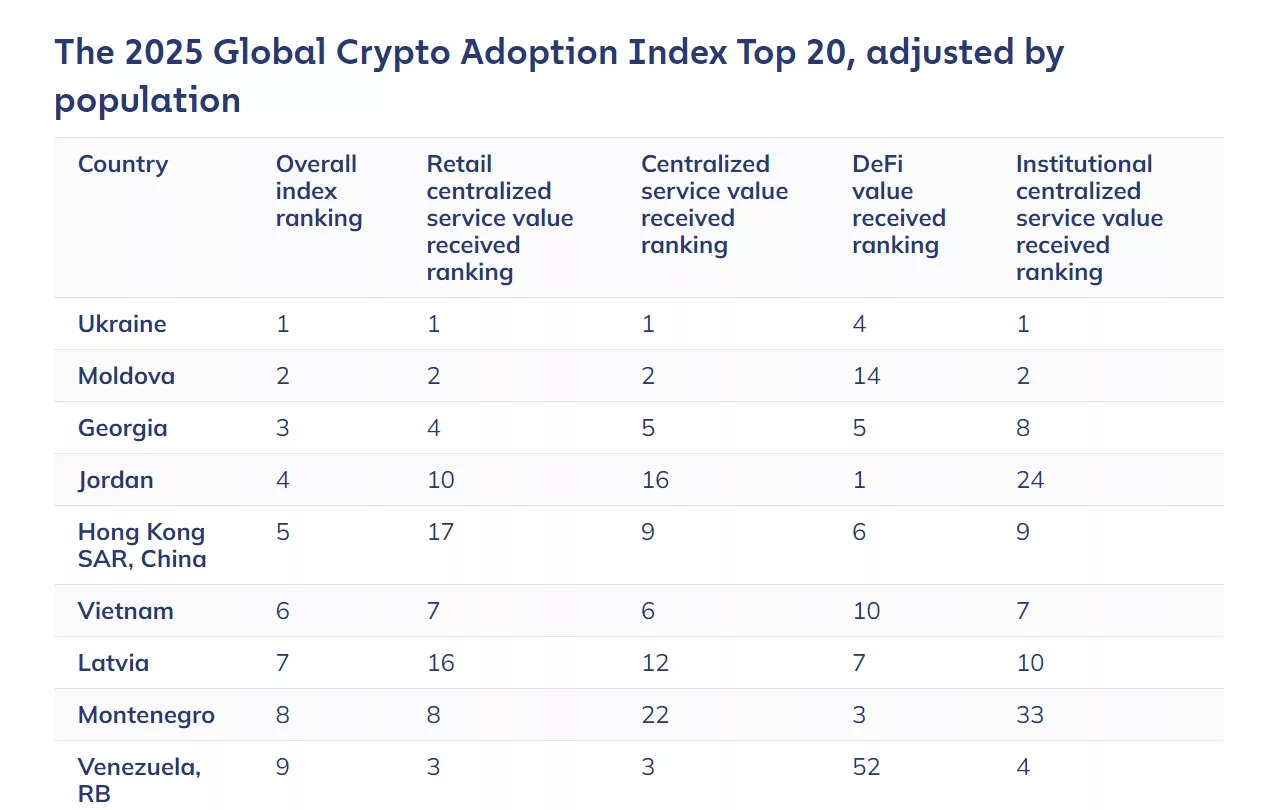

However, the two regions still rank lower in crypto adoption compared to other Asian nations such as India, Japan, Vietnam and Indonesia according to data from Chainalysis. India is currently ranked first in terms of retail and institutional service value in crypto, while Vietnam is in third place. Meanwhile, Hong Kong and China rank in 17th place by retail centralized service value received.

Hong Kong and China are ranked lower compared to other Asian regions in terms of global crypto adoption | Source: Chainalysis

Hong Kong and China are ranked lower compared to other Asian regions in terms of global crypto adoption | Source: Chainalysis

Chairman of Shanghai-based Wanxiang Blockchain and Hong Kong crypto exchange Hashkey Group, Xiao Feng, declared in his keynote speech that he would like to see greater joint efforts in making “more standards and rules” in the crypto industry as it continues to grow at a rapid pace.

“Blockchain technology has moved from the initial stages of technological development to the stage of large-scale applications,” said Xiao.

He also highlighted the increased excitement surrounding the conference as it reflected the hype around crypto assets. He said that tickets for the event were sold out within a few days before the event kicked off, which “has not happened in years.”

Growing crypto interest in Hong Kong and China

At the summit, Director of Blockchain and Digital Assets at Hong Kong-based Cyberport, Rachel Lee stated that the firm hopes to work more closely with stakeholders from mainland China to foster developments in the crypto industry.

In 2023, the company received an investment of $50 million from the Hong Kong government in a bid to support the sector’s growth.

On the other hand, President of Solana Foundation, Lily Liu said that the organization has been investing heavily in China’s developer ecosystem. Liu stated that the foundation hopes to explore collaboration in areas such as decentralized payments and artificial intelligence.

She viewed China as “a leader” in terms of how massive the country’s payments industry is, as the region has a population of over a billion.

Although China has remained firm in its stance against crypto trading in the mainland, several regulators have called for an easing of the ban in light of recent developments regarding the push for yuan-pegged stablecoins. Some Chinese firms have even expressed interest in applying for a Hong Kong-issued stablecoin license, before pausing due to government warnings.

In addition, a recent document from the Hong Kong Legislative Council seems to hint at future collaboration with the mainland government. The special bulletin stated that Hong Kong is currently seeking support from the central Chinese government in exploring the issuance of an offshore Renminbi-backed stablecoin.

By issuing RMB-backed stablecoins, Hong Kong could strengthen its position as a global hub for digital assets and web3 innovation. Meanwhile, Beijing could benefit from developing their own stablecoins to promote cross-border trade settlement and challenge the U.S dollar’s domination over the stablecoin market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DASH rose by 8.58% on December 3, 2025, driven by insider purchases and upcoming earnings schedule

- DoorDash director Alfred Lin’s $100M stock purchase boosts shares 8.58% on Dec 3, 2025, signaling confidence in long-term growth. - DASH shows mixed short-term trends (11.72% weekly drop vs. 35.93% annual gain) amid broader market volatility and earnings season uncertainty. - Analysts project 2.22 EPS for DoorDash, with ratings split between "Strong Buy" and "Hold," reflecting cautious optimism about revenue growth and macroeconomic risks. - Insider buying contrasts with CEO’s $56.5M share sale, highligh

U.S. November ADP employment change at -32K, vs. 10K expected and 42K prior.

Hyperliquid (HYPE) Price Fluctuations: Unraveling Blockchain Hazards and Institutional Confidence for 2025

- Hyperliquid (HYPE) dominates 73% of Perp DEX market share in 2025 through $5B TVL, BlackRock/Stripe partnerships, and 11% HLP returns despite security breaches. - Repeated 2025 security incidents ($4.9M POPCAT attack, $21M private key breach) triggered 20%+ price drops and $4B TVL decline amid liquidity flight. - Institutional trust persists as TVL/open interest grew post-March 2025, but circulating supply unlocks and Lighter/Aster competition threaten HYPE's $34 price stability. - Platform's success hin

Strategic Property Investment in the Revitalization of the Former Xerox Campus: Infrastructure-Led Renewal in Webster, NY

- Webster , NY, is transforming its post-Xerox campus via $14.3M in state infrastructure grants for industrial upgrades and public-private partnerships. - Road, sewer, and electrical improvements reduced industrial vacancy to 2%, attracting $650M fairlife® dairy plant and 250 jobs. - Residential values rose 10.1% annually as NEAT corridor targets $1B in development by 2026 with $283M public-private investment. - Strategic infrastructure funding de-risks development, creating a scalable model for post-indus