Aster News Today: Crypto Market Stalemate: Is the DEX Boom a Lasting Trend or Just a Short-Lived Bearish Break?

- Crypto market shows neutrality as funding rates stabilize near equilibrium, though bearish trends persist amid recent declines. - Decentralized exchange Aster dominates with $10.6B 24-hour volume, outpacing rivals via hybrid on-chain/off-chain model. - Market shifts toward DEXes reflect post-FTX trust erosion, but Aster's reliance on incentives raises sustainability concerns. - Analysts debate if stable funding rates signal bullish reversal or temporary pause, as DEX derivatives aim to capture 25% market

After a stretch of downward momentum, the cryptocurrency market is showing signs of moving toward a more balanced state, as funding rates across leading centralized and decentralized exchanges (CEXs and DEXs) begin to level out. Based on a

!

At the same time, decentralized exchanges are gaining momentum, with

The combination of steadier funding rates and increased DEX activity points to an evolving and more sophisticated market environment. While CEXs still hold the majority share in derivatives trading, decentralized options are increasingly seen as credible alternatives for leveraged crypto trades. Experts observe that Aster’s expansion, fueled by liquidity rewards and cross-chain features, signals a rising preference for transparent and non-custodial trading solutions. Nevertheless, the platform’s heavy use of token incentives raises concerns about whether users will stay once these rewards are reduced.

Traders are also watching to see if the recent stabilization in funding rates will lead to a significant bullish turnaround or if it simply marks a brief respite in the prevailing bearish trend. Current projections suggest that decentralized derivatives platforms could account for more than a quarter of the global crypto derivatives market by 2026, driven by tighter regulations on centralized exchanges and ongoing improvements in DeFi technology.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ICP Value Jumps 30% Following Key Network Improvements: Exploring How Protocol Advancements Are Transforming Long-Term Value Outlook for Web3 Infrastructure

- Internet Computer (ICP) surged 30% to $4.71 in November 2025, driven by protocol upgrades and AI-powered smart contracts. - Flux/Stellarator upgrades enhanced storage and sharding, while Chain Fusion enabled cross-chain interoperability with Bitcoin , Ethereum , and Solana . - Institutional adoption and hybrid cloud partnerships boosted DeFi TVL to $237 billion, though dApp engagement dropped 22.4% amid regulatory scrutiny. - Security milestones like Niobium/Magnetosphere fortified governance, yet challe

Crypto Market Loses $400B in Just One Month

The total crypto market cap fell by $400 billion in a month, raising concerns among investors amid rising volatility.Bearish Sentiment Grows Among InvestorsWhat’s Next for the Crypto Market Cap?

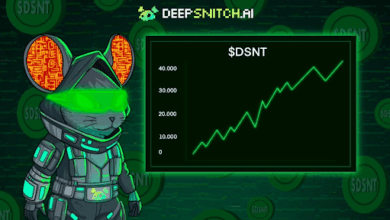

XRP Price Prediction December 2025: Sentiment Crashes as Traders Move Toward DeepSnitch AI After 74% Jump

XRP price prediction gains new importance after Santiment reports extreme fear levels. DeepSnitch AI accelerates past $678K as investors move toward intelligence-first presales.Fear-driven pullback reshapes XRP price prediction outlookFinal verdict: Fear-driven XRP reset changes December’s outlookFAQs

How to Buy DeepSnitch AI From the Official Website? A Complete Guide to Joining the Presale of the Next 100X Crypto Moonshot of 2026

This beginner-friendly, step-by-step guide shows you how to buy DeepSnitch AI, from connecting your wallet to purchasing your first DSNT tokens in one go.What is DeepSnitch AI, and why is everyone talking about it?Is it safe to buy DeepSnitch AI?How to buy DeepSnitch AI from the official website in 3 easy stepsIs DeepSnitch AI worth investing in or just another hype token?ConclusionFAQs