BlackRock Debuts Bitcoin ETP on London Stock Exchange as UK Eases Crypto Investment Rules

Quick Breakdown

- BlackRock launches iShares Bitcoin ETP on the London Stock Exchange after FCA eases crypto restrictions.

- UK regulator lifts four-year ban on crypto-linked ETNs, marking a shift toward a more open market.

- FCA supports blockchain tokenization, signaling its commitment to innovation in asset management.

BlackRock expands Bitcoin offerings to the UK market

Global asset management giant BlackRock has introduced its iShares Bitcoin Exchange-Traded Product (ETP) on the London Stock Exchange, marking a significant milestone in the UK’s evolving crypto investment landscape.

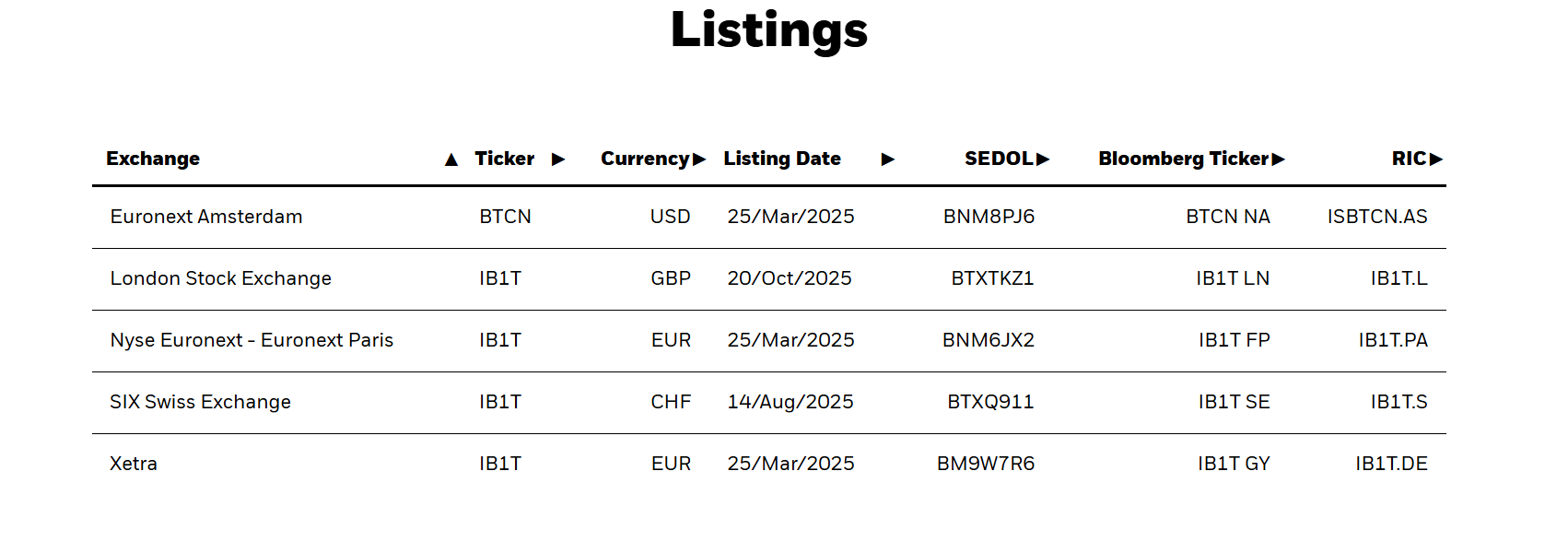

iShares Bitcoin ETP listings include the London Stock Exchange. Source: BlackRock

iShares Bitcoin ETP listings include the London Stock Exchange. Source: BlackRock

The launch follows the Financial Conduct Authority’s (FCA) recent decision to loosen restrictions on crypto investment vehicles, allowing UK investors new regulated access to Bitcoin exposure.

According to the asset manager’s website on Monday, the product enables investors to purchase fractions of Bitcoin (BTC)—trading around $110,923—through units priced from approximately $11. The ETP mirrors Bitcoin’s market movements while remaining within a regulated trading framework, giving retail investors a safer path to enter the crypto market without holding digital assets directly.

FCA reverses four-year ban on crypto-linked products

The move follows a major regulatory shift in the UK. On October 9, the FCA lifted its four-year ban on crypto exchange-traded notes (ETNs), signaling a softer stance on digital asset investment products.

David Geale, FCA’s executive director of payments and digital finance, noted that since the initial restrictions, the market has matured and become better understood, paving the way for broader investor access.

Regulator encourages innovation through tokenization

Despite easing its position on ETPs and ETNs, the FCA maintained its ban on crypto derivatives for retail investors, citing their high-risk nature. The regulator, however, confirmed it would continue monitoring market developments to reassess future approaches.

BlackRock’s growing dominance in Bitcoin investment

BlackRock remains one of the most dominant issuers of Bitcoin-linked investment products. Data from SoSoValue shows its iShares Bitcoin ETF in the U.S. boasts over $85 billion in net assets, underscoring strong investor confidence in the firm’s crypto strategies.

Meanwhile, BlackRock CEO Larry Fink believes the next major transformation in global finance will come from tokenizing traditional assets such as equities, bonds, and real estate. Fink said the company views tokenization as an opportunity to bring new investors into mainstream financial products through digital means.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

A decade-long tug-of-war ends: "Crypto Market Structure Bill" sprints to the Senate

At the Blockchain Association Policy Summit, U.S. Senators Gillibrand and Lummis stated that the "Crypto Market Structure Bill" is expected to have its draft released by the end of this week, with revisions and hearings scheduled for next week. The bill aims to establish clear boundaries for digital assets by adopting a classification-based regulatory framework, clearly distinguishing between digital commodities and digital securities, and providing a pathway for exemptions for mature blockchains to ensure that regulation does not stifle technological progress. The bill also requires digital commodity trading platforms to register with the CFTC and establishes a joint advisory committee to prevent regulatory gaps or overlapping oversight. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, is still being iteratively updated.

Gold surpasses the $4,310 mark—Is the "bull frenzy" returning?

Boosted by expectations of further easing from the Federal Reserve, gold has risen for four consecutive days. Technical indicators show strong bullish signals, but there remains one more hurdle before reaching a new all-time high.

Trend Research: Why Are We Still Bullish on ETH?

Against the backdrop of relatively accommodative expectations in both China and the US, which suppress asset downside volatility, and with extreme fear and capital sentiment not yet fully recovered, ETH remains in a favorable "buy zone."