Trezor rolls out the first quantum-ready hardware wallet with transparent secure element

Trezor has launched the Safe 7, a next-generation hardware wallet featuring the world’s first transparent secure element and a quantum-ready architecture.

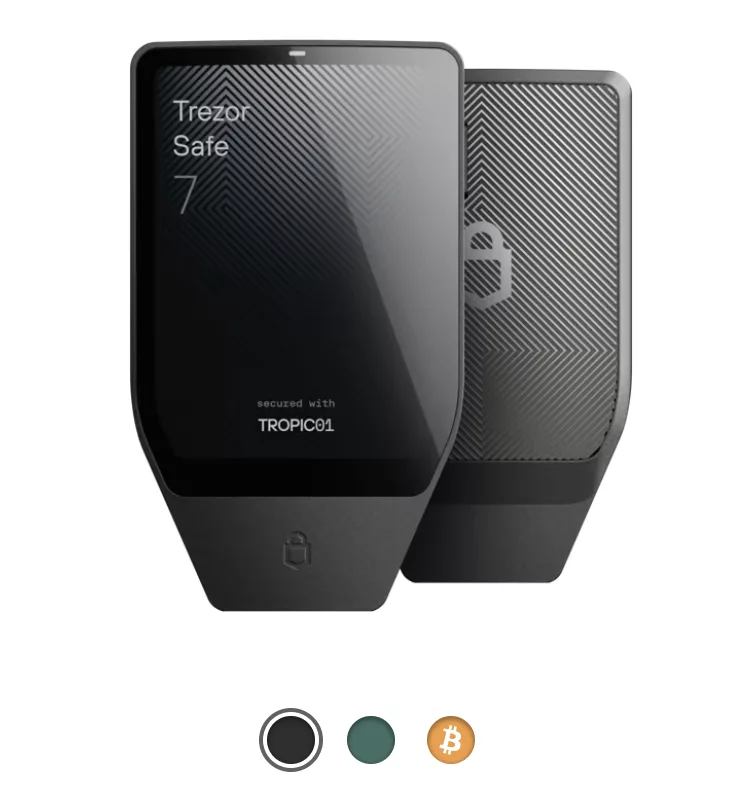

- Trezor Safe 7 offers a transparent secure element, dual-chip isolation, quantum-ready architecture, touchscreen confirmation, wireless charging, and broad crypto support.

- It arrives as quantum threats rise, future-proofing crypto against “Harvest-Now-Decrypt-Later” attacks.

In a press release shared with crypto.news, Trezor announced the launch of the Safe 7, a next-generation hardware wallet featuring two industry-first innovations: a fully auditable secure element and a quantum-ready architecture.

At the heart of the device is TROPIC01, the world’s first transparent secure element, allowing the crypto community to inspect and verify its design. This addresses a long-standing security challenge: trusting proprietary hardware without insight into how it works.

Trezor’s quantum-ready hardware wallet | Source: Safe 7 | trezor.io

Trezor’s quantum-ready hardware wallet | Source: Safe 7 | trezor.io

Safe 7 is also built with quantum-ready architecture, ensuring the device can support post-quantum secure updates in the future. The wallet combines this future-proof security with a dual-chip design, keeping private keys isolated while requiring physical confirmation on a 2.5-inch high-resolution color touchscreen.

Other features include Bluetooth Low Energy connectivity, Qi2-compatible wireless charging, a durable aluminum unibody with Gorilla Glass protection, and IP54 resistance against dust and splashes. The device supports thousands of coins, staking, and third-party integrations via the Trezor Suite platform. The Safe 7 is available in Charcoal Black and Bitcoin-only editions for $249.

Trezor’s Safe 7 comes at a time when the crypto industry is increasingly worried about quantum computing threats . As advances in quantum technology accelerate, experts warn that current cryptographic algorithms protecting digital assets could eventually be broken, putting billions in digital wealth at risk.

“Harvest-Now-Decrypt-Later attacks are already underway. Hostile governments and cybercriminal groups are stockpiling encrypted data—medical files, financial transactions, classified intelligence, private communications—confident that quantum computers will eventually crack it,” said David Carvalho, Founder and CEO of Naoris Protocol, in a recent interview with crypto.news.

“Within the next decade, Bitcoin and other blockchains will have to move to post-quantum algorithms . It’s not a question of if, but when. That’s why we built a quantum-ready bootloader into Safe 7,” said Trezor CTO Tomáš Sušanka.

Other companies (e.g. Qastle ) are also beginning to explore quantum-resistant solutions, signaling a broader trend in the industry to anticipate next-generation threats before they materialize.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell faces the ultimate test: At least three dissenters at the December meeting, Federal Reserve consensus collapses!

The "Fed mouthpiece" reported that internal divisions within the Federal Reserve have intensified amid a data vacuum, with three board members appointed by Trump strongly supporting a dovish stance, while the hawkish camp has recently expanded.

Weekly Hot Picks: Data Disappearance Doesn’t Stop the Fed’s Hawkish Stance! Global Multi-Asset Markets Face “Backstabbing”

The U.S. government shutdown has ended, but the release of key data remains chaotic. The Federal Reserve has sent frequent hawkish signals, causing significant declines in gold, silver, stocks, and currencies on Friday. The U.S. has launched Operation "Southern Spear". Buffett delivered his farewell letter, and the "Big Short" exited abruptly. What exciting market events did you miss this week?

SignalPlus Macro Analysis Special Edition: Is It Going to Zero?

Over the past week, cryptocurrency prices declined once again. BTC briefly reached $94,000 on Monday due to lighter selling pressure before pulling back, and major cryptocurrencies saw further week-on-week declines...