House of Doge Acquires Italian Soccer Team

House of Doge, the corporate arm of the Dogecoin Foundation, has acquired a majority stake in Italy’s soccer team US Triestina Calcio 1918, marking a milestone in the convergence of digital assets and traditional industries. The move comes as cryptocurrency firms seek tangible footholds in regulated sectors. By acquiring a century-old European football club, House

House of Doge, the corporate arm of the Dogecoin Foundation, has acquired a majority stake in Italy’s soccer team US Triestina Calcio 1918, marking a milestone in the convergence of digital assets and traditional industries.

The move comes as cryptocurrency firms seek tangible footholds in regulated sectors. By acquiring a century-old European football club, House of Doge is translating token-based enthusiasm into real-world ownership and signaling a shift in how crypto brands pursue legitimacy and growth.

Crypto and Football: A Growing Alliance

House of Doge becomes Triestina’s largest shareholder, bringing capital and blockchain plans. The club, based in Italy’s Serie C, will test cryptocurrency-based ticketing and merchandise payments.

The acquisition was executed in collaboration with Brag House Holdings, House of Doge’s publicly traded merger partner. Brag House provided the listed structure that enabled the purchase and continues to oversee governance and market access. Together, the firms are integrating Brag House’s gaming and fan ecosystem with House of Doge’s blockchain network, creating a single framework that connects digital communities with traditional sports audiences.

“Our investment is about proving that digital assets can drive real-world value, culture, and passion. Football provides the ideal stage to demonstrate how decentralized communities can create sustainable impact,” said Marco Margiotta, CEO of House of Doge.

It’s official! House of Doge is now the majority owner of U.S. Triestina 1918, one of Italy’s oldest professional football clubs!Dogecoin was founded on Community—and the world’s game is one of the biggest communities there is. We will support Triestina with immediate capital…

— House of Doge (@houseofdoge) October 20, 2025

Analysts note that crypto firms are converting on-chain communities into off-chain assets that generate revenue. By entering sports, gaming, and entertainment, companies like House of Doge aim to balance volatility with stable operations.

Expanding the Industry’s Legitimacy

The link between cryptocurrency and football is growing quickly. Clubs now use blockchain for sponsorships, fan-voting, and tokenized loyalty systems. For crypto firms, partnerships with trusted teams bring access to millions of fans and help reinforce credibility.

In 2025, Tether increased its stake to 10.7% in Juventus F.C., becoming the second-largest shareholder. The firm aims to expand fan-token integration and stablecoin payments in Serie A. Bitpanda also teamed with Arsenal F.C. and Paris Saint-Germain F.C. to enhance blockchain-based fan rewards. Socios continues its partnerships with FC Barcelona and Inter Milan to build global fan engagement.

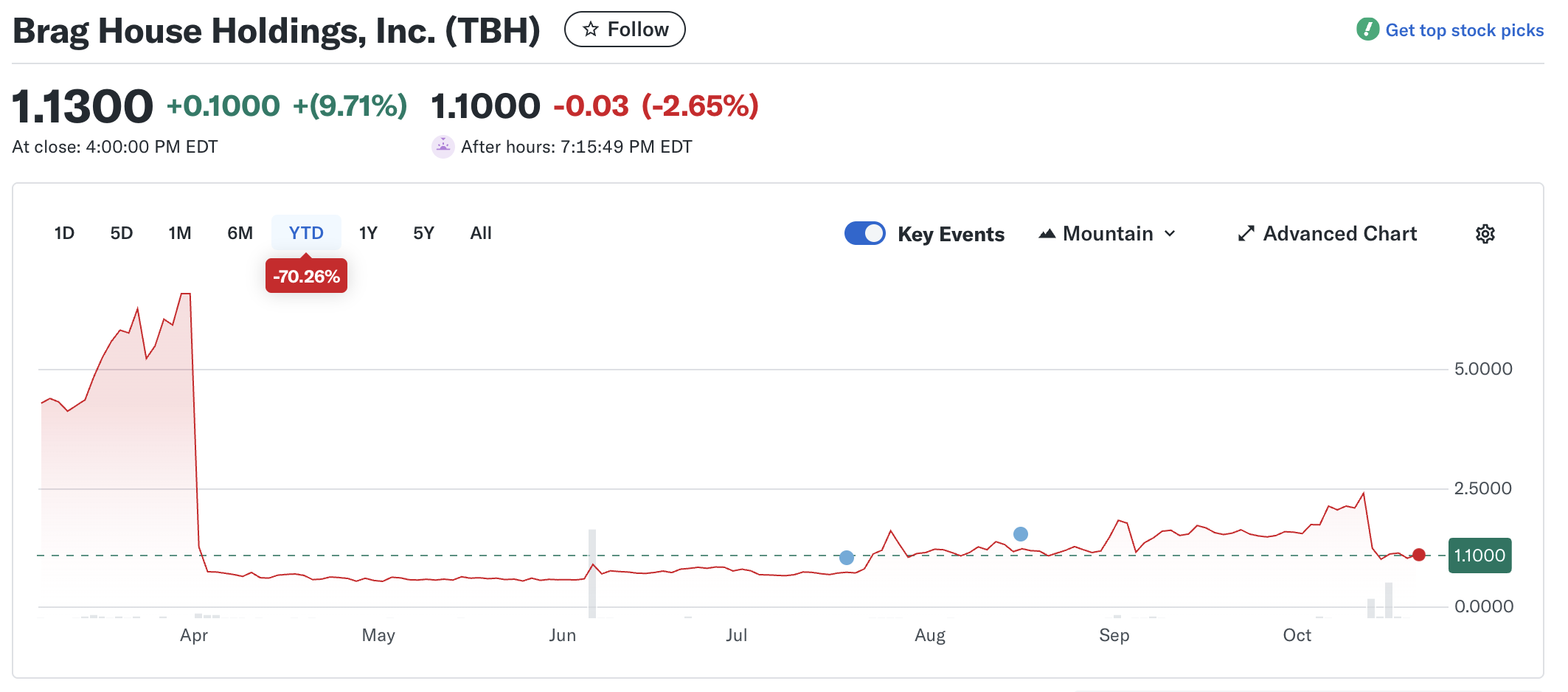

The House of Doge deal aligns with its plan to go public via a reverse merger with Brag House Holdings (TBH). TBH also began trading in March at about $4.30 per share but has since fallen to $1.13, a drop of nearly 74%. This reflects the broader volatility among small-cap digital asset firms.

TBH Performance Since Launch /

Source:Yahoo

TBH Performance Since Launch /

Source:Yahoo

Dogecoin (DOGE) trades near $0.20—up 1.9% from yesterday but down 25% over the month. Its one-year high was $0.466, recorded on December 8 last year. At that time, optimism about a potential $1 breakout was strong, but the current price represents a decline of roughly 57% from that peak.

DOGE performance over the past year / Source: BeInCrypto

DOGE performance over the past year / Source: BeInCrypto

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Centralized Web Vulnerability: Cloudflare Disruption Impacts 20% of Traffic, Alarming Investors

- Cloudflare's 2025 outage disrupted 20% of global traffic due to a configuration error, affecting major platforms like X and Spotify . - Shareholder Baillie Gifford reduced its stake by 14.4% amid valuation concerns, selling $781.5M worth of shares. - The incident triggered a 3.9% stock drop, highlighting investor fears over operational resilience and systemic risks. - Critics warned of centralized infrastructure vulnerabilities, urging redundancy measures like multi-CDN architectures. - Cloudflare pledge

ZK-Technology's Rapid Rise: Advancements in Blockchain Scalability and Signs of Growing Institutional Embrace

- Zero-knowledge (ZK) technology is accelerating blockchain adoption through scalability breakthroughs, with ZK rollups processing 10B+ Ethereum transactions and achieving 15,000 TPS. - Institutional giants like JPMorgan , Goldman Sachs , and Deutsche Bank are deploying ZK-based systems for secure settlements and tokenized asset management, signaling mainstream validation. - ZK infrastructure now supports $3.5B TVL across platforms like ZKsync and StarkNet, with Ethereum's zkEVM upgrade attracting $200M in

Astar (ASTR) Price Rally: Blockchain Integration and the 2025 DeFi Revival

- Astar (ASTR) surges in 2025 due to on-chain adoption and DeFi renaissance, driven by Agile Coretime upgrades and institutional investments. - Q3 2025 saw 20% active wallet growth and $2.38M TVL, contrasting with broader DeFi’s decline, highlighting Astar’s liquidity resilience. - Strategic partnerships with Web2 giants boost ASTR’s real-world utility via loyalty programs and decentralized identity solutions. - Astar 2.0’s 150,000 TPS cross-chain interoperability bridges Ethereum , Polkadot , and Binance,

Astar 2.0 and What It Means for Blockchain Infrastructure

- Astar 2.0 introduces a modular cross-chain infrastructure supporting EVM and WASM, enhancing DeFi scalability and interoperability. - Key upgrades include Astar zkEVM for low-cost transactions and LayerZero integration to bridge Ethereum , Polkadot , and Binance Smart Chain. - Tokenomics 3.0 features a fixed 10.5B ASTR supply and dApp Staking v3, incentivizing liquidity and governance participation through the Astar Contribution Score. - Strategic partnerships with Startale and Plaza, plus Agile Coretime