Who is the real "controller" behind the evaporation of $1.9 billion?

The drop in October was not an ordinary correction,

but a blatant display of power.

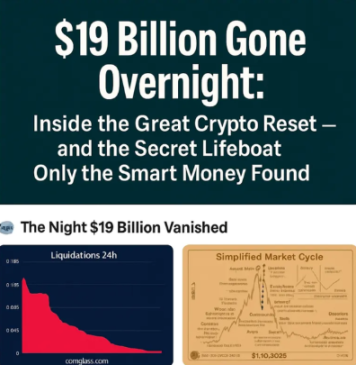

1.9 billions dollars in positions were wiped out overnight,

this was not a "black swan," but the system telling you—

who is the real operator behind the scenes.

❶ This is not a crash, but a "reminder"

Last week's events were far more than just a price collapse.

If you still think the crypto market runs freely,

then you haven't seen the truth at all.

The rules here are not written on the blockchain,

but deep inside the wallets of whales and the matching engines.

❷ 1.9 billions dollars evaporated overnight

No Trump tariffs, no China FUD,

no external news catalyst.

The real trigger was—Binance's oracle glitch.

The whales were the first to spot the anomaly,

quietly cleared the table,

while retail investors hadn't even realized the game was over.

❸ The problem is not liquidation, but vulnerability

You can perfectly control leverage and set stop-losses,

but when the exchange misprices your collateral,

all risk management becomes meaningless.

This is the hidden cost of centralized infrastructure—

you think you are trading,

but in reality, you are borrowing someone else's game engine.

❹ The crypto world is like an F1 car

It is incredibly fast, technologically advanced, and endlessly innovative.

But no one checks—

whether the tires can withstand such speed.

When liquidity cracks appear,

the whole machine can spiral out of control within seconds.

This is not a hacker attack, nor macro headwinds,

but the system itself overloading and losing balance.

❺ A 24/7 market, built on a 9-to-5 foundation

Traditional finance can hit the "pause button" in times of panic,

but the crypto market cannot.

This is both its strength and its curse.

The market never sleeps,

and sometimes it collapses in its dreams.

❻ The problem is not Binance, but complexity itself

Every new innovation brings new vulnerabilities.

Every cycle exposes the same fragility in different forms.

This round just came with a new "system error" shell.

❼ So, what is the real defense?

If you can still be wiped out even with proper risk management,

what you need is not smarter bets,

but more thorough protection.

The survival rule in the crypto world is not to make you rich overnight,

but to let you survive long enough to witness the next wave of wealth.

❽ Survival Rule One: Never put all your funds on an exchange

Cold wallets are for secure storage,

hot wallets are for daily trading.

If you play with contracts,

please set up separate accounts to isolate risk.

Convenience is poison—security is the real return.

❾ Survival Rule Two: Refuse full position and cross margin

Every trader without risk controls

will eventually be liquidated.

Only invest what you can afford to lose.

If you refuse to set limits,

the market will set them for you.

❿ 1.9 billions dollars is not a loss, but tuition

Optimists see progress, analysts see mistakes,

while realists see—inevitability.

Market crises never repeat,

they only rhyme in new lines of code.

We haven't fully understood this line of code yet,

but the lesson is already written on the chain.

Conclusion:

This crash is not the end, but a reminder.

Reminding us:

The crypto market has never been a decentralized paradise,

but a system fueled by speed and leverage,

where any tiny mistake can ignite the whole system.

Next time the market falls into chaos,

smart money won't panic,

they will first make sure—they are not under the system's loopholes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$8.8 billion outflow countdown: MSTR is becoming the abandoned child of global index funds

The final result will be revealed on January 15, 2026, and the market has already started to vote with its feet.

Deconstructing DAT: Beyond mNAV, How to Identify "Real vs. Fake HODLing"?

There is only one iron rule for investing in DAT: ignore premium bubbles and only invest in those with a genuine flywheel of continuously increasing "crypto per share."

Empowered by AI Avatars, How Does TwinX Create Immersive Interaction and a Value Closed Loop?

1. **Challenges in the Creator Economy**: Web2 content platforms suffer from issues such as opaque algorithms, non-transparent distribution, unclear commission rates, and high costs for fan migration, making it difficult for creators to control their own data and earnings. 2. **Integration of AI and Web3**: The development of AI technology, especially AI Avatar technology, combined with Web3's exploration of the creator economy, offers new solutions aimed at breaking the control of centralized platforms and reconstructing content production and value distribution. 3. **Positioning of the TwinX Platform**: TwinX is an AI-driven Web3 short video social platform that aims to reconstruct content, interaction, and value distribution through AI avatars, immersive interactions, and a decentralized value system, enabling creators to own their data and income. 4. **Core Features of TwinX**: These include AI avatar technology, which allows creators to generate a learnable, configurable, and sustainably operable "second persona", as well as a closed-loop commercialization pathway that integrates content creation, interaction, and monetization. 5. **Web3 Characteristics**: TwinX embodies the assetization and co-governance features of Web3. It utilizes blockchain to confirm and record interactive behaviors, turning user activities into traceable assets, and enables participants to engage in platform governance through tokens, thus integrating the creator economy with community governance.

Aster CEO explains in detail the vision of Aster privacy L1 chain, reshaping the decentralized trading experience

Aster is set to launch a privacy-focused Layer 1 (L1) public chain, along with detailed plans for token empowerment, global market expansion, and liquidity strategies.